Reetu | Nov 10, 2022 |

CBIC issued Clarification on Refund related issues

The Central Board of Indirect Taxes and Customs(CBIC) has issued Clarification on Refund related issues via releasing Circular.

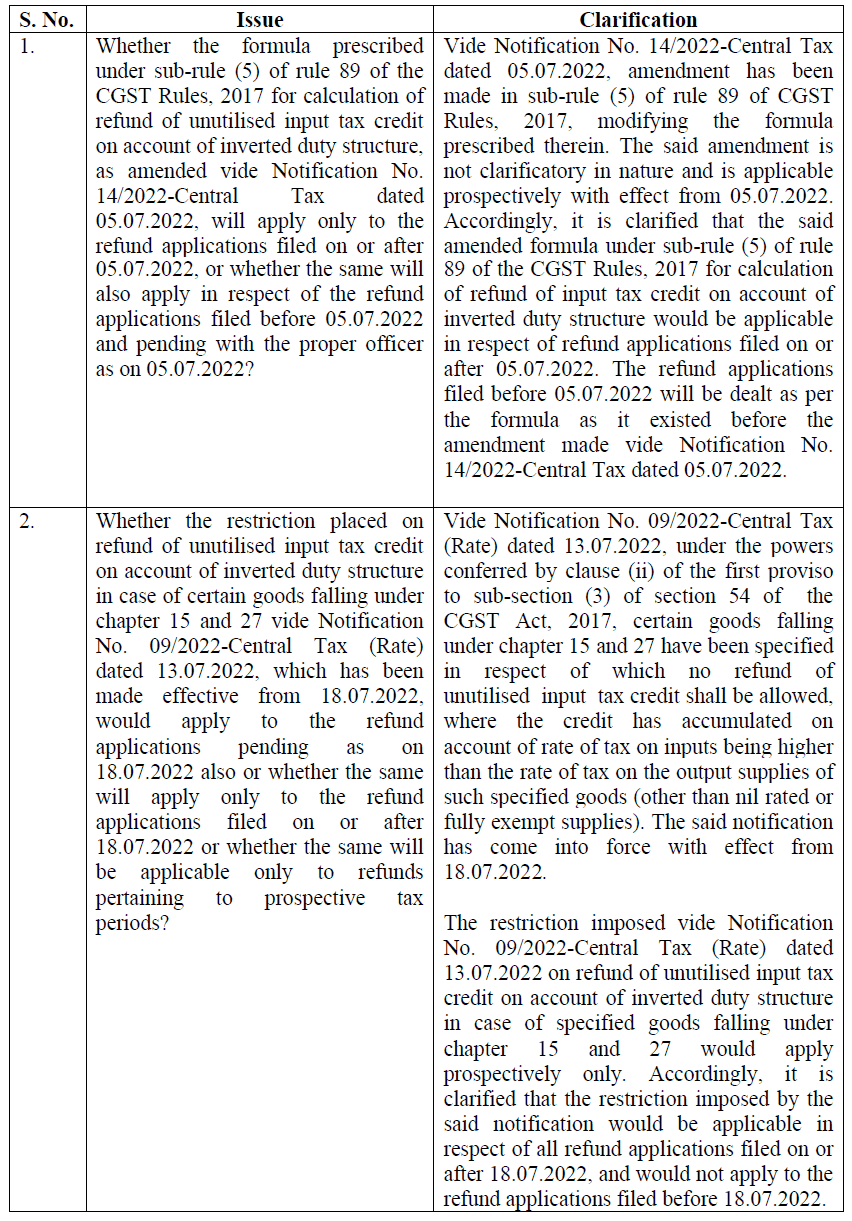

The Circular Stated, “Attention is invited to sub-section (3) of section 54 of CGST Act, 2017, which provides for the refund of unutilized input tax credit in cases where credit is accumulated on account of rate of tax of inputs being higher than the rate of tax on output supplies i.e. on account of inverted duty structure. Sub-rule (5) of rule 89 of CGST Rules, 2017 prescribes the formula for grant of refund in cases of inverted duty structure. Vide Notification No. 14/2022-Central Tax dated 05.07.2022, amendment has been made in the formula prescribed under sub-rule (5) of rule 89 of the CGST Rules, 2017. Further, vide Notification No. 09/2022-Central Tax (Rate) dated 13.07.2022, which has been made effective from 18.07.2022, the restriction has been placed on refund of unutilised input tax credit on account of inverted duty structure in case of supply of certain goods falling under chapter 15 and 27.”

Representations have been received from the trade and the field formations seeking clarification on various issues pertaining to the implementation of the above notifications.

In order to clarify the issues and to ensure uniformity in the implementation of the provisions of law across the field formations, the Board, in exercise of its powers conferred by section 168 (1) of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as “CGST Act”), hereby clarifies the issues as under:

For Official Circular Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"