Vanshika verma | Feb 2, 2026 |

Budget 2026 Overhauls Buyback Taxation: Capital Gains to Replace Dividend Tax

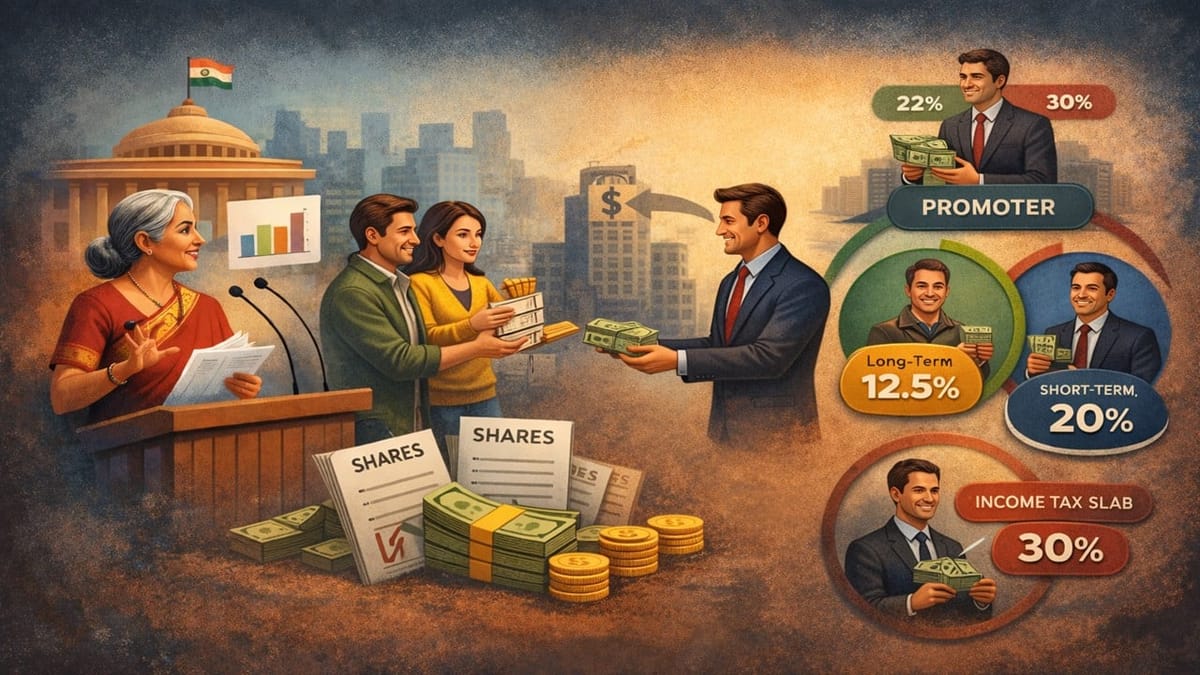

During the budget 2026, Finance Minister Nirmala Sitharaman proposed that buyback proceeds for all types of shareholders will be taxed as capital gains.

Previously, when a company bought back its shares, the amount received by shareholders was taxed as a dividend. However, the cancellation of shares was treated as a capital loss. This created problems for small shareholders who often did not earn any capital gains in a year, so even if they suffered a capital loss from a share buyback, they had no profits to set it off against.

However, the old system divided it into dividend income and capital loss, which made taxation complicated and inconsistent.

To remove this confusion, the Finance Bill 2026 has changed the treatment of buybacks. After changes, now a buyback is considered as a single capital gains transaction. There is no dividend taxation and no separate capital loss. The entire transaction is taxed only under capital gains, making the system simple and logical.

If the shares are held for the long term, whether listed or unlisted, the gain will be taxed at 12.5 per cent. If the shares are listed and held for a short period, the gain will be taxed at 20 per cent. If the shares are unlisted and held for a short period, the gain will be taxed according to the investor’s normal income tax slab rate.

If a promoter is a domestic company, it has to pay about 22% tax on its income. But if the promoter is not a domestic company (for example, an individual, foreign company, or other entity), then the tax rate is around 30%.

For promoters, the tax they have to pay will mostly stay the same because the money they receive is treated as a dividend, and dividends are taxed in their hands.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"