CA Pratibha Goyal | Jan 1, 2020 |

GST Rate Changes as per 38th GST Council Meeting as Notified by CBIC

Summary of GST Rate Changes as per 38th GST Council Meeting as Notified by CBIC is given below for reference:

Single GST Rate of 18% notified for Woven and Non-Woven Bags

In 38th GST Council meeting, it was proposed that Single GST Rate would be notified Woven and Non-Woven Bags and sacks of polyethylene or polypropylene strips or the like , whether or not laminated, of a kind used for packing of goods. Therefore in line of that decision, Single GST Rate on woven bags of 18% is thus being notified for the both types of bags.

Changed GST Rate on upfront amount of long term lease of industrial/ financial infrastructure

GST Exempted on upfront amount of long term lease of industrial/ financial infrastructure plots by an entity having 20% or more ownership of Central or State Government

In 38th GST Council meeting, it was proposed To exempt upfront amount payable for long term lease of industrial/ financial infrastructure plots by an entity having 20% or more ownership of Central or State Government.

Presently, the exemption is available to an entity having 50% or more ownership of Central or State Government.

Same has been notified now.

Changed GST Rate on upfront amount of long term lease of industrial/ financial infrastructure

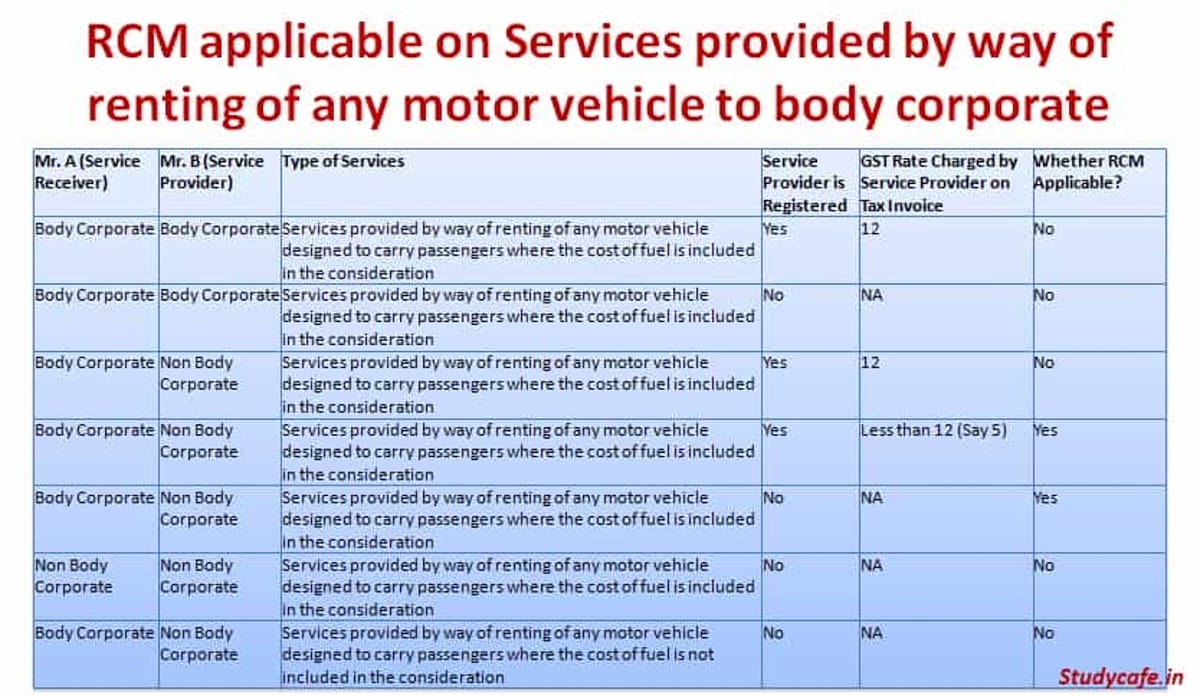

RCM applicable on Services provided by way of renting of any motor vehicle to body corporate

In 38th GST Council meeting it was proposed that RCM should be applicable on Services provided by way of renting of any motor vehicle, provided to a body corporate by a Non Body Corporate, who does not issue an invoice charging central tax at the rate of 6 per cent.

Same has been notified now.

This has been explained with the help of below mentioned examples:

| Mr A (Service Receiver) | Mr B (Service Provider) | Type of Services | Service Provider is Registered | GST Rate Charged by Service Provider on Tax Invoice | Whether RCM Applicable |

| Body Corporate | Body Corporate | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration | Yes | 12 | No |

| Body Corporate | Body Corporate | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration | No | NA | No |

| Body Corporate | Non Body Corporate | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration | Yes | 12 | No |

| Body Corporate | Non Body Corporate | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration | Yes | Less than 12 (Say 5) | Yes |

| Body Corporate | Non Body Corporate | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration | No | NA | Yes |

| Non Body Corporate | Non Body Corporate | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration | No | NA | No |

| Body Corporate | Non Body Corporate | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is not included in the consideration | No | NA | No |

CA Pratibha Goyal

This article has been shared by CA Pratibha Goyal. She runs a youtube channel in name of Studycafe and has a telegram channel as well.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"