CMA Susanta Kumar Saha | Aug 3, 2019 |

Discount And Its Treatment Under GST Law

By CMA. Susanta Kumar Saha

The word discount hasnt been defined in GST law. Cambridge dictionary defines the word discount to mean as a reduction in the usual price, whereas as per Collins dictionary the word discount to mean as a reduction in the usual price of something.

It is a common practice for the companies to give discounts of different types, from time to time, to survive in the competitive market. In this article, I will discuss about the treatment of discount in GST law.

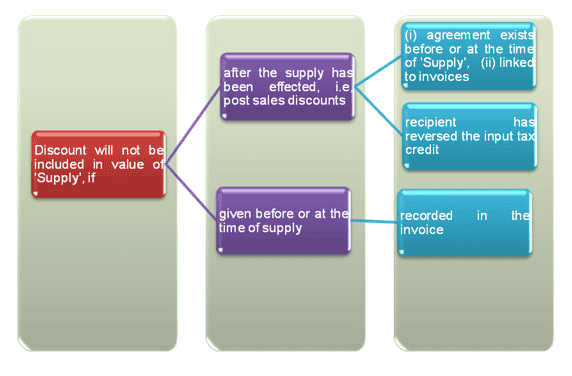

Section 15(3) of the CGST Act, 2017 (similar provision exits in SGST/UTGST Act, 2017) stipulates that the value of the supply shall not include any discount subject to the following conditions :

Different type of discounts, may be categorised broadly under two types. Lets say, case – I, type of discounts which are given before or at the time of supply and are recorded in the invoice at the time of supply, and case II, type of discounts which are given after the sale has been effected.

a. trade discount at the time of supply;

b. special discount for making full payment in advance;

c. bulk purchase discount, say, additional discount of 5% on purchase worth of Rs. 20,000/- or more;

d. get 10% discount on purchase worth of Rs. 25,000/- and above, 15% discount on purchase worth of Rs. 40,000/- and above;

e. buy six plates made of steel, get a set of two bowl made of steel free;

f. buy two pastes of 100 gm each and get one tooth brush free;

g. buy three shirts and get one shirt free;

h. buy 10 cartoons of biscuits and get 100 ml of one coconut oil bottle free;

A close examination of the nature of discounts, discussed supra, reveals that such type of discounts were prevailing and were brought to the knowledge of the recipients (customers) at the time of supply. Few discounts as stated above, might even been declared on the spot before sales took place. The mode of communication in this case, may even be verbal as we see similar type of spot discounts in shopping malls. As discount offered in all the supplies, discussed supra, satisfy the condition as stipulated in section 15(3)(a) of the CGST Act, 2017 (similar provision exists in SGST/UTGST Act, 2017), value of supply shall not include such discounts and outward tax liability on such supplies will accordingly be calculated.

On a plain reading of the examples given in sl. no A(e) to A(h) above, one may get tempted to conclude that input tax credit (ITC) may not be available on the items which might appear to have given free.

In the case of examples given in point no. A(e) and A(g), there is no free issue of goods, rather six plates and two bowls are supplied at a price of six plates and likewise four shirts are supplied at the price of three shirts. These type of discounts may be termed as quantity discounts for furtherance of sales. As the supply is made in the course or furtherance of sale, there shall be no denial of ITC.

Now let us assume that in case of example given in point no. A(f), the company offering such discount scheme, manufactures both the products and in case of example given in point no. A(h), the company offering such discount scheme, manufactures biscuits only and has bought 100 ml bottles of coconut oil from the market. We will also examine whether the company can claim the benefits of input tax credit (ITC).

Again in case of point A(f), the manufacturer offers two pastes of 100 gm each and one tooth brush at the cost of two pastes only. Similarly, in case of point A(h), the company offers 10 cartoons of biscuits and 100 ml of one coconut oil bottle at the cost of 10 cartoons of biscuits.

Let us analyse whether the free items can constitute as supplies. If so, what would be the position with respect to the claim of ITC on such items

Section 7 of the CGST Act, 2017 (similar provision exists in SGST/UTGST Act, 2017) stipulates supply to include all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business.

