Advance Rulings in Customs : Advance ruling provide certainty in taxation thereby ensuring EODB and aids in achieving the goal of Aatmanirbhar Bharat

Reetu | Dec 17, 2021 |

Advance Rulings in Customs : Advance ruling provide certainty in taxation thereby ensuring EODB and aids in achieving the goal of Aatmanirbhar Bharat

As the Advance ruling given by the AAR in all over India, provides certainty & surety in taxation of GST regime, there by ensuring Ease of doing Business and aids in achieving the Goal of making India a Aatmanirbhar Bharat.

Here’s a thread on information about Advance Rulings in Customs.

“Advance Ruling“ means a wriiten decision on any of the questions relating to classification of goods, applicability of notifications having a bearing on the rate of duty, and other similar notifications, principles to be adopted for the purposes of valuation of the goods, or determination of country of origin raised by the applicant in his application in respect of any goods prior to its importation or exportation.

Advance Ruling under customs can be sought on specific issues, like :

(i) Classification of goods under the Customs Tariff Act, 1975 (51 of 1975);

(ii) Applicability of a notification issued under sub-section (1) of section 25, having a bearing on the rate of duty;

(iii) Principles to be adopted for the purposes of determination of value of the goods;

(iv) Applicability of notifications issued in respect of tax or duties under Customs Act, Customs Tariff Act, 1975 (51 of 1975) or any other law for the time being in force as a duty of Customs.

Any person;

(i) holding a valid Importer-exporter Code Number granted under section 7 of the Foreign Trade (Development and Regulation) Act, 1992 (22 of 1992); or

(ii) exporting any goods to india; or

(iii) with a justifiable cause to the satisfaction of the authority.

The Advance Ruling pronounced by the authority shall be binding only

(a) on the applicant who sought it;

(b) in respect of any matter referred to in subsection (2) section 28H;

(c) on the Principal Commissioner of Customs or Commissioner of Customs, and the customs authorities subordinate to him, in respect of the applicant.

The CAAR is required to pronounce its complete (in all manner and after removal of any deficiency) ruling within three months from the date of receipt of application.

An Advance Ruling shall remain in force till there is a change in law or facts on the basis of which the Advance Ruling has been pronounced.

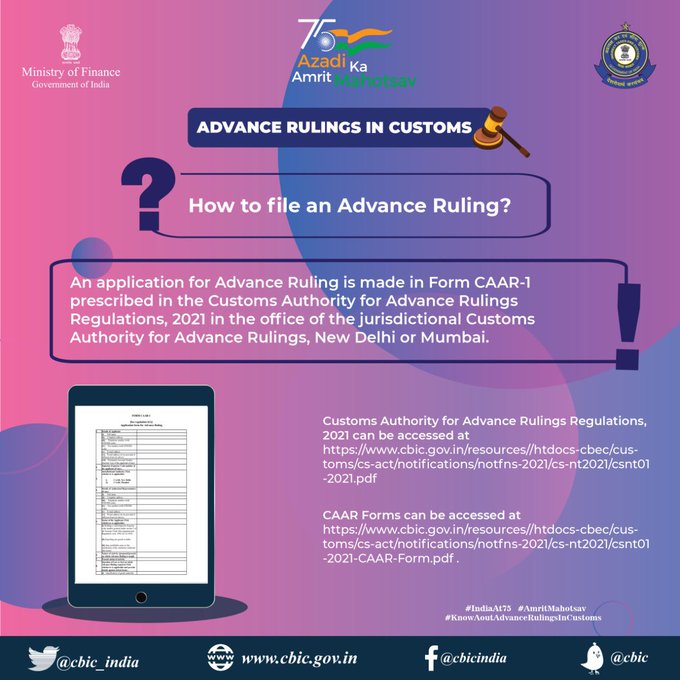

An application for Advance Ruling is made in Form CAAR-1 prescribed in the Customs Authority for Advance Rulings Regulations, 2021 in the office of the jurisdictional Customs Authority for Advance Rulings, News Delhi or Mumbai.

Appeals against the ruling given by the Customs Advance Ruling authority may be filed within sixty days from the date of the communication of such ruling or order, in the Form CAAR-2.

The appeals lies before the High Court and it could allow thirty days extension for filing such appeal, if the cause presented by the appellant seems sufficient proof of delay.

Advance Ruling may not be given if the question raised in the application is-

(a) already pending in the applicant’s case before any officer of customs, Appellate Tribunal or any Court, or

(b) same as in an already matter decided by the Appellate Tribunal or any Court.

An Advance Ruling would be deemed void where the authority finds that an Advance Ruling pronounced by it has been obtained by the applicant by fraud or misrepresentation of facts.

In Such cases, concerned customs officer can proceed to issue demand for short-levy unde Section 28(1) or 28(4) of the act.

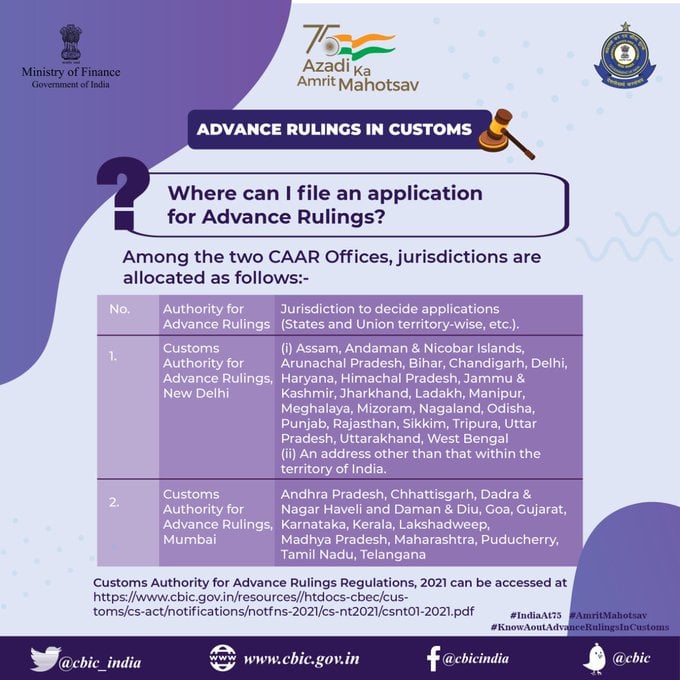

Among the two CAAR Offices, jurisdictions are allocated as follows :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"