CA Deepak Bharti | Dec 4, 2018 |

Bird Eye view of Benami Transaction (Prohibition) Act 1988

In the last few months we have seen a major crackdown on Benami properties and their owners by the Government. Specialized Anti-Benami units have been set up by the Income Tax department across the country and in almost every state and thousands of properties already stand attached under the Prohibition of Benami Property Transactions Act, 1988 [as amended in 2016] (hereinafter “Benami Act”). This article endeavors to give you a bird’s eye view of what exactly does this law entail, what kind of transactions are outlawed, the civil and criminal implications/sanctions imposed by the Benami Act on persons entering into such transactions, and finally, how the anti-benami law operates and the defences/exceptions/remedies available against action taken under the Benami Law.

Benami is a Persian term which essentially means something without a name. However, in the present context, it means proxy. So, a benami property is a property bought by the original owner using a proxy. This helps him park his unaccounted money safely while avoiding paying taxes to the government at the same time. Benami transactions are quite prevalent in land purchases, where unaccounted money is used to make the purchase.

In the last few months we have seen a major crackdown on Benami properties and their owners by the Government. Specialized Anti-Benami units have been set up by the Income Tax department across the country and in almost every state and thousands of properties already stand attached under the Prohibition of Benami Property Transactions Act, 1988 [as amended in 2016] (hereinafter “Benami Act”). This article endeavors to give you a bird’s eye view of what exactly does this law entail, what kind of transactions are outlawed, the civil and criminal implications/sanctions imposed by the Benami Act on persons entering into such transactions, and finally, how the anti-benami law operates and the defences/exceptions/remedies available against action taken under the Benami Law.

The Prohibition of Benami Property Transaction Act, 1988 was enacted in year 1988. However due to some political gaps and some other reasons this act could never came into force for almost 28 years. However to curb black money new government who came in power in year 2014, revised the Act and broadens its scope, with the insertion of 63 new sections and changing its name to The Benami Transactions (Prohibition) Act, 1988 with an aim to not only track the Benami properties but also Benami transactions, and made it applicable with effect from 1st November 2016, surprisingly 7 days before the date of Demonetization. Now under this Act Benami includes every transaction, properties either moveable or immovable, bank accounts and any other transaction, which falls within the purview of this law.

“Benamidar” means a person or a fictitious person, as the case may be, in whose name the benami property is transferred or held and includes a person who lends his name.

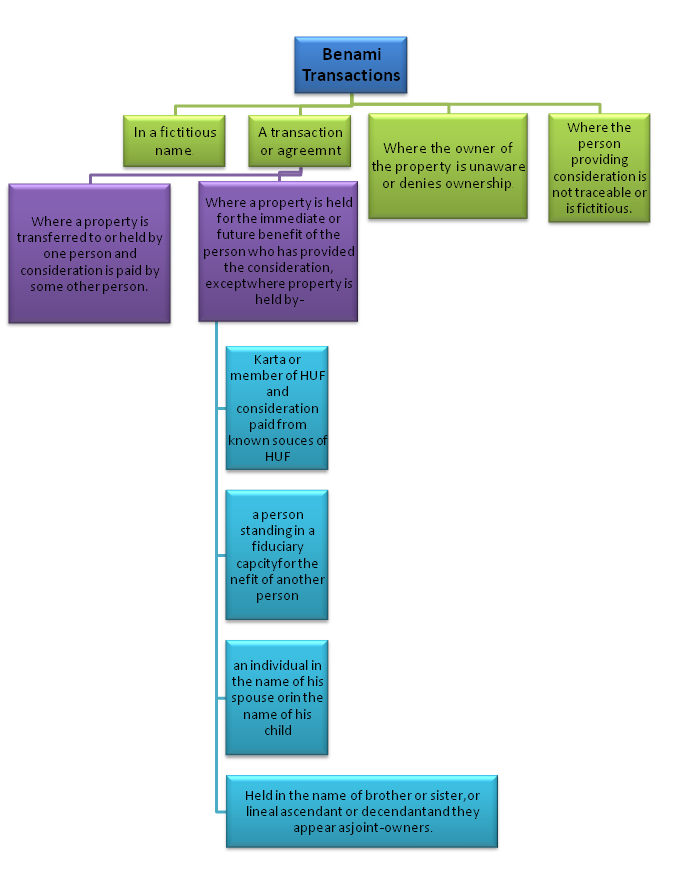

To begin at the beginnings, let us examine what a ‘Benami Transaction’ is:

(A) a transaction or an arrangement

a. where a property is transferred to, or is held by, a person*,

+

the consideration for such property has been provided, or paid by, another person; and

b. the property is held for the immediate or future benefit, direct or indirect, of the person who has provided the consideration, except when the property is held by:

i. a Karta, or a member of a Hindu undivided family, as the case may be, and the property is held for his benefit or benefit of other members in the family and the consideration for such property has been provided or paid out of the known sources of the Hindu undivided family; or

ii. a person standing in a fiduciary capacity for the benefit of another person towards whom he stands in such capacity and includes a trustee, executor, partner, director of a company, a depository or a participant as agent of a depository etc. ; or

iii. any person being an individual in the name of his spouse or in the name of any child of such individual and the consideration for such property has been provided or paid out of the known sources of the individual ; or

iv. any person in the name of his brother or sister or lineal ascendant or descendant, where the names of brother or sister or lineal ascendant or descendant and the individual appear as joint-owners in any document, and the consideration for such property has been provided or paid out of the known sources of the individual.