100 ml coconut oil bottle being supplied here with 10 cartoons of biscuits and one tooth brush being supplied here with two pastes of 100 gm each are certainly for consideration, and not gratuitous. Supply of one 100 ml coconut oil bottle and one tooth brush are not independent but conditional to purchase of biscuits of specified quantity and two pastes of 100 gm each respectively. Supply of 100 ml of coconut oil bottle is connected to supply of biscuits which is being manufactured by the company and similarly supply of tooth brush is also connected to supply of paste, both of which are being manufactured by the company. Therefore, supply of 100 ml coconut oil bottle and tooth brush are clearly in the course or furtherance of business.

Having understood that both the supplies are in the course or furtherance of business, let us understand their nature of supply, i.e, whether they are composite supply or mixed supply.

Section 2(30) of the CGST Act, 2017 (similar provision exists in SGST/UTGST Act, 2017) stipulates composite supply to mean a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Section 2(90) of the CGST Act, 2017 (similar provision exists in SGST/UTGST Act, 2017) stipulates principal supply to mean the supply of goods or services which constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary.

Section 2(74) of the CGST Act, 2017 (similar provision exists in SGST/UTGST Act, 2017) stipulates mixed supply to mean two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

In these cases, predominant supplies are obviously supply of biscuits and supply of tooth pastes and not coconut oil and tooth brush respectively according to my considered view. Furthermore, coconut oil and tooth brush are offered as complementary items on purchase of biscuits and tooth paste respectively. Therefore, supply of coconut oil is ancillary to biscuits and similarly supply of tooth brush is ancillary to tooth paste. Thus the argument that the biscuit and coconut oil are two independent supplies and are artificially bundled, may not be tenable according to my considered view.

Coconut oil and tooth brush are not the principal supplies but biscuits and tooth paste are only principal supplies respectively in the above examples, both the supplies are to be considered as composite supplies and not mixed supplies according to my considered view.

Section 16(1) of the CGST Act, 2017 (similar provision exists in SGST/UTGST Act, 2017) stipulates that every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

Since, coconut oil and tooth brush are been supplied here in the course or furtherance of business, ITC can be claimed according to my considered view. As supply of these items are conditional and are neither supplied as free nor as gift (gratuitous supply), credit of input tax are not blocked under section 17(5) of the CGST Act, 2017 according to my considered view.

There may be an argument that clause 1 of Schedule I states that permanent transfer or disposal of business assets where input tax credit has been availed on such assets shall be treated as supply even without consideration. As there is no consideration for the said free quantities (tooth brush or 100 ml bottle of coconut oil), one may further argue that valuation rules may have to be referred, to determine the value of free supply as per Section 15(4) of the said act.

However, this argument may not be tenable at all as the free products (tooth brush or 100 ml bottle of coconut oil) are available to the recipients only upon fulfilment of conditions specified therein, stated above, whereas the clause 1 of Schedule I refers to those cases where the business asset has been transferred solo and in individual capacity i.e. transfer of which is not dependent on any other supply, and is absolutely without consideration. Thus, on both the counts, this argument will not be tenable according to my considered view.

The matter whether the value of supply will exclude the value of post sale discounts, will be governed by the provision of clause (b) of sub-section (3) of section 15 of the CGST Act, 2017 which is reproduced below :

(3) The value of the supply shall not include any discount which is given

(a) .

(b) after the supply has been effected, if

(i) such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and

(ii) input tax credit (ITC) as is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of the supply.

From perusal of the above, it is evident that post sale discount, shall not form part of the value of supply only if it satisfies the following conditions:

(i) there exists an agreement for discount which was entered into between the parties either at or before the supply took place;

(ii) the supply was made in accordance with such agreement and must not for any other supplies;

(iii) such discount must be specifically linked with invoices vide which supply was made under the agreement;

(iv) ITC attributable to such discounts have been duly reversed by the recipient(s).

Thus it may be concluded that prior and proper documentation holds the key for the purpose of excluding discount from the value of supply. Without going into the legal interpretation of the word agreement, it is desirable to have written agreement in place to establish the claim.

