Reetu | Mar 23, 2023 |

Bank Audit: PSBs to decide Audit Exposure of Branches; Chartered Accountant worried

CAs who audit public sector banks (PSBs) are concerned since the Reserve Bank of India has left it up to the banks to decide how much of their branch business would be audited beginning in FY24. According to auditors, this would have a significant influence on their capacity to correctly assess the situation and expose the risks.

The RBI has dramatically restricted the percentage of branch businesses that can be audited for the current financial year.

According to a recent RBI circular, the statutory branch audit of PSBs shall cover a minimum of 70% of funded and non-funded activity for FY23, and from FY24, they can choose the proportion of business coverage they want to be reviewed. Previously, any PSB branch’s audit coverage was 90%.

The RBI has also stated that the PSB board has the authority to choose which branches would be audited, implying that not all branches will be audited. There are 84,000 bank branches in India, and the RBI has stated that each auditor can only cover two of them.

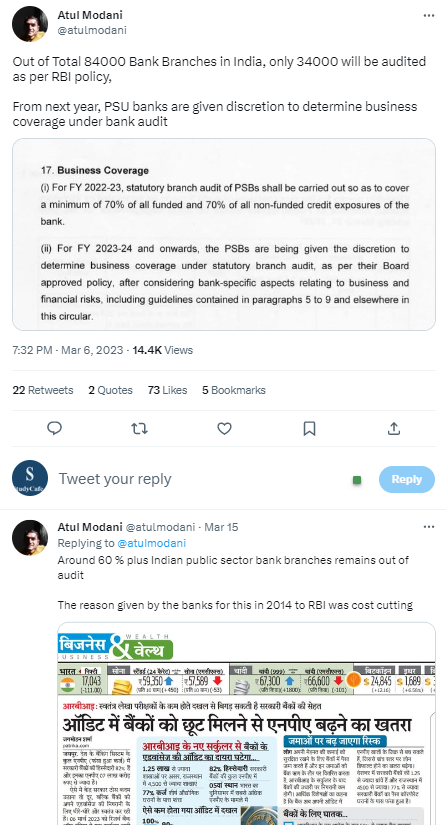

“For FY23, statutory branch audits of PSBs must cover at least 70% of all funded and 70% of all non-funded credit exposures of the bank. For FY23-24 and onwards, PSBs are given the discretion to determine business coverage under statutory branch audit, as per their board-approved policy, after considering bank-specific aspects relating to business and financial risks,” according to the RBI circular.

CA Atul Modaniji writes: Out of Total 84000 Bank Branches in India, only 34000 will be audited as per RBI policy, From next year, PSU banks are given discretion to determine business coverage under bank audit.

CA Sansaar writes that very Branch of Public Sector Banks as well as Private Sector Banks should be Audited by the Auditors from the RBI Panel.

CA Abhishek Raja Ram writes: When NPA will rise or Bank Fraud will rise they will ask, “What was Auditor doing?” But no one will ever question that they have reduced branches and fees hike is only 10% that too after so many years.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"