Deepak Gupta | Mar 27, 2019 |

Analysis on Composition Scheme For Service Providers in GST Regime

GST Council in its 31st GST Council meeting proposed a decision of framing composition scheme for small service tax provider. This decision was made more clarified in 32nd GST Council meeting whereby it was proposed that a Composition Scheme shall be made available for Suppliers of Services (or Mixed Suppliers) with a Tax Rate of 6% (3% CGST +3% SGST) having an Annual Turnover in the preceding Financial Year up to Rs 50 lakhs.

This decision has been made effective by notification number 2/2019-Central Tax Rate dated 7th March 2019 and will be implemented from 1st April 2019.

Through this article we have tried to analyse the scheme and discuss various pros and cons for the same.

The Composition Scheme For Service Providers in GST Regime will be effective from 1st April 2019.

[All the requirements must be fulfilled]

a.) The Turnover of Service provider for preceding Financial Year should not exceed Rs. 50 Lakh.

| Thus if a service provider wishes to avail this scheme in FY 2019-20, his turnover for FY 2018-19 should not be more than Rs. 50 Lakh. |

b.) The supplier should not be eligible to pay tax under sub-section (1) of section 10 of the said Act;

c.) The supplier should not be engaged in business of ice cream, Pan Masala, Tobacco and tobacco substitutes.

d.) The supplier should not be engaged in the business of making any supplies on which GST is not leviable under this Act (i.e., petro products or alcoholic liquor).

e.) The supplier should not be making any interstate supplies.

f.) The supplier should not be a casual taxable person, non-resident taxable person and

g.) The supplier should not making any supply through e-commerce operator (ECO) on which TCS applies.

GST rate of 6% will be applicable on a person who is opting for Composition Scheme For Service Providers. This rate is applicable on all supplies made by the service provider irrespective of the fact whether they are exempt supplies or are taxed at different rate.

The GST will be paid by own pocket of Service provider and he cannot charge the same in the invoice or he cannot issue tax invoice.

| An important thing to note here is that the service provider opting for composition scheme cannot issue tax invoice and he will issue bill of supply for the supplies made by him. On Bill of Supply he will mention that he is a Taxable Person paying tax as per Notification No-02/2019-Centarl Tax (Rate), not eligible to collect tax on supplies. |

Also he shall not be allowed to claim any input in respect of goods, services or capital goods procured by him for giving service.

Turnover for determining the eligibility to opt this scheme shall be aggregate of taxable, exempt, nil or zero rated supplies. The notification clarified that supplies made before the date of the registration shall also be considered while calculating the turnover limit. In other words, if supplier takes the GST registration for the first time, the value of total supplies made during the relevant period shall be considered for determining his eligibility to opt for this scheme.

For Example during the FY 2019-20 the supplier has made supplies of 19 Lakhs upto September 2019 after which it takes registration as a service receiver under composite scheme. The supplier makes next supplies of 45 Lakhs during tenure of October 2019 to March 2019.

For FY 2020-21 the supplier will not be eligible to opt for composition scheme as he has mad total supplies of 64 Lakhs (which is more than 50 Lakhs) during FY 2019-20

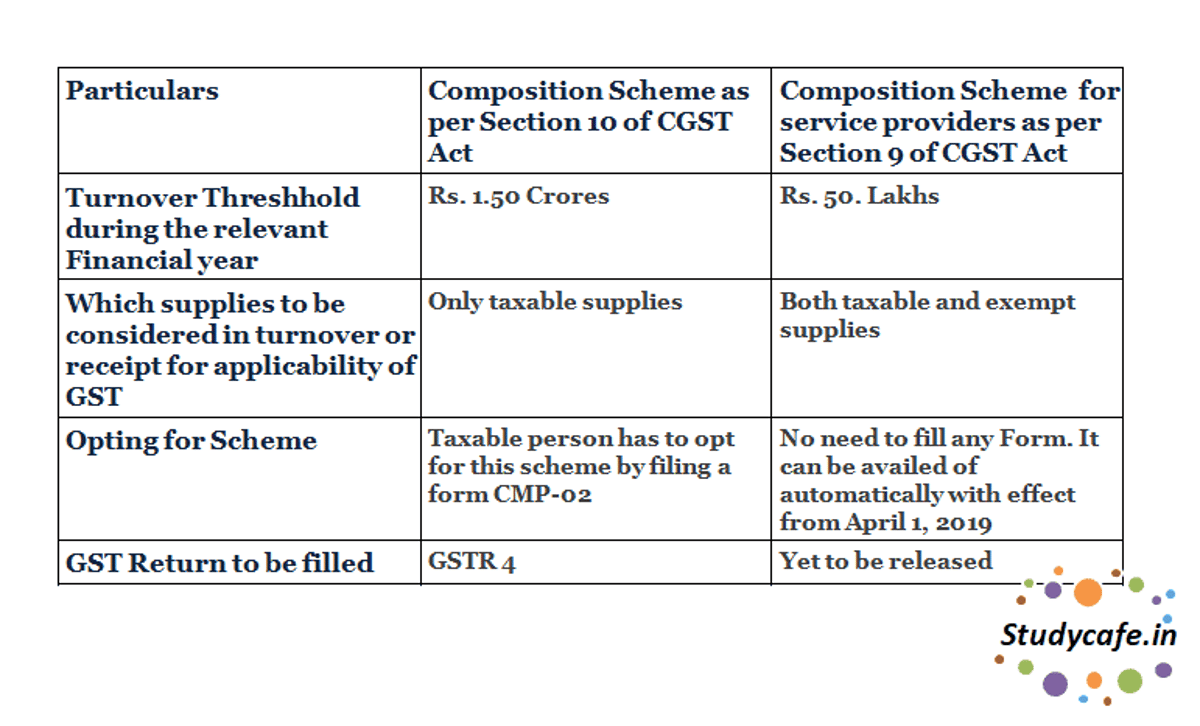

Small comparative Analysis has been made on exiting Composition Scheme as per Section 10 of CGST Act and Composition Scheme for service providers as per Section 9 of CGST Act

| Particulars | Composition Scheme as per Section 10 of CGST Act | Composition Scheme for service providers as per Section 9 of CGST Act |

| Turnover Threshold during the relevant Financial year | Rs. 1.50 crores | Rs. 50. lakhs |

| Which supplies to be considered in turnover or receipt for applicability of GST | Only taxable supplies | Both taxable and exempt supplies |

| Opting for Scheme | Taxable person has to opt for this scheme by filing a form CMP-02 | No need to fill any Form. It can be availed automatically if the relevant conditions are fulfilled with effect from April 1, 2019 |

| GST Return to be filled | GSTR 4 | Yet to be released |

Applicability of GST Reverse Charge Mechanism on a person opting for composition scheme

GST Reverse Charge Mechanism is applicable on a person opting for composition scheme

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information.

Tags : composition scheme gst, gst composition scheme rules, gst composition scheme for service providers, composition scheme limit, what is composition scheme, gst composition scheme turnover limit, gst composition scheme last date, gst composition rules

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"