The Central Board of Direct Taxes(CBDT) has notified JCIT(A)/Addl.CIT(A) to facilitate conduct of E-appeal Proceeding via issuing Notification.

Reetu | Jun 15, 2023 |

CBDT notifies JCIT(A)/Addl. CIT(A) to facilitate conduct of E-appeal Proceeding

The Central Board of Direct Taxes(CBDT) has notified JCIT(A)/Addl. CIT(A) to facilitate conduct of E-appeal Proceeding via issuing Notification.

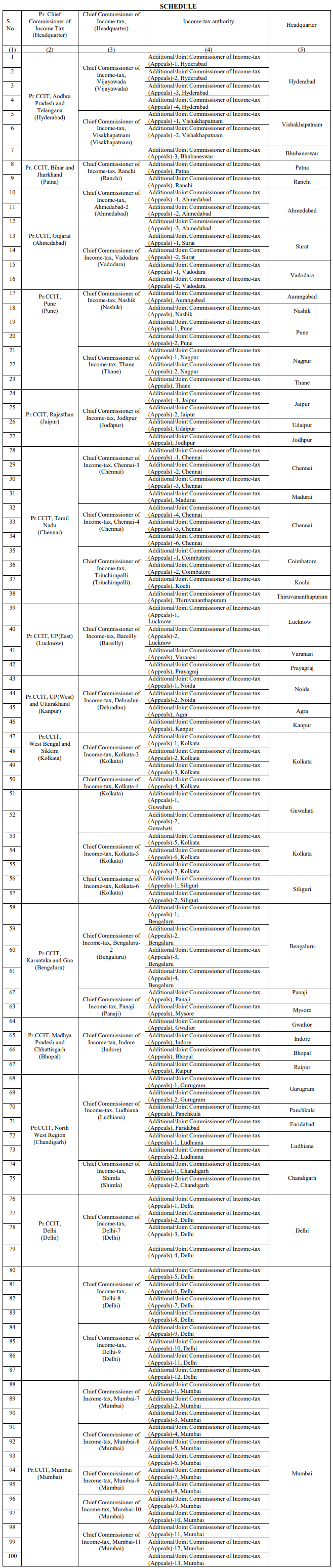

In exercise of the powers conferred by sub-sections (1) and (2) of section 120 of the Income-tax Act, 1961 (43 of 1961) (hereinafter referred to as the Act) and to give effect to the e-Appeals Scheme, 2023 (hereinafter referred to as the Scheme) made under sub-section (5) of section 246 of the Act and published vide Notification No. 33 of 2023 of the Government of India in the Ministry of Finance, Department of Revenue, vide number S.O. 2352(E), dated the 29th of May, 2023, in the Gazette of India, Extraordinary, Part II, Section 3, Subsection(ii), the Central Board of Direct Taxes (hereinafter referred to as the Board), hereby directs that the income-tax authorities specified in column (4) of the Schedule below, having their headquarters at the places specified in the corresponding entries in column (5) of the said schedule and functioning subordinate to the income-tax authorities specified in column (3) of the said schedule shall exercise the powers and perform functions, in order to facilitate the conduct of e-appeal proceedings, in respect of such persons or classes of persons or incomes or classes of income or cases or classes of cases, with respect to appeals covered under section 246 of the Act, except the cases excluded under sub-section (6) of that section, as specified by the Board in paragraph 3 of the Scheme.

This Notification shall come into force from the date of its publication in the Official Gazette.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"