The due date of furnishing the tax audit report for FY 2024-25 is extended from September 30, 2025, to October 31, 2025.

Nidhi | Sep 25, 2025 |

Big Relief for CAs: Tax Audit Due Date Extended to October 31; Is ITR due date also extended?

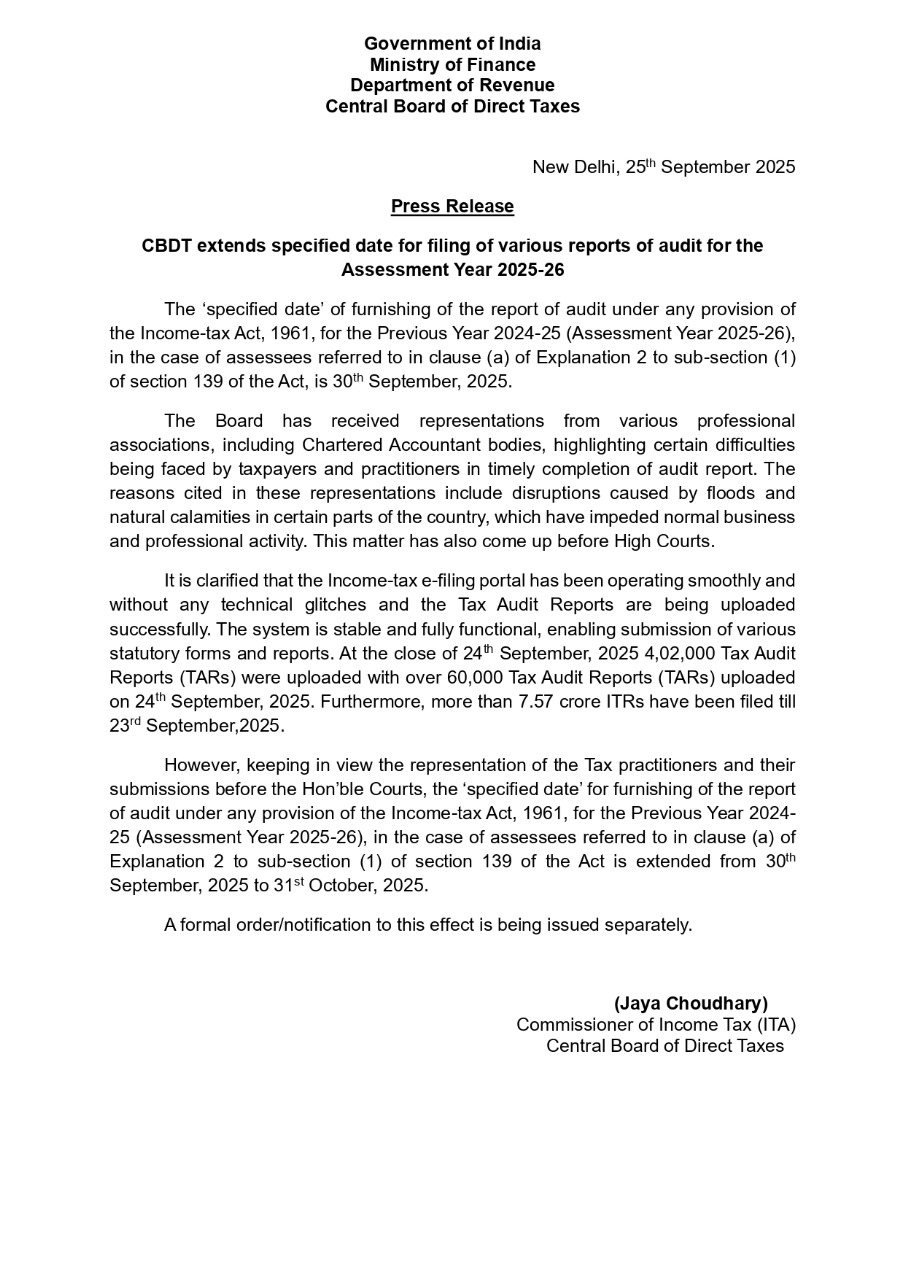

In a significant relief to the chartered accountants and taxpayers, the Central Board of Direct Taxes (CBDT) has extended the due date for filing the Tax Audit Report. As per the press release issued by CBDT, the due date of furnishing the tax audit report under the Income Tax Act, 1961, for the financial year 2024-25 (Assessment Year 2025-26) is extended from September 30, 2025, to October 31, 2025.

The extension is for:

No Extension for ITR Due Dates for Audit Assessees

In simple words:

Tax Audit due date is linked with ITR date and not the vice versa. As per the provisions, due date of ITR is prescribed in Section 139, and audit report’s due date is prescribed as 1 month prior to ITR due date [Section 44AB]. Now due date for audit is extended not of ITRs, therefore, there is no automatic extension for ITR. Due date for ITR remains same as of now, unless, notification extends the same.

CBDT received several requests and representations for Tax Audit Extension

This decision was made after CBDT received several requests and representations from various tax professionals and CA associations. They raised issues about natural calamities like floods in some parts of the country, which affected the business operations. Many of these issues also went to different High Courts.

The Chartered Accountant community, taxpayers and other professionals raised concerns regarding the technical glitches on the Income Tax e-filing portal. Recently, on September 24, many CAs held a pen-down strike, demanding the extension.

The CBDT also mentioned in its press release that the Income Tax e-filing portal is working smoothly, and over 4,02,000 Tax Audit Reports had already been uploaded by September 24. It further notified that over 60,000 TARs were filed on just that day, and over 7.57 crore ITRs have already been filed by taxpayers till September 23, 2025. However, after keeping in view the difficulties faced by professionals and the discussions in High Courts, the government decided to extend the audit report filing due date.

Thanks to the CA community and other tax bodies, which repeatedly sent representatives to the government and also filed writ petitions. The new extended due dates offer much-needed relief for accurate and compliant filings. It will reduce the stress among CAs and ensure quality compliance.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"