Reetu | Sep 12, 2022 |

CA Foundation December 2022 Exam Schedule Released by ICAI

The Institute of Chartered Accountants of India(ICAI) has released ICAI CA Foundation December 2022 Exam Dates at their Official Site.

In pursuance of Regulation 22 of the Chartered Accountants Regulations, 1988, the Council of the Institute of Chartered Accountants of India is pleased to announce that the next Chartered Accountants Foundation Examination will be held on the dates and places which are given below provided that a sufficient number of candidates offer themselves to appear from each of the below mentioned places.

[As per syllabus contained in the scheme notified by the Council under Regulation 25 F (3) of the Chartered Accountants Regulations, 1988.]

Exam Dates: 14th, 16th, 18th & 20th December 2022

It may be emphasized that there would be no change in the examination schedule in the event of any day of the examination schedule being declared a Public Holiday by the Central Government or any State Government / Local Holiday.

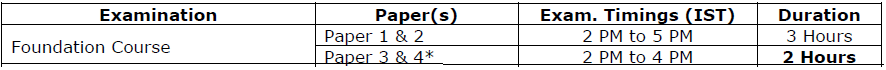

Paper(s) 3 & 4 of the Foundation Examination are of 2 hours duration. The examination wise timing(s) are given below:

*In Paper 3 and 4 of the Foundation Examination there will not be any advance reading time, whereas, in Paper 1 & 2, an advance reading time of 15 minutes will be given from 1.45 PM (IST) to 2 PM (IST).

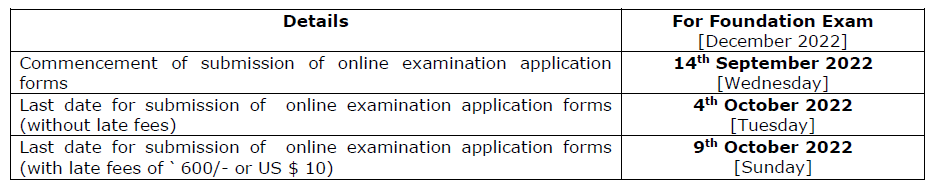

As a part of automation and platform consolidation, ICAI is pleased to announce that all candidates in respect of the Foundation Examination will be required to apply online at https://eservices.icai.org (Self Service Portal – SSP) for December 2022 Exam onwards and also pay the requisite examination fee online. These forms are based on the eligibility of your course based on announcements and regulations. These forms will be available on SSP, and you are requested to log in with your credentials (Username <SRN@icai.org> and password). These Exam forms will be available in SSP effective designated dates as would be announced on www.icai.org.

Kindly Note: If you have never registered as a user in SSP, Kindly open the following URL: https://eservices.icai.org

Please use forgot password option in case you have forgotten or lost your password. Students are also requested to Create User Name, Register Course, Convert Course, Revalidate, Update Photo, Signature and Address on SSP only.

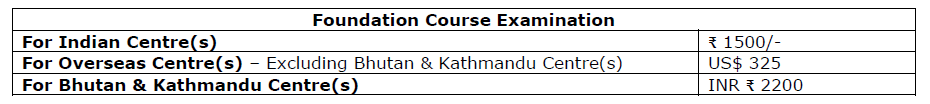

The examination fee can be remitted online by using VISA or MASTER or MAESTRO Credit / Debit Card / Rupay Card / Net Banking / Bhim UPI.

Furthermore, for students seeking a change of examination city/medium for the Chartered Accountants Foundation Examination – December 2022, the correction window for the examination forms already filled shall be available during 8th October 2022 [Saturday] to 13th October 2022 [Thursday].

The late fee for submission of examination application form after the scheduled last date would be 600/- (for Indian / Kathmandu / Bhutan Centres) and US $ 10 (for Abroad Centres) as decided by the Council.

To Read More Details Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"