(B) a transaction or an arrangement in respect of a property carried out or made in a fictitious name; or

(C) a transaction or an arrangement in respect of a property where the owner of the property is not aware of, or, denies knowledge of, such ownership;

(D) a transaction or an arrangement in respect of a property where the person providing the consideration is not traceable or is fictitious;

* “person” shall include:

Individual, HUF, Company, AOP/BOI, Firm, Artificial juridical person

As per Section 53A of the Transfer of Property Act, 1882, a person becomes the owner of a property when a part performance of the contract has been executed, however Benami transaction shall not include any transaction involving the allowing of possession of any property to be taken or retained in part performance of a contract referred to in Section 53A of the Transfer of Property Act, 1882, if, under any law for the time being in force, where

(i) consideration for such property has been provided by the person to whom possession of property* has been allowed but the person who has granted  possession thereof continues to hold ownership of such property;

possession thereof continues to hold ownership of such property;

(ii) stamp duty on such transaction or arrangement has been paid; and

(iii) the contract has been registered

Thus, acquisition of a property in the name of a person other than the one paying the consideration thereof may result into a Benami Transaction.

*”Property” means assets of any kind, whether movable or immovable, tangible or intangible, corporeal or incorporeal and includes any right or interest or legal documents or instruments evidencing title to or interest in the property and where the property is capable of conversion into some other form, then the property in the converted form and also includes the proceeds.

It must be noted that, contrary to popular misconception, the application of benami law is not confined to immoveable properties alone. The term ‘property’, for the purposes of Benami, is quite wide and includes within its wide ambit: assets of ‘any kind’; whether movable or immovable, tangible or intangible, corporeal or incorporeal; and not only that, it also includes any right or interest or legal documents or instruments evidencing title to, or interest in the property and where the property is capable of conversion into some other form, then the property in the converted form is included as well. In fact, the proceeds from the property are also included within the definition of ‘property’.

Section 3 provides No person shall enter into any Benami transaction.

Benami transactions have been a part of Indian society for a while. One of the earliest instances of recognition of this practice can be traced to a Calcutta case wherein – a person purchased property in the name of his wife, and the same was held to be fictitious and therefore invalid. However, in the next few decades, the judicial stance towards Benami became a little less certain and there was considerable ambivalence with respect to the legality of the concept. The Privy Council in fact observed that the idea was quite unobjectionable. In fact, in some decisions, the Courts went on to observe that certainbenamitransactions werecustoms of the country and must be recognized as such, thereby giving it a veneer of legality, since custom was one of the important sources of law back then.

Where the Initiating Officer, on the basis of material in his possession, has reason to believe that any person is a benamidar in respect of a property, he may, after recording reasons in writing, issue a notice within a period of 30 days to the person to show cause within such time as may be specified in the notice why the property should not be treated as benami property.

Notice will be issued to

Any such notice may be addressed as follows

| S No. | In case of- | Notice to be addressed to- |

| 1. | An individual | such individual |

| 2. | A firm | managing partner or the manager of the firm |

| 3. | A Hindu Undivided Family | Karta or any member of such family |

| 4. | A company | principal officer thereof |

| 5. | Any other association or body of individuals | principal officer or any member thereof |

| 6. | Any other person (not being an individual) | person who manages or controls his affairs |

For the implementation of this Act and Adjucating part, Central Government shall appoint designated officers who shall be referred to as Inspecting Officers. The Inspecting officers shall be the officer not below rank of Deputy Commissioner or Assistant Commissioner of Income Tax, Designated for this purpose. The appellate authority under this Act shall be the Appellate authority as specified under Prevention of Money Laundering Act 2002.

The Central Government shall, by notification, establish an Appellate Tribunal to hear appeals against the orders of the Adjudicating Authority under this Act. Any person, including the Initiating Officer, aggrieved by an order of the Adjudicating Authority may prefer an appeal in such form and along with such fees, as may be prescribed, to the Appellate Tribunal against the order passed by the Adjudicating Authority under Section 26, within a period of forty-five days from the date of the order. The Appellate Tribunal may entertain any appeal after the said period of forty-five days, if it is satisfied that the appellant was prevented, by sufficient cause, from filing the appeal in time. On receipt of an appeal, the Appellate Tribunal may, after giving the parties to the appeal an opportunity of being heard, pass such orders thereon as it thinks fit.

Any person, including the Initiating Officer, aggrieved by an order of the Adjudicating Authority may prefer an appeal in such form and along with such fees, as may be prescribed, to the Appellate Tribunal against the order passed by the Adjudicating Authority under Section 26, within a period of forty-five days from the date of the order. The Appellate Tribunal may entertain any appeal after the said period of forty-five days, if it is satisfied that the appellant was prevented, by sufficient cause, from filing the appeal in time. On receipt of an appeal, the Appellate Tribunal may, after giving the parties to the appeal an opportunity of being heard, pass such orders thereon as it thinks fit.

Any party aggrieved by any decision or order of the Appellate Tribunal may file an appeal to the High Court within a period of sixty days from the date of communication of the decision or order of the Appellate Tribunal to him on any question of law arising out of such order.

Special courts are also to be constituted by Central government, after consultation with Chief Justice of High Court, which shall hear the appeal made by the aggrieved parties who are not satisfied by the orders of High Court.

**************************************************************

Disclaimer

All rights reserved. No part of this Article may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior permission, in writing, from the author.

About Author

Author of this article is CA Deepak Bharti who is member of ICAI. He can be reached at [email protected]. Suggestions/comments are most welcome.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"