Deepak Gupta | Nov 23, 2019 |

Rule 36(4) ITC Restriction : 12 FAQ’s

Q1. What is the original source of this Rule 36(4)

Section 43A (4) of CGST (Amendment) Act, 2018 which states that :

The procedure for availing input tax credit in respect of outward supplies not furnished under sub-section (3) shall be such as may be prescribed and

Note : This section i.e. Section 43A is not effective as on date

You May Also Refer : 20% ITC restrictions : Understanding Circular No. 123/2019 dated 11.11.2019

Q2. Example of 20% restriction

| Particulars | ITC as Per Books | ITC as per GSTR-2A | Eligible ITC | Ineligible ITC |

| Case -1 | 100 | 60 | 72 | 28 |

| Case – 2 | 100 | 90 | 100 | 0 |

Q3. Is it still mandatory to check conditions of Section 16 of CGST Act, 2017 for claiming ITC

YES.

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“The conditions and eligibility for the ITC that may be availed by the recipient shall continue to be governed as per the provisions of Chapter V of the CGST Act and the rules made thereunder.”

You May Also Refer : Calculation of Input tax credit as per new GST Rule 36(4)

Q4. Whether govt. portal / common portal will calculate the 20% amount and inform about the restriction

NO.

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“This being a new provision, the restriction is not imposed through the common portal and it is the responsibility of the taxpayer that credit is availed in terms of the said rule and therefore, the availment of restricted credit in terms of sub rule (4) of rule 36 of CGST Rules shall be done on self-assessment basis by the tax payers.”

You May Also Refer : Consequences if 20% ITC RULE 36 (4) is not followed

Q5. Whether the 20% restriction applies on Imports, RCM, ISD also

NO.

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“The taxpayers may avail full ITC in respect of IGST paid on import, documents issued under RCM, credit received from ISD etc. which are outside the ambit of sub-section (1) of section 37, provided that eligibility conditions for availment of ITC are met in respect of the same.”

Q6. Date of applicability of this Rule 36(4)

9th Oct 2019.

Q7. Whether we need to check this 20% restriction for the invoices dated prior to 9th Oct 2019

YES, but only if you are claiming / availing the ITC of those invoices AFTER 9th Oct 2019.

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“The restriction of 36(4) will be applicable only on the invoices / debit notes on which credit is availed after 09.10.2019”

You May Also Refer : Changes in GST ITC Availment Conditions

Q8. Whether we need to check the 20% restriction supplier wise

NO.

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“The restriction imposed is not supplier wise. The credit available under sub-rule (4) of rule 36 is linked to total eligible credit from all suppliers against all supplies whose details have been uploaded by the suppliers”

Q9. Whether we need to check the 20% on whole ITC or only the eligible ITC

ONLY ELIGIBLE ITC.

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“The calculation would be based on only those invoices which are otherwise eligible for ITC. Accordingly, those invoices on which ITC is not available under any of the provision (say under sub- section (5) of section 17) would not be considered for calculating 20 percent of the eligible credit available.”

Q10. Which day’s GSTR-2A we need to check for 20% ITC restriction

11th day of the month succeeding the relevant month (Notification No. 46/2019)

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“The taxpayer may have to ascertain the same from his auto populated FORM GSTR 2A as available on the due date of filing of FORM GSTR-1 under sub-section (1) of section 37”

You May Also Refer : How to Reconcile the ITC for New Rule 36(4) of CGST Rule, 2017

Q11. When can I claim the full eligible ITC

When invoices accumulating to 83.33 % of your total eligible ITC are uploaded by your suppliers in their GSTR-1.

Circular No. 123/42/2019 – GST dated 11th Nov 2019 states that :

“The taxpayer may avail full ITC in respect of a tax period, as and when the invoices are uploaded by the suppliers to the extent Eligible ITC / 1.2.”

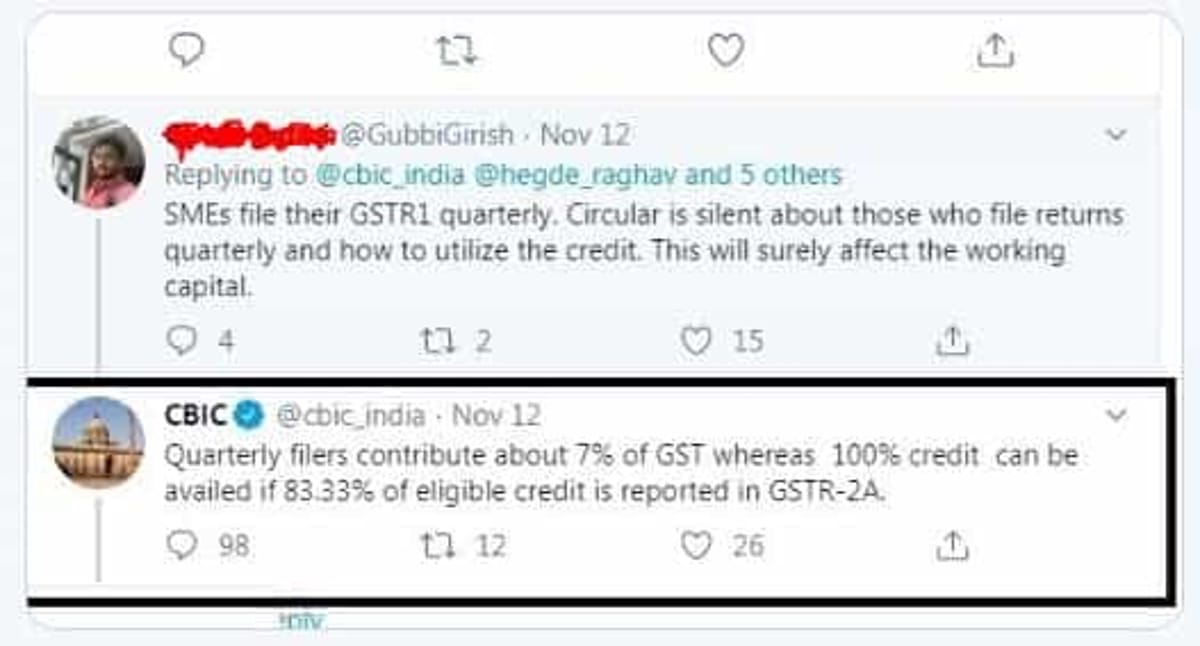

Q12. Whether the 20% restriction applies on assessee’s filing Quarterly GSTR-1

Rule 36(4) ITC Restriction : 12 FAQ’s

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

For Regular Updates Join:

Tags : GST, Rule 36(4), 20% ITC Restriction

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"