CA Bimal Jain | Feb 2, 2022 |

Budget 2022: Changes Under Customs & Excise

The Finance Minister has introduced the Finance Bill, 2022 in Lok Sabha today, that is 1st February, 2022. Changes in Customs, Central Excise, GST law and rates have been proposed through the Finance Bill, 2022.

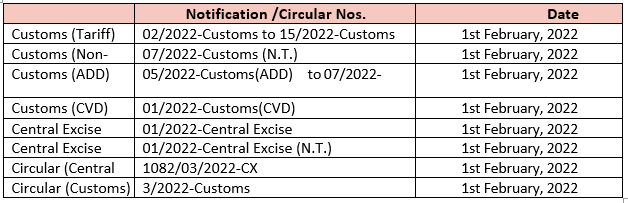

To prescribe effective rates of duty, following notifications are being issued:

Unless otherwise stated, all changes in rates of duty will take effect from the midnight of 1st February/ 2nd February, 2022. A declaration has been made under the Provisional Collection of Taxes Act, 1931 in respect of clause 97 (a) of the Finance Bill, 2022 so that changes proposed therein take effect from the midnight of 1st February/ 2nd February, 2022. The remaining legislative changes would come into effect only upon the enactment of the Finance Bill, 2022 or from 1st May, 2022.

This document summarises the changes made/ proposed under the Customs and Excise – Section wise in comparative manner for easy digest.

(i) Customs duty rate changes: The change in the rates of duty, tariff rates, omission of certain exemption and amendments in certain exemptions, conditions to exemptions, clarifications relating to applicability of SWS etc.

(ii) Tarrifisation: An exhaustive exercise has been carried out for simplification of tariff structure. Unconditional concessional rates prescribed through various notifications are being moved to Tariff (First) Schedule in the Customs Tariff Act. These changes in tariff rate shall come into effect from 1st May, 2022. Accordingly, the respective entries in the concerned notifications will be omitted with effect from the 1st May, 2022. The duty rates on such item shall then operate through First Schedule of Customs Tariff Act, 1975. It may however be noted that certain rate changes in the Customs Tariff are coming into effect immediately by virtue of declaration under the Provisional Collection of Taxes Act.

(iii) Legislative changes in the Customs Act, Customs Tarff Act and Rules made thereunder:

a) Certain significant changes are being made in the Customs Act. The definition of ‘proper officer’ is being modified; officers of DRI, Audit and Preventive formation are being specifically included in the class of officers of Customs; explicit provision is being made for assigning functions to officer of Customs by the Board or Pr. Commissioner/Commissioner of Customs; concurrent jurisdiction is being provided for in certain circumstance, as the Board may specify; explicit provision is being made to delineate jurisdiction on cases involving short levy/payment of duty or erroneous refund etc. and to provide for concurrent exercise of powers. Further, enabling provisions are being added to tackle the menace of systemic undervaluation. Procedures with respect to Advance Ruling are being rationalised. A section is being added to make unauthorised publication of import or export data, an offence under the Customs Act.

b) In a major trade facilitation measure the Import of Goods Concessional Rate of Duty (IGCR) Rules,2017 have been comprehensively revised. End-to-end automation is being introduced in the entire process; various forms are being standardized and any transaction based permissions or intimations are being done away with. Periodical statement under these rules shall also be submitted on the common portal.

To Read More Details Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"