Reetu | Nov 16, 2023 |

All about GST ITC Reversal on Account of Rule 37A

The Input Tax Credit (ITC) reversal is necessary in a variety of situations, including the acquisition of goods and services for non-business purposes, blocked ITC, and so on.

In the case of ITC reversal, the credit for previously used input is added to the output tax liability to invalidate the ITC claimed previously.

Vide Rule 37A of CGST Rules, 2017 the taxpayers have to reverse the Input Tax Credit (ITC) availed on such invoice or debit note, the details of which have been furnished by their supplier in their GSTR-1/IFF but the return in FORM GSTR-3B for the said period has not been furnished by their supplier till the 30th day of September following the end of financial year in which the Input Tax Credit in respect of such invoice or debit note had been availed.

The said amount of ITC is required to be reversed by such taxpayers, while furnishing a return in FORM GSTR-3B on or before the 30th day of November following the end of such financial year, as part of this legal obligation.

Currently GSTN provides no facility to check if tax has been paid by supplier on invoice or debit note reflecting in GSTR-2B for which ITC has been claimed.

To facilitate the taxpayers, such amount of ITC required to be reversed on account of Rule 37A of CGST Rules for the financial year 2022-23 has been computed from system and has been communicated to the concerned recipient. The email communication to this effect has been sent on the registered email id of the taxpayer.

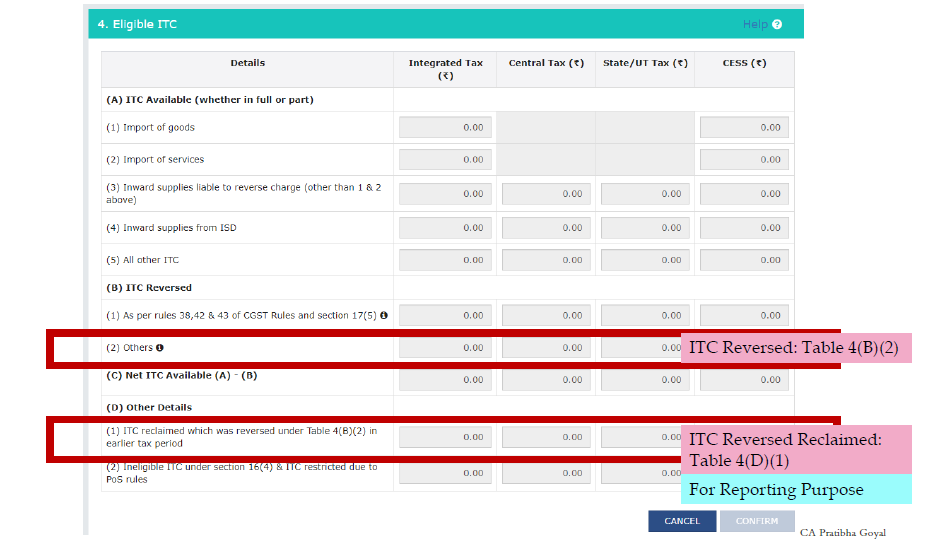

The taxpayers are advised to take note of it and to ensure that such ITC, if availed by them, is reversed as per rule 37A of CGST Rules before 30th of November, 2023 in Table 4(B)(2) of GSTR-3B while filing the concerned GSTR-3B.

Where the said amount of ITC is not reversed by the registered person in a return in FORM GSTR-3B on or before the 30th day of November following the end of such financial year during which such input tax credit has been availed, such amount shall be payable by the said person along with interest @ 24% thereon under section 50.

Where the supplier subsequently furnishes the return in FORM GSTR-3B for the said tax period, the said registered person may re-avail the amount of such credit in the return in FORM GSTR-3B for a tax period thereafter.

To Download in PPT Form – Click Here

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"