Tista | Jan 13, 2020 |

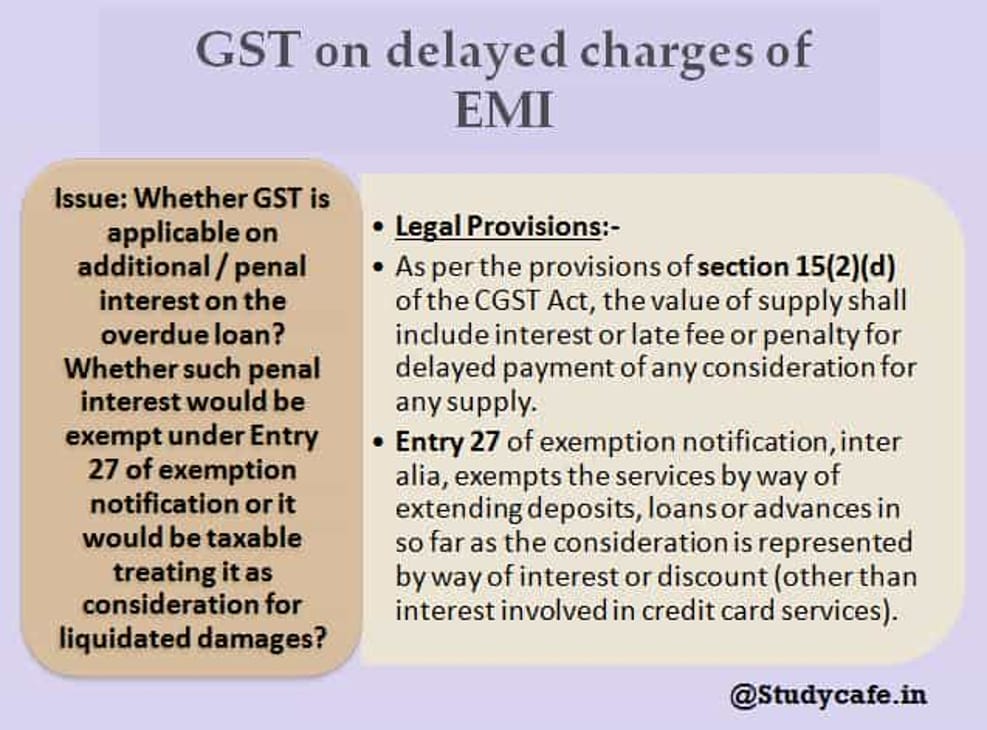

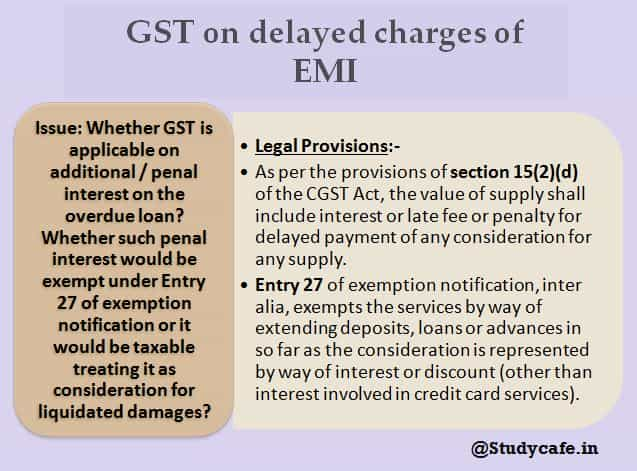

GST on delayed charges of EMI

Clarification regarding applicability of GST on delayed payment charges in case of late payment of Equated Monthly Instalments (EMI)- [Circular No. 102/21/2019-GST dated 28.06.2019]

Issue: Whether GST is applicable on additional / penal interest on the overdue loan Whether such penal interest would be exempt under Entry 27 of exemption notification or it would be taxable treating it as consideration for liquidated damages

GST on delayed charges of EMI

Clarification :-

Legal Provisions:-

• As per the provisions of section 15(2)(d) of the CGST Act, the value of supply shall include interest or late fee or penalty for delayed payment of any consideration for any supply.

• Entry 27 of exemption notification, inter-alia, exempts the services by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount (other than interest involved in credit card services). Here, interest means interest payable in any manner in respect of any moneys borrowed/debt incurred (including a deposit, claim or other similar right or obligation), but does not include any service fee or other charge in respect of the moneys borrowed or debt incurred or in respect of any credit facility which has not been utilised.

Explanation:-

There are two transaction options involving EMI that are prevalent in the trade. In view of the provisions of law discussed in preceeding para, these two options, along with the GST applicability on them, have been explained with the help of illustrations as under –

Illustration – 1 : X sells a mobile phone to Y. The cost of mobile phone is ₹40,000/. However, X gives Y an option to pay in installments, ₹11,000/- every month before 10th day of the following month, over next four months (₹11,000/- × 4 = ₹44,000/-). As per the contract, if there is any delay in payment by Y beyond the scheduled date, Y would be liable to pay additional/ penal interest amounting to ₹500/- per month for the delay.

In some instances, X is charging Y Rs. 40,000/- for the mobile and is separately issuing another invoice for providing the services of extending loans to Y, the consideration for which is the interest of 2.5% per month and an additional/ penal interest amounting to Rs. 500/- per month for each delay in payment.

In this case, the amount of penal interest is to be included in the value of supply [in terms of section 15(2)(d)]. The transaction between X and Y is for supply of taxable goods i.e. mobile phone.

Accordingly, the penal interest would be taxable as it would be included in the value of the mobile, irrespective of the manner of invoicing.

Illustration – 2 : X sells a mobile phone to Y. The cost of mobile phone is ₹40,000/- Y has the option to avail a loan at interest of 2.5% per month for purchasing the mobile from M/s. ABC Ltd. The terms of the loan from M/s. ABC Ltd. allows Y a period of four months to repay the loan and an additional/ penal interest @ 1.25% per month for any delay in payment.

Here, the additional/ penal interest is charged for a transaction between Y and M/s. ABC Ltd., and the same is getting covered under exemption Entry 27. Consequently, in this case the ‘penal interest’ charged thereon on a transaction between Y and M/s. ABC Ltd. would not be subject to GST as the same would be covered under said exemption entry. However, any service fee/ charge or any other charges, if any, are levied by M/s. ABC Ltd. in respect of the transaction related to extending deposits, loans or advances does not qualify to be interest as defined in exemption notification, and accordingly will not be exempt.

Moreover, the value of supply of mobile by X to Y would be Rs. 40,000/- for the purpose of levy of GST.

NOTE : It is further clarified that the transaction of levy of additional/ penal interest does not fall within the ambit of entry 5(e) of Schedule II of the CGST Act as this levy of additional/ penal interest satisfies the definition of “interest” as contained in exemption notification [elaborated above].

For Regular Updates Join : https://t.me/Studycafe

Tags : GST

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"