Studycafe | Mar 8, 2021 |

E-Invoicing Mandatory for Turnover of more than Rs 50 Cr

As per notification no. 05/2021 dated 8th March 2021 by the Central Board of Indirect Taxes & Customs [CBIC], E-Invoicing is now mandatory for Turnover of more than Rs 50 cr. Currently, the limit for generating the E-Invoice is Rs 100 Cr and more which has been put into effect from 1st January 2021, while for companies having turnover more than Rs 500 crore was made effective from October 1, 2020.

This notification shall be effective from the 1st day of April 2021.

This notification came as the amendment in earlier GST notification Number 13/2020 dated 21st March 2020.

E-Invoice can be generated from https://einvoice1.gst.gov.in/

GST e-invoice System – FAQs

GST e-invoice/IRN System

Frequently Asked Questions

A. E-invoice – Basics:

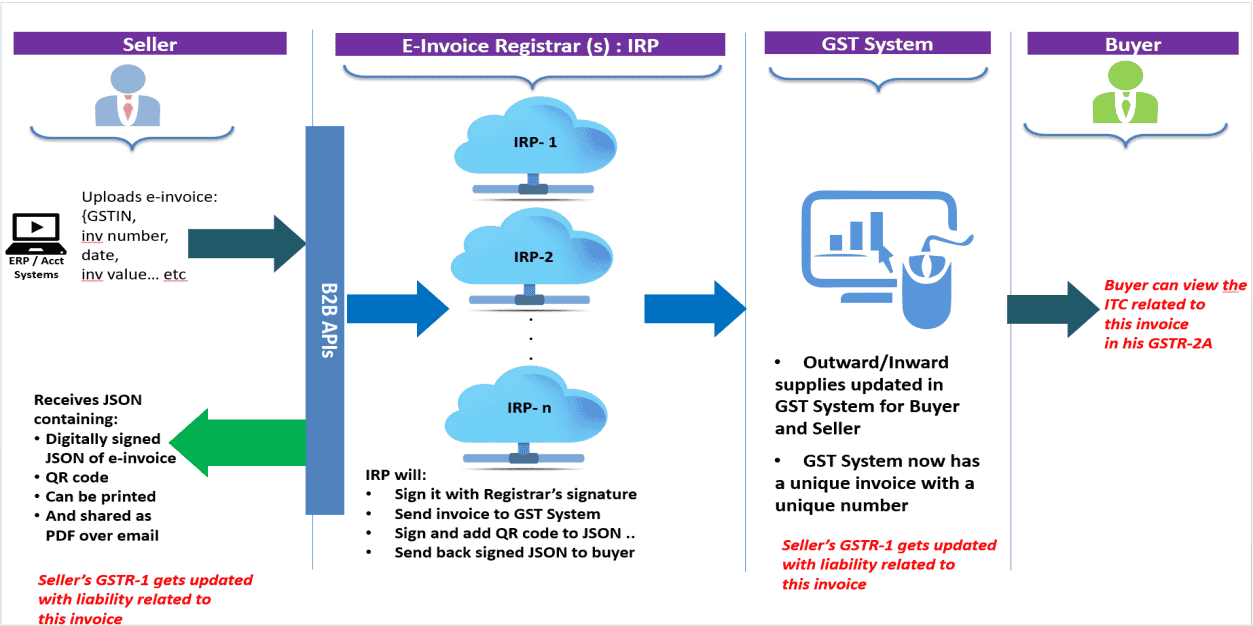

As per Rule 48(4) of CGST Rules, notified class of registered persons have to prepare invoice by uploading specified particulars of invoice (in FORM GST INV-01) on Invoice Registration Portal (IRP) and obtain an Invoice Reference Number (IRN).

After following above ‘e-invoicing’ process, the invoice copy containing inter alia, the IRN (with QR Code) issued by the notified supplier to buyer is commonly referred to as ‘e-invoice’ in GST.

Because of the standard e-invoice schema (INV-01), ‘e-invoicing’ facilitates exchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format.

Please note that ‘e-invoice’ in ‘e-invoicing’ doesn’t mean generation of invoice by a Government portal.

There is no much difference indeed.

Registered persons will continue to create their GST invoices on their own Accounting/Billing/ERP Systems. These invoices will now be reported to ‘Invoice Registration Portal (IRP)’. On reporting, IRP returns the e-invoice with a unique ‘Invoice Reference Number (IRN)’ after digitally signing the e-invoice and adding a QR Code. Then, the invoice can be issued to the receiver (along with QR Code).

A GST invoice will be valid only with a valid IRN.

For more detailed process, please go through ‘e-invoice – Detailed Overview’

Presently, it is mandated for registered persons whose aggregate turnover (based on PAN) in a financial year is more than Rs. 100 Crores. But w.e.f. 1st April 2021, the limit will be reduced to Rs. 50 Cr.

e-invoice has many advantages for businesses such as Auto-reporting of invoices into GST return, auto-generation of e-way bill (where required).

e-invoicing will also facilitate standardisation and inter-operability leading to reduction of disputes among transacting parties, improve payment cycles, reduction of processing costs and thereby greatly improving overall business efficiency.

Businesses will continue to issue invoices as they are doing now. Necessary changes on account of e-invoicing requirement (i.e. to enable reporting of invoices to IRP and obtain IRN), will be made by ERP/Accounting and Billing Software providers in their respective software. They need to get the updated version having this facility.

As per Rule 48(4), notified person has to prepare invoice by uploading specified particulars in FORM GST INV-01 on Invoice Registration Portal and after obtaining Invoice Reference Number (IRN).

As per Rule 48(5), any invoice issued by a notified person in any manner other than the manner specified in Rule 48(4), the same shall not be treated as an invoice.

So, the document issued by notified person becomes legally valid only with an IRN.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"