Reetu | Mar 28, 2024 |

CA Student files Grievance before MCA Complaining Clash of Exam Dates with Lok Shabha Election

A CA Finalist Student lodged a complaint against the Institute of Chartered Accountants of India (ICAI) before MCA complaining about the Clash of Election and Exam Dates.

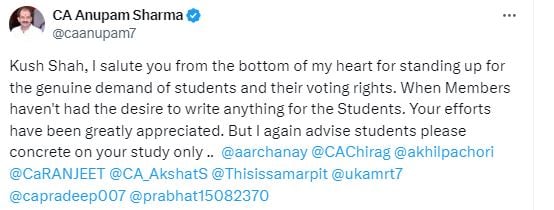

Chartered Accountant Anupam Sharma by sharing the post on his official Twitter account applauds this step of the student and also advises all the students preparing for exams to stay focused and concrete on their study.

He wrote, “Kush Shah, I salute you from the bottom of my heart for standing up for the genuine demand of students and their voting rights. When Members haven’t had the desire to write anything for the Students. Your efforts have been greatly appreciated. But I again advise students please concrete on your study only ..@aarchanay @CAChirag @akhilpachori @CaRANJEET @CA_AkshatS @Thisissamarpit @ukamrt7 @capradeep007 @prabhat15082370.”

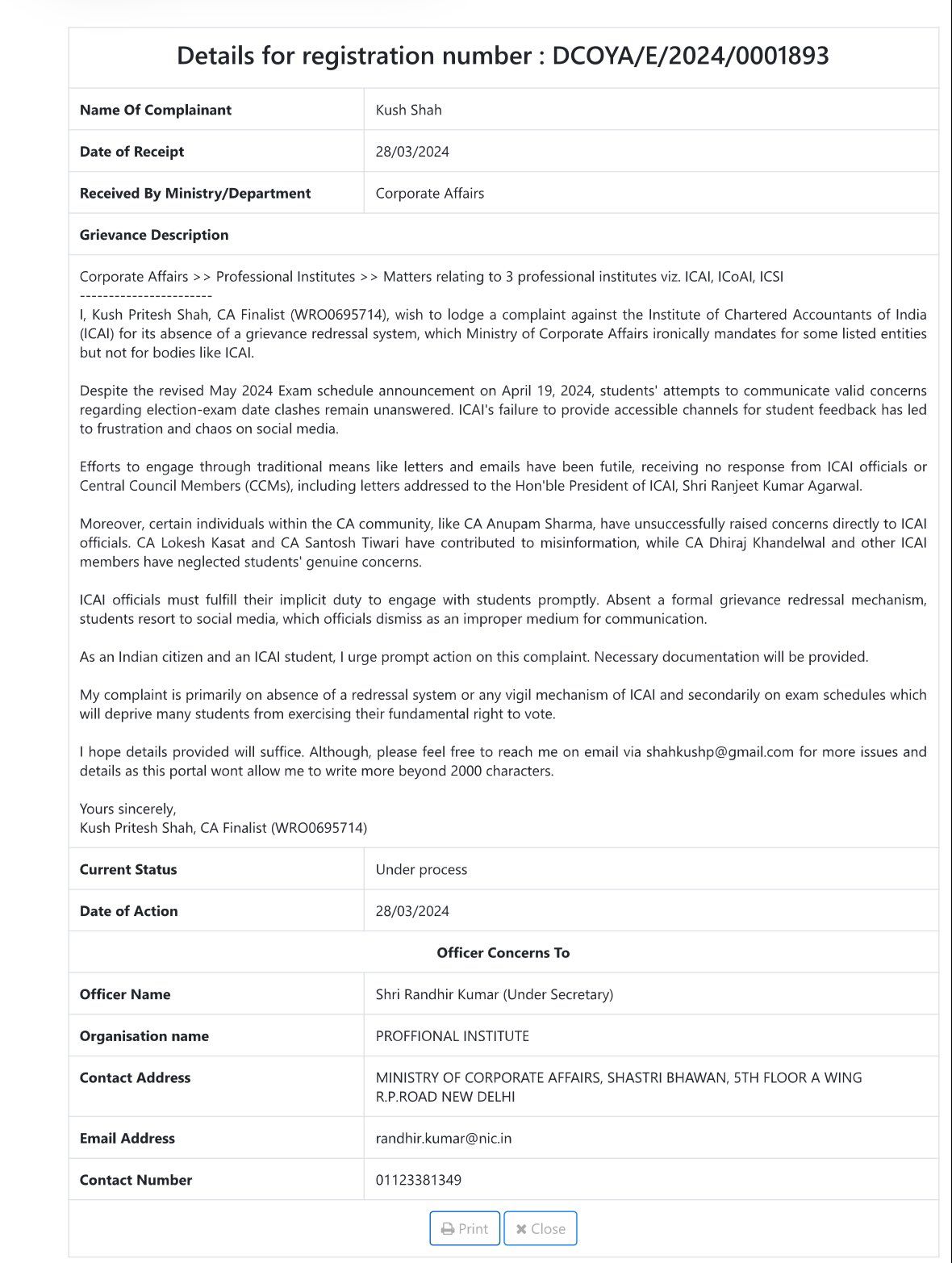

He also shared the compliant filed by the student.

Recently, ICAI released the Revised Chartered Accountancy (CA) Final and Intermediate Examination schedule for May 2024. The Revision in the dates of CA Exams are done in view of the Lok Sabha Elections, 2024. As the 18th Lok Sabha Election dates were announced by the Election Commission that are scheduled in the month of April – June 2024.

But, even after revising the dates of CA Exams, the students are not happy with the decision taken. Sharing their disappointment, several students took to social media platforms to express their genuine concerns about the updated schedule for the CA May exams 2024, urging the Institute to consider moving the CA Intermediate and Final exams from May to June, following the 18th Lok Sabha general elections.

Since the revised schedule came, a week has passed but ICAI hasn’t considered the requests of CA students to shift the dates to next month.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"