Reetu | Jun 14, 2023 |

CBIC instructions to GST officers to eliminate fake/bogus GST registration for passing fake ITC

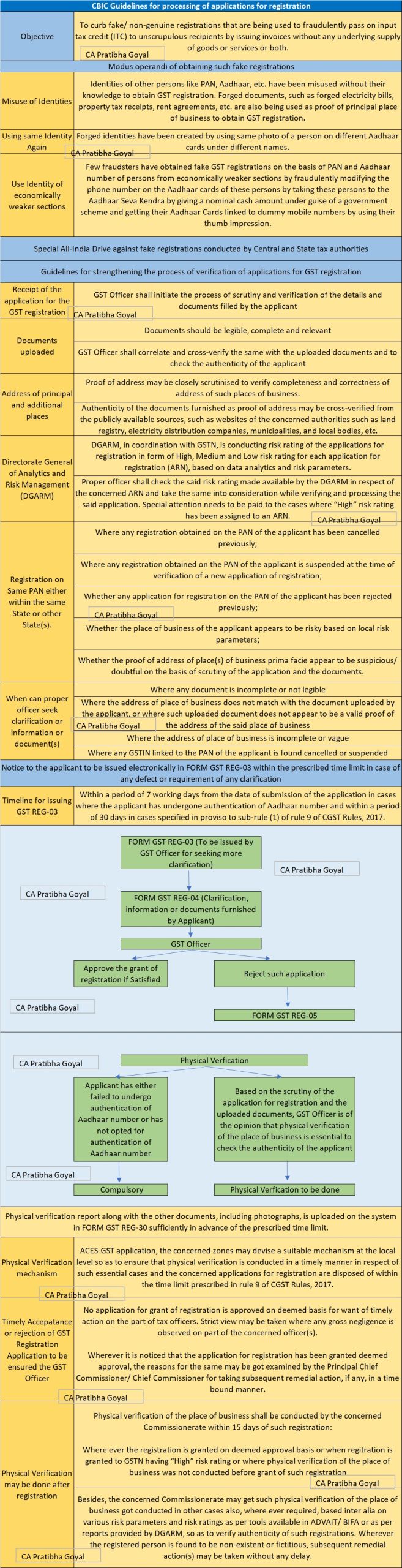

The Central Board Indirect Taxes and Customs(CBIC) has issued Guidelines for Processing of Applications for Registration via issuing Instruction Notification. CBIC has instructed GST officers to ensure “unscrupulous elements” do not obtain “fake/bogus GST registration for passing of fake input tax credit (ITC).

Instances have come to notice regarding unscrupulous elements obtaining fake/ bogus registration under GST and defrauding the Government exchequer. Such fake/ non-genuine registrations are being used to fraudulently pass on input tax credit to unscrupulous recipients by issuing invoices without any underlying supply of goods or services or both. This menace of fake registrations and issuance of bogus invoices for passing of fake ITC has become a serious problem, wherein fraudulent people engage in dubious and complex transactions, causing revenue loss to the government.

Various modus operandi of obtaining such fake registrations have been detected by Central and State Tax administrations. In some cases, identities of other persons like PAN, Aadhaar, etc. have been misused without their knowledge to obtain GST registration. Forged documents, such as forged electricity bills, property tax receipts, rent agreements, etc. are also being used as proof of principal place of business to obtain GST registration. In some cases, forged identities have been created by using same photo of a person on different Aadhaar cards under different names. In one of the cases detected recently, it has been found that a few fraudsters have obtained fake GST registrations on the basis of PAN and Aadhaar number of persons from economically weaker sections by fraudulently modifying the phone number on the Aadhaar cards of these persons by taking these persons to the Aadhaar Seva Kendra by giving a nominal cash amount under guise of a government scheme and getting their Aadhaar Cards linked to dummy mobile numbers by using their thumb impression.

To address this problem of fake registration and fake input tax credit, Instruction No.01/2023-GST dated 04.05.2023 has been issued for concerted and coordinated action on a mission mode by Central and State tax authorities in the form of a Special All-India Drive against fake registrations.

In this context, it is further felt that verification of applications for registration by the proper officers is one of the most crucial steps in the direction of preventing the menace of fake or bogus registrations. While numerous initiatives have been/are being undertaken on the policy and systems level, it is pertinent to strengthen the process of scrutiny and verification of such applications for registration at the end of tax officers.

Accordingly, the following guidelines are issued for strengthening the process of verification of applications for registration at the end of tax officers in a uniform manner:

1. Immediately on receipt of the application for the registration in the Task List of the concerned officer on ACES-GST application, the officer shall initiate the process of scrutiny and verification of the details filled by the applicant in the application for registration in FORM GST REG-01and the documents uploaded by the applicant along with the said application.

2. FORM GST REG-01prescribes a list of documents to be uploaded by the applicant in respect of photograph, constitution of business, principal place of business, bank account, etc. The proper officer shall carefully scrutinize the said documents to ensure that the documents are legible, complete and relevant. Further, the details or information furnished by the applicant in the application should also be carefully examined by the proper officer to check completeness of the same, to correlate and cross-verify the same with the uploaded documents and to check the authenticity of the applicant. The details of the address of principal and additional places of business and the corresponding documents uploaded with the application as proof of address may be closely scrutinised to verify completeness and correctness of address of such places of business. Further, to the extent possible, the authenticity of the documents furnished as proof of address may be cross-verified from the publicly available sources, such as websites of the concerned authorities such as land registry, electricity distribution companies, municipalities, and local bodies, etc.

To Read Full Guidelines Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"