Priyanka Kumari | Nov 14, 2023 |

CAs Question ICAI Ghaziabad branch for spending Rs. 42,898 on liquor

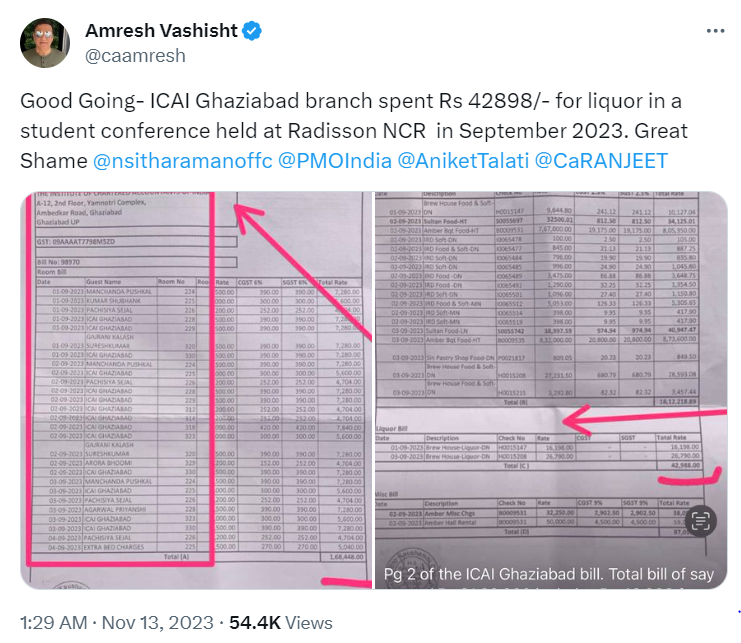

The Institute of Chartered Accountants of India (ICAI) has spent Rs. 42,898 for liquor for the mega student conference conducted in Delhi on September 2nd and 3rd, 2023, which has become an issue of controversy.

The tweet included scanned photos of the bill, which showed that about 21 lakhs were spent on the two-day programme. Within this budget, Rs. 42,998 was set up for liquor, with Rs. 16,198 spent on day one and Rs. 26,790 spent on day two.

Following this tweet, many individuals raised their concerns and comments about the expense. They believe that this issue should be presented to the ICAI and the ethics committee for further investigation.

A comment stated that it is such a rare thing by ICAI, I believe. What is required to do this, is an obvious query in mind; that appeasing students in such a way (offering liquor) is something quite questionable. After all, ICAI is supposed to be a highly moralistic, ethical backbone & systematic organisation!

The student conferences are planned with a view of enhancing knowledge, developing skills, giving networking opportunities, supporting professional growth, and providing career advice. When these objectives are exceeded, the ICAI must conduct a comprehensive inquiry and take necessary action.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"