What could happen to valuation if the proper and prior agreement could not be established

Assume there was an agreement which states (say) the distributers will be eligible for a trip to Manali on lifting of 10,000 cartoons of coconut oil of 100 ml each during the quarter January to March. Upon being eligible for the trip, by a distributor, based on the criteria as per the agreement, the company, lets say, has issued a credit note with tax (GST) for a lump sum amount of, Rs. 25,000/- plus taxes (say ) at applicable rate.

The agreement didnt have an option to choose between a trip to Manali or a cash amount, in lieu of Manali trip. The basis on which the company has evaluated the cost of Manali trip equivalent to Rs. 25,000/- cannot be established as no trip details were laid down in the agreement, viz, trip to Manali by flight for two nights three days with a stay in a 5 star hotel or something of similar line. Thus the nexus, i,e, the discount was offered in accordance with a pre-existed agreement has been made, will be very difficult to established in this case and therefore the value of discount may not be excluded from the value of supply according to my considered view.

Now let us look at another type of discount, i,e, employee discount :

Lets assume, a retail store who sells different type of clothing, apparels etc has a policy of giving 10% discount in addition to prevailing promotional schemes. Even if no such scheme is available for the time being, the employee will be entitled to 10% discount. Whether the discount will be excluded from the value of supply for the purpose of payment of tax (GST) by the company

Explanation to section 15 of the CGST Act, 2017 states that employer and employee shall be deemed to be related persons. Rule 28 of the CGST Rules, 2017 stipulates that value of supply of goods or services or both between related persons, other than through an agent, would be the open market value of such supply. Thus, the employer would be failing in discharging proper tax liability if tax (GST) has been calculated on a value net off discount at the rate of 10%.

a. Form GSTR-3B : discounts which have met the conditions as stipulated under section 15(3)(b), will be netted off against taxable value and tax amount under table no. 3.1(a);

b. Form GSTR–1 :

(i) in case of B2CS: to be shown in Table 7 after reducing from taxable value and tax amount; and

(ii) in case of B2B: to be shown in Table 9B as a separate document.

c. Form GSTR-9 :

(i) invoice and credit note, both, pertains to the same financial year, say for an example, July, 2017 to March, 2018 :

(ii) invoice relates to the period (say), July, 2017 to March, 2018 and credit note was issued during the period April, 2018 to March, 2019;

d. Form GSTR-9C :

(i) if credit note has been issued post 31st March, 2018 (in this case), to be shown in table 5E;

(ii) if credit note has not issued as per GST law, but has been accounted for in the financial statement, to be shown in table 5J.

D. The Government of India, Ministry of Finance, Department of Revenue, CBIC, GST Policy Wing, exercising its powers conferred under section 168(1) of the CGST Act, 2017, has issued clarification on various doubts related to treatment of sales promotion schemes under GST vide Circular No. 92/11/2019-GST dated 7th March, 2019. A brief synopsis is given below :

a. Free samples and gifts :

b. Buy one and get one free offer :

We have discussed the scenario with similar examples as mentioned in point no A(e), A(f) or A(g) and thus the same points have not been repeated here again.

c. Discounts including Buy more, save more offers :

We have discussed the scenario with similar examples as mentioned in point no B(b) or B(c) and thus the same points have not been repeated here again..

d. Secondary Discounts :

Matter related to secondary discounts has been more elaborately clarified vide Circular No. 105/24/2019-GST dated 28th June, 2019, described below in brief through a diagram:

e. Financial / Commercial Credit Note :

It has been clarified that financial or commercial credit note can be issued when the conditions laid down in clause (b) of sub-section (3) of section 15 of the CGST Act, 2017 are not satisfied. However, secondary discounts shall not be excluded while determining the value of supply by the supplier and there shall be no impact on availability or otherwise of ITC in the hands of supplier.

Disclaimer : The publications contain information solely for informational purpose. It is not a guidance note and does not constitute any professional advice at all. The author does not accept any responsibility for any loss or damage of any kind arising out of any information in this article or for any actions taken in reliance thereon.

This Article is written by CMA Susanta Kumar Saha. He can be reached at sksaha02@gmail.com.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"