Vanshika verma | Feb 19, 2026 |

Surat Businessman Held for Rs. 18 Crore GST Fraud Under Section 69

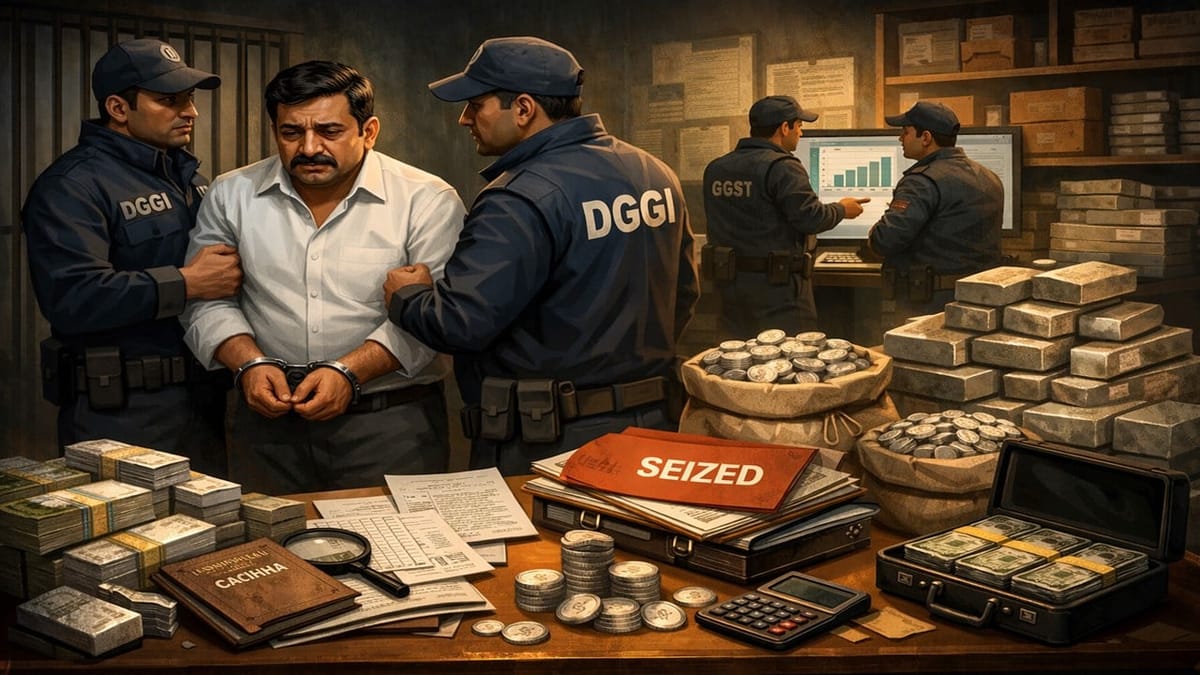

The Directorate General of GST Intelligence (DGGI) in Surat arrested Yatinkumar Sumatilal Shah on Monday. He is the owner of a bullion business called M/s Sumati Silver in Surat. Officials said they found tax evasion of about Rs. 18 crore.

In October last year, acting on a tip-off, DGGI officers conducted searches at the firm’s premises in Navapura, Surat, as well as at Yatinkumar’s home. During the search, they seized important documents, including unofficial (kachha) challan books and other records. These documents allegedly showed that silver bullion and silver items were being sold without proper tax invoices.

Officials stated, “incriminating documents, including parallel (kachha) challan books and related records evidencing clandestine supply of silver bullion and silver articles without issuance of tax invoices,” were seized.

After examining the seized records, officers found that the firm had reportedly made unaccounted sales worth more than Rs. 600 crore over the last three years. Because these sales were not properly recorded, the government allegedly lost about Rs. 18 crore in GST revenue.

Officials said the offences fall under the CGST Act, 2017 and are considered serious, meaning they are cognisable and non-bailable. Yatinkumar was arrested under Section 69 of the CGST Act, and further investigation is currently ongoing.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"