CA Pratibha Goyal | Mar 27, 2025 |

Breaking: CA Final Exams to be Held Thrice a Year from 2025

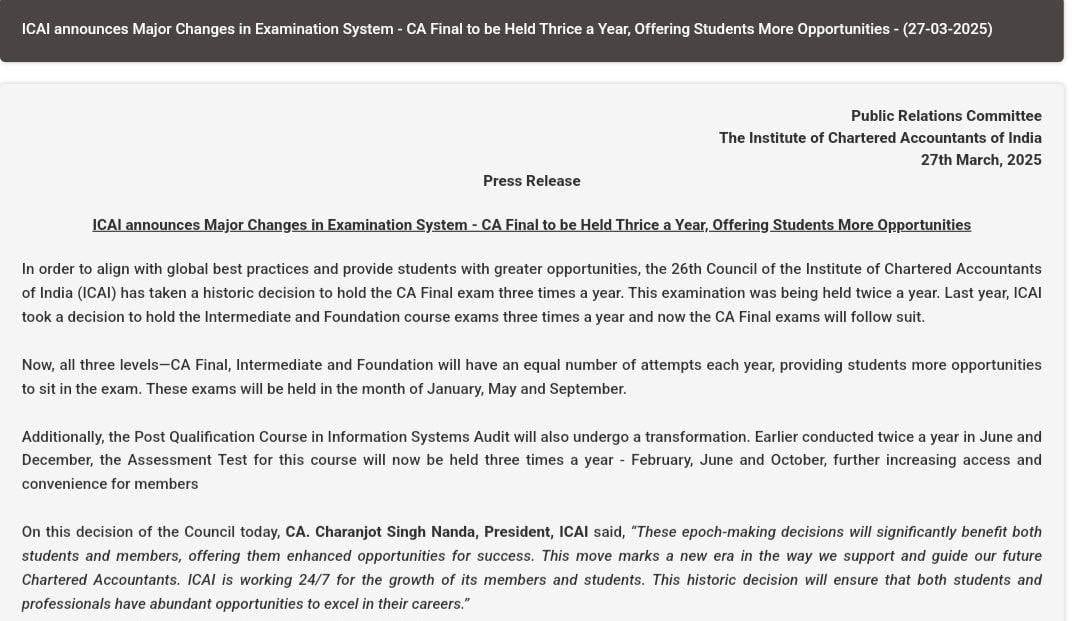

The CA final exams will now be held three times a year starting in 2025, instead of twice a year as previously announced by the Institute of Chartered Accountants of India (ICAI). The decision was made at the 441st Council Meeting, which took place in New Delhi on March 27, 2025.

ICAI last year also made a similar adjustment for exams in the Intermediate and Foundation course. With this latest ruling, all three levels of the Chartered Accountancy course will now have the same timeline.

“To stay in sync with international best practices and provide students with additional chances, the 26th Council of ICAI has taken a historic decision to hold the CA Final examination thrice a year. Earlier, the examination was held twice a year,” ICAI stated.

According to ICAI, candidates will have more flexibility in their endeavors as the CA exams will now take place in January, May, and September.

Additionally, changes to the Post Qualification Course in Information Systems Audit have been announced by the ICAI. The course assessment test, which was formerly administered twice a year in June and December, will now be administered three times a year in February, June, and October.

Along with other council members, ICAI President CA. Charanjot Singh Nanda and Vice President CA. Prasanna Kumar D. talked about these reforms as part of efforts to expand access to exams and professional education.

It is anticipated that the change will give students more opportunities to pass their tests and successfully finish the qualifying procedure.

ICAI will soon share further details on the updated schedule and associated recommendations.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"