Reetu | Aug 23, 2022 |

CBIC initiated probe into Fraudulently Claiming ITC of Rs.37.5 lakh on Farmer

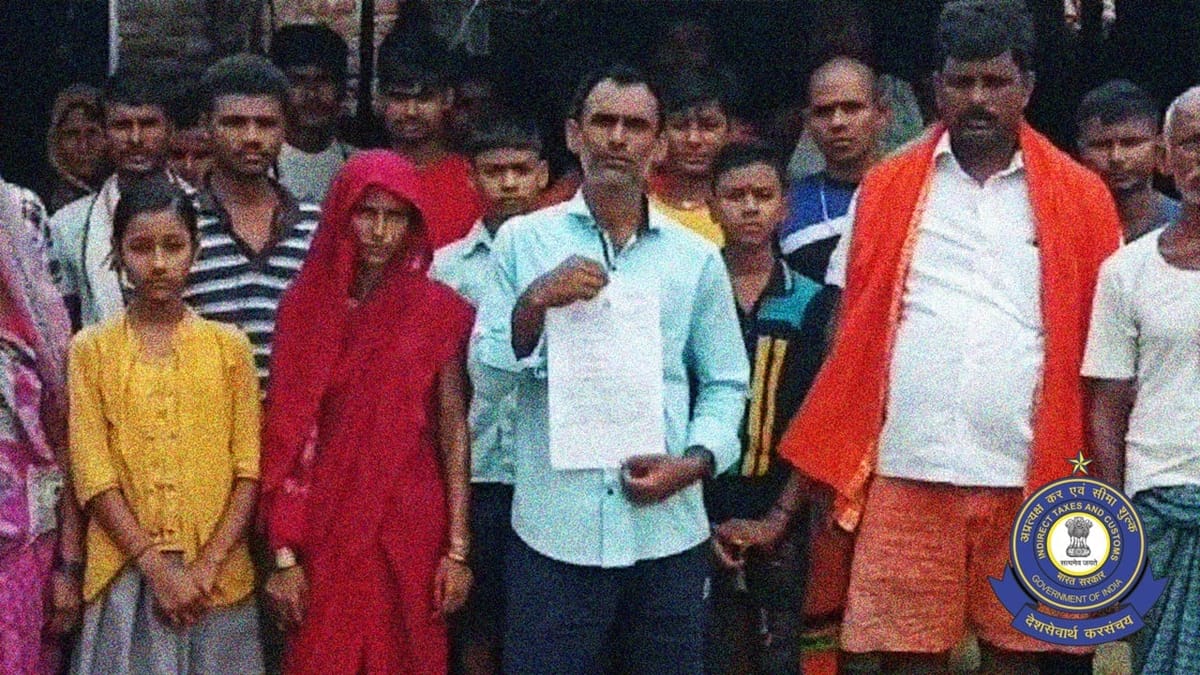

The CGST Officials has send a Notice of Rs.37.5 lakh alongwith applicable interest and penalty for Fraudulently Claiming ITC to daily wage laborer, who had opened the company on his PAN card. Seeing the notice of such a huge amount, he was shocked. Girish is a resident of Maghouna village in Khagaria district.

When word of it spread, a crowd of villagers gathered at his home. The police were informed about the incident. The district administration was perplexed as to how the tax notice for such a sizable sum ended up at the home of the worker who supported his family by working for wages. The case’s cables were connected in Pali, Rajasthan, according to the investigation. Maa Vaishno Trading Company was the name on the notice.

The letter was sent to Sh. Yadav in his role as the owner of M/s Maa Vaishno Trading Company, Pali, Rajasthan, for which a GST registration had been obtained based on his PAN Card, according to an investigation of the case by CGST authorities.

The aforementioned company is accused of violating the GST Law by improperly claiming an input tax credit of Rs. 37.5 lakh based on invoices for services only.

When GST authorities approached him today, Sh. Yadav said that the firm in Pali had been established without his consent by allegedly utilising the PAN card he had provided for the opening of a bank account.

Further investigations in the case are underway.

Recent reports in a section of the media have highlighted a case of Sh. Girish Yadav, a resident of Khagaria, Bihar having received a letter from the jurisdictional GST authorities for recovery of GST amounting to Rs. 37.5 lakh alongwith applicable interest and penalty (1/4)

— CBIC (@cbic_india) August 22, 2022

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"