Reetu | Sep 9, 2022 |

CA Nov 2022 Exam: ICAI Extends Submission Date of Online Exam Application Forms

The Institute of Chartered Accountants of India(ICAI) has extended the Submission Date of Online Examination Application Forms for CA Inter and Final Nov 2022 Examination.

The deadline for CA Inter and Final applications was September 7, however, it has been extended to September 10. Candidates who have not yet submitted an application may do so by going to the official website, icai.org. They must submit their application.

For the Chartered Accountants Examinations in November 2022, the Institute has for the first time implemented a system for examinees to submit their examination forms via the Self Service Portal (SSP). The students may be having some difficulties filling out their exam forms as a result of the system modification, it is said. In order to better serve the needs of the students, the Institute has decided to extend the deadlines for submitting examination forms, either with or without late fees.

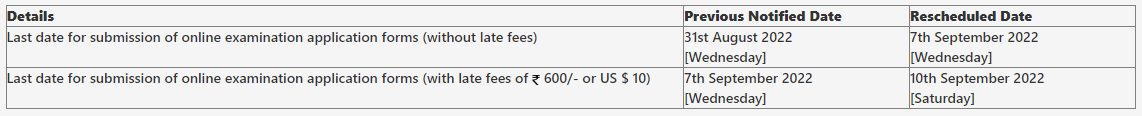

The following dates(s) may be noted:

Additionally, the correction window for the already completed examination forms will be open from September 8th (Thursday) to September 13th (Tuesday) for students who wish to change their examination city, group, or medium for the Chartered Accountants Examinations taking place in November 2022.

The candidates are urged to take note of the aforementioned information and visit www.icai.org frequently.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"