Deepak Gupta | Nov 5, 2018 |

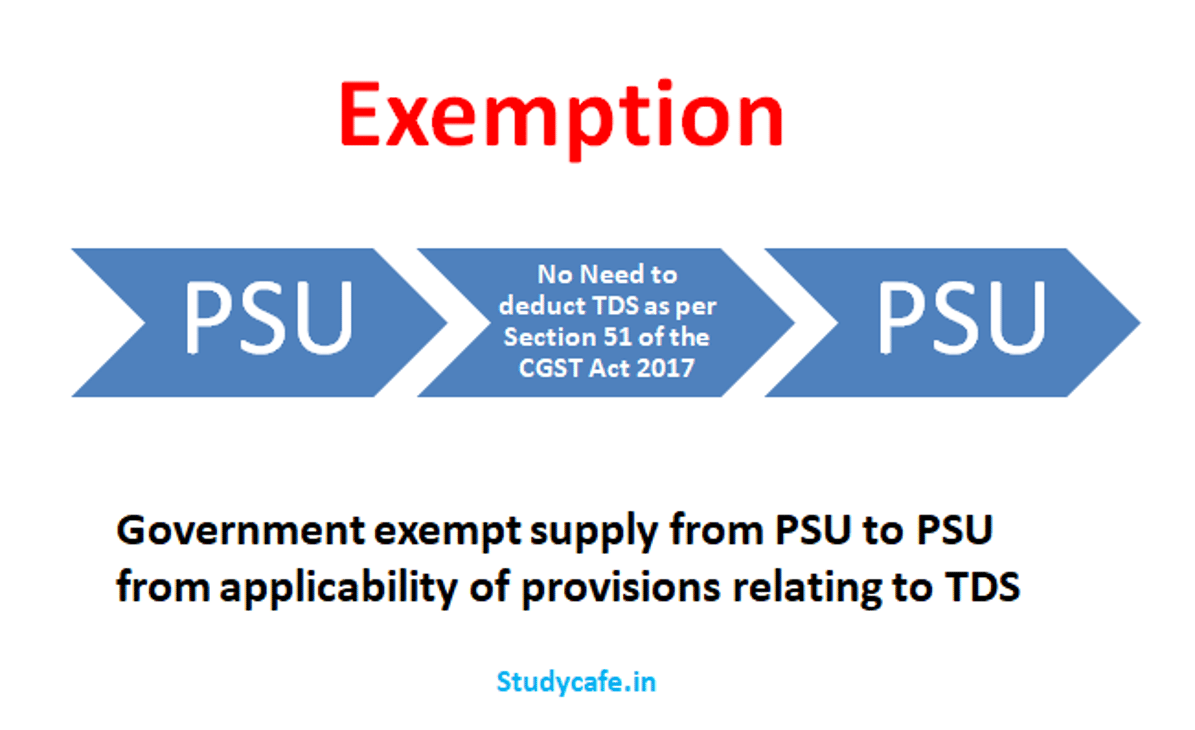

CBIC exempt supply from PSU to PSU from GST TDS :

Government of India has exempted supply from PSU to PSU from applicability of provisions relating to TDS under GST vide Notification No. 61/2018 Central Tax dated 5th November, 2018.

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 61/2018 Central Tax

New Delhi, the 5th November, 2018

G.S.R. (E). In exercise of the powers conferred by sub-section (3) of section 1, read with section 51 of the Central Goods and Services Tax Act, 2017 (12 of 2017), hereafter in this notification referred to as the said Act, the Central Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance, Department of Revenue No. 50/2018-Central Tax, dated the 13th September, 2018, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub- section (i) vide number G.S.R 868(E), dated the 13th September, 2018, namely:

In the said notification, after the proviso, the following proviso shall be inserted, namely:- Provided further that nothing in this notification shall apply to the supply of goods or services or both from a public sector undertaking to another public sector undertaking, whether or not a distinct person, with effect from the 1st day of October, 2018.

[F. No. CBEC/20/06/16/2018-GST]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Note:- The principal notification was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R 868 (E), dated the 13th September, 2018 and subsequently amended vide notification No. 57/2018-Central Tax, dated the 23rd October, 2018, published vide number G.S.R 1057(E), dated the 23rd October, 2018.

CBIC exempt supply from PSU to PSU from GST TDS, Government exempt supply from PSU to PSU from applicability of provisions relating to TDS, Supply from PSU to PSU exempt from GST TDS, supply to psu is exempt from gst tds

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"