CA Deepak Bharti | Nov 25, 2018 |

place of supply of services vat uae, place of supply vat uae, UAE VAT : Date and Place of Supply, place of supply under uae vat, vat on expenses uae, date of supply uae vat, vat accounting entries in uae, vat law in uae pdf, uae vat law, place of supply vat uae, date of supply uae vat, place of supply of services vat uae, uae vat time of supply, place of supply under uae vat, place of supply vat uae tally, vat on advance payments uae, claiming vat on advance payment in uae, Date and Place of Supply as per UAE VAT Law

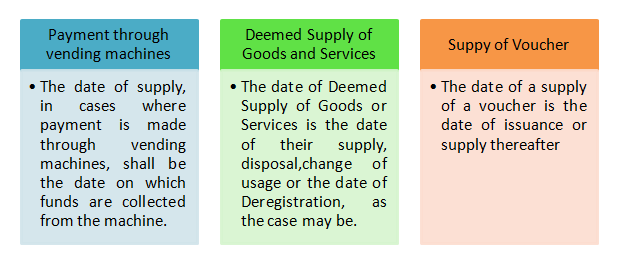

UAE VAT : Date and Place of Supply :The tax which has been levied and needs to be assessed, will require a specific date to be established for the transaction for taxpayer and tax administration to carry out the quantification. This article provides for the manner of determining the Date of Supply.

The Date of supply shall not be entirely left at the discretion of the taxable person. Taxable persons first need to look into which clause of this article is applicable for a supply and then ascertain the date so stated under that clause.

Tax shall be calculated on the date of supply of Goods or Services, which shall be earlier of any of the following dates:

A more brief view of the above discussion can be depicted below:

| Description | Applicability | Date of Supply |

| Transfer supervised by supplier | Goods | Transfer of lawful possession of Goods |

| Transfer without supervision bySupplier | Goods | Collection with lawful possession of Goods |

| Assembly and installation | Goods | Completion of assembly or Installation |

| Import under customs legislation | Goods | Date of Import as per customs Legislation |

| Delivery towards sale on approval | Goods | Acceptance or 12 months from date of transfer of goods or its placement at disposal of recipient |

| Provision of services | Services | Completion of service |

| Receipt of payment /issuance of tax invoice | Both Goods and Services | Whichever is Earlier |

The date of supply of Goods or Services for any contract that includes periodic payments or consecutive invoices is the earliest of any of the following dates, provided that it does not exceed one year from the date of the provision of such Goods and Services:

(a) The date of issuance of any Tax Invoice.

(b) The date on which payment is due as shown on the Tax Invoice.

(c) The date of receipt of payment.

Place of supply is most important because it is the determination of the place of supply that provides the information as to which state is entitled to collect the tax in respect of the taxable supply effected by the taxable person on the date of supply.

When a transaction is referred to as supply made, it can refer to the location of the supplier at the time of affecting the outward supply or refer to the location of the goods at the time of affecting the supply.

Place of supply is important to know whether tax is payable in UAE or not. If place of supply is within UAE then VAT is applicable on those supplies and the taxable person shall be liable to discharge VAT as prescribed. This article puts the places of supply in three categories, namely:

Of all the important aspects to be determined, place of supply is most important because it is the determination of the place of supply that provides the information as to which state is entitled to collect the tax in respect of the taxable supply effected by the taxable person on the date of supply.

1. The place of supply of Goods shall be in the UAE if the supply was made in the UAE, and does not include Export from or Import into the UAE.

2. The place of supply of installed or assembled Goods if exported from or imported into the State shall be:

a. In the State if assembly or installation of the Goods was done in the State.

b. Outside the State if assembly or installation of the Goods was done outside the State.

3. The place of supply of Goods that includes Export or Import shall be as follows:

a. Inside the State in the following instances:

i. If the supply includes exporting to a place outside the Implementing States.

ii. If the Recipient of Goods in an Implementing State is not registered for Tax in the state of destination, and the total exports from the same supplier to this state does not exceed the mandatory registration threshold for said state.

iii. The Recipient of Goods does not have a Tax Registration Number in the State, and the total exports from the same supplier in an Implementing State to the State exceed the Mandatory Registration Threshold.

b. Outside the State in the following instances:

i. The supply includes an Export to a customer registered for Tax purposes in one of the Implementing States.

ii. The Recipient of Goods is not registered for Tax in the Implementing State to which export is made, and the total exports from the same supplier to this Implementing State exceeds the mandatory registration threshold for said state.

iii. The Recipient of Goods does not have a Tax Registration Number and the Goods are imported from a supplier registered for Tax in any of the Implementing States from which import is made, and the total imports from the same supplier to the State do not exceed the Mandatory Registration Threshold.

4. Goods shall not be treated as exported outside the State and then re-imported if such Goods are supplied in the State and this supply required that the Goods exit and then re-enter the State according to the instances specified in the Executive Regulation of this Decree-Law.

The whole discussion about the place of supply in each of the three categories identified above, has been summarised in the table below for ease of understanding.

| Transaction | Origin | Destination | Recipient | Additional Facts ofRecipient | Place ofSupply |

| Supply | UAE | UAE | Any | Registered or unregistered in UAE | UAE |

| Assembly | UAE | UAE | Any | Registered or unregistered in UAE | UAE |

| Supply | UAE | RoW | Any | – | UAE |

| Supply | UAE | GCC | In GCC |

| UAE |

| Supply | UAE | UAE | UAE |

| UAE |

Where place of supply is in UAE the supply will be liable to VAT notwithstanding the destination of journey of the goods.

| Transaction | Origin | Destination | Recipient | Additional Facts ofRecipient | Place ofSupply |

| Supply | Outside UAE | Outside UAE | Any | – | Outside UAE |

| Assembly | Outside UAE | Outside UAE | Any | – | Outside UAE |

| Supply | UAE | Within GCC | In GCC | Registered in GCC | Outside UAE |

| Supply | UAE | Within GCC | In GCC |

| Outside UAE |

| Supply | GCC | UAE | UAE |

| Outside UAE |

Where place of supply is outside UAE the supply will not be liable to VAT as it would be an export as per article 45 and kindly refer to Chapter V for detailed discussion on export.

Supply of water and energy (specified forms) does not follow the general principles of place of supply in view of the significance of economic activity involving water and energy.

The place of supply in case of supply of Water and Energy can be determined from the below table:

| Description | Supply By | Supply To | Place of Supply | EffectivePlace ofSupply | |

| Water andEnergy | Taxable Person | Taxable Person | Place of Residence of Taxable Trader | Within UAE | UAE |

| Within GCC | Outside UAE | ||||

| Taxable Person | Non-Taxable Person | Actual Consumption | Within UAE | UAE | |

| Outside UAE | Outside UAE | ||||

Place of supply of services will be the place of residence of supplier of Services.

The place of residence of supplier of service shall be:

Article 30: As an exception to what is stipulated in Article (29) of this Decree-Law, the place of supply in special cases shall be as follows:

For telecommunications and electronic Services specified in the Executive Regulation of the Decree-Law, the place of supply shall be:

The actual use and enjoyment of all telecommunications and electronic Services shall be where these Services were used regardless of the place of contract or payment.

**************************************************************

Disclaimer

All rights reserved. No part of this Article may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior permission, in writing, from the author.

About Author

Author of this article is CA Deepak Bharti who is member of ICAI. Currently he is working as partner in M/s N A V & Co. Chartered Accountants, handling the Corporate Compliance and Legal Department. He can be reached at [email protected]. Suggestions/comments are most welcome.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"