MOF vide press release has announced that any payments made overseas by debit/ credit cards up to Rs 7 lakh will be exempt from TCS

CA Pratibha Goyal | May 22, 2023 |

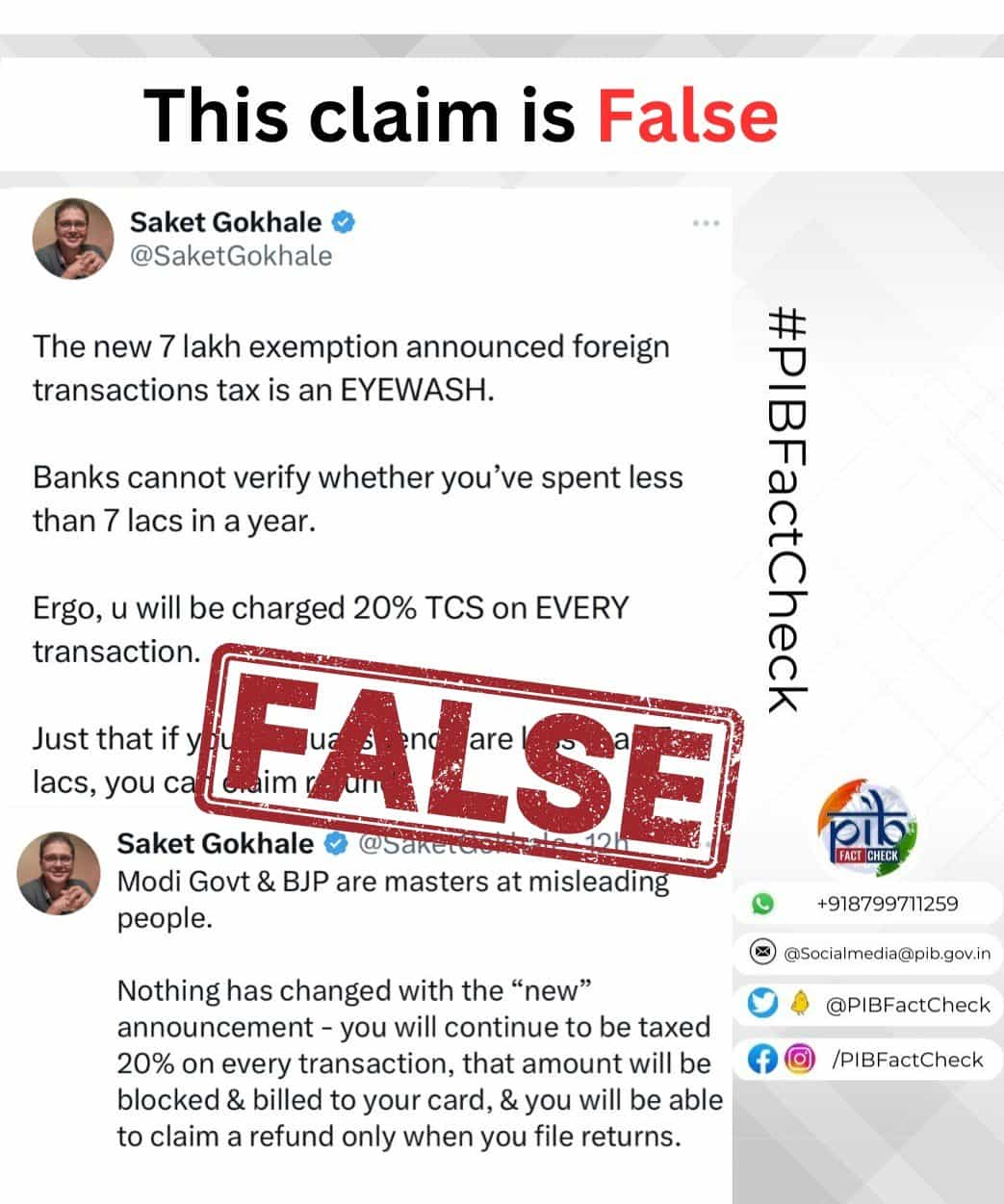

Banks have mechanism to verify whether you’ve spent less than 7 lacs for collecting TCS: GOI

Ministry of Finance (MOF) vide press release has announced that any payments made by an individual using their overseas debit or credit cards up to Rs 7 lakh per financial year will be exempt from the LRS limitations and, as a result, will not incur any Tax Collection at Source (TCS) in order to prevent any procedural uncertainty.

On this news, there was a rumor if Banks have a mechanism to verify whether you’ve spent less than 7 lacs for collecting TCS.

PIB Fact Check has clarified that this claim is False. Liberalised Remittance Scheme (LRS) spends of an individual are compiled & monitored by the Reserve Bank of India (RBI).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"