Reetu | Dec 25, 2023 |

CBIC imposed Anti-Dumping Duty on imports of Industrial Laser Machinery

The Central Board of Indirect Taxes and Customs (CBIC) has imposed Anti-Dumping Duty on imports of Industrial Laser Machinery originating in or exported from China via issuing Notification.

The Notification reads as follows:

Whereas in the matter of ‘Industrial Laser Machines, used for cutting, marking, or welding’ (hereinafter referred to as the subject goods) falling under tariff items 84561100, 84569090, 84798199, 85152190, 85158090 and 90132000 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs Tariff Act), originating in, or exported from China PR (hereinafter referred to as the subject country), and imported into India, the designated authority in its final findings, issued vide notification 06/07/2022-DGTR, dated the 27th September, 2023 published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 27th September, 2023, read with corrigendum issued vide notification 06/07/2022-DGTR dated 6th December, 2023 published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 7thDecember, 2023, has inter alia come to the conclusion that—

(i) the subject goods have been exported to India from the subject country at dumped prices;

(ii) the domestic industry has suffered material injury on account of subject imports from subject country; (iii)the material injury has been caused by the dumped imports of subject goods from the subject country,

and has recommended imposition of an anti-dumping duty on the imports of subject goods, originating in, or exported from the subject country and imported into India, in order to remove injury to the domestic industry.

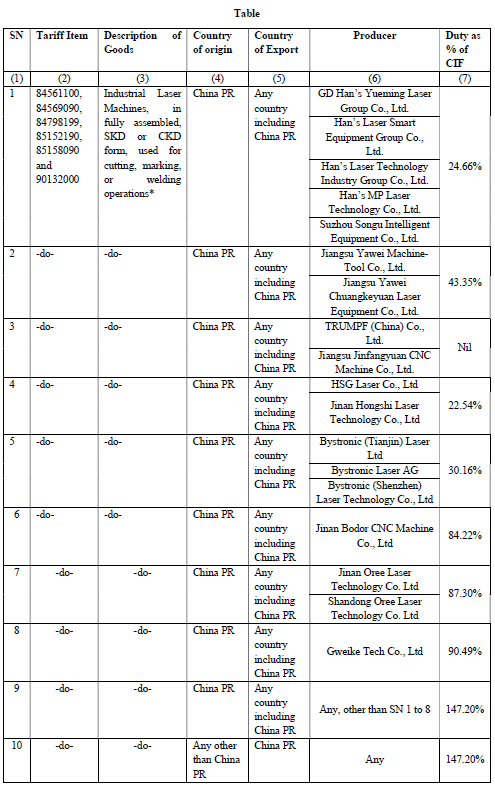

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A of the Customs Tariff Act read with rules 18 and 20 of the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the designated authority, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under tariff item of the First Schedule to the Customs Tariff Act as specified in the corresponding entry in column (2), originating in the country as specified in the corresponding entry in column (4), exported from the countries as specified in the corresponding entry in column (5), produced by the producers as specified in the corresponding entry in column (6), and imported into India, an anti-dumping duty calculated at the rate as specified in the corresponding entry in column (7) of the said Table, namely:

The anti-dumping duty imposed under this notification shall be effective for a period of five years (unless revoked, superseded or amended earlier) from the date of publication of this notification in the Official Gazette, and shall be payable in Indian currency.

Explanation: For the purposes of this notification, rate of exchange applicable for the purposes of calculation of such anti-dumping duty shall be the rate which is specified in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the said Act.

For Official Notification Download PDF Given:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"