CA Pratibha Goyal | Sep 19, 2025 |

CBIC notifies Major ITC Reporting Change in GST Annual return: Know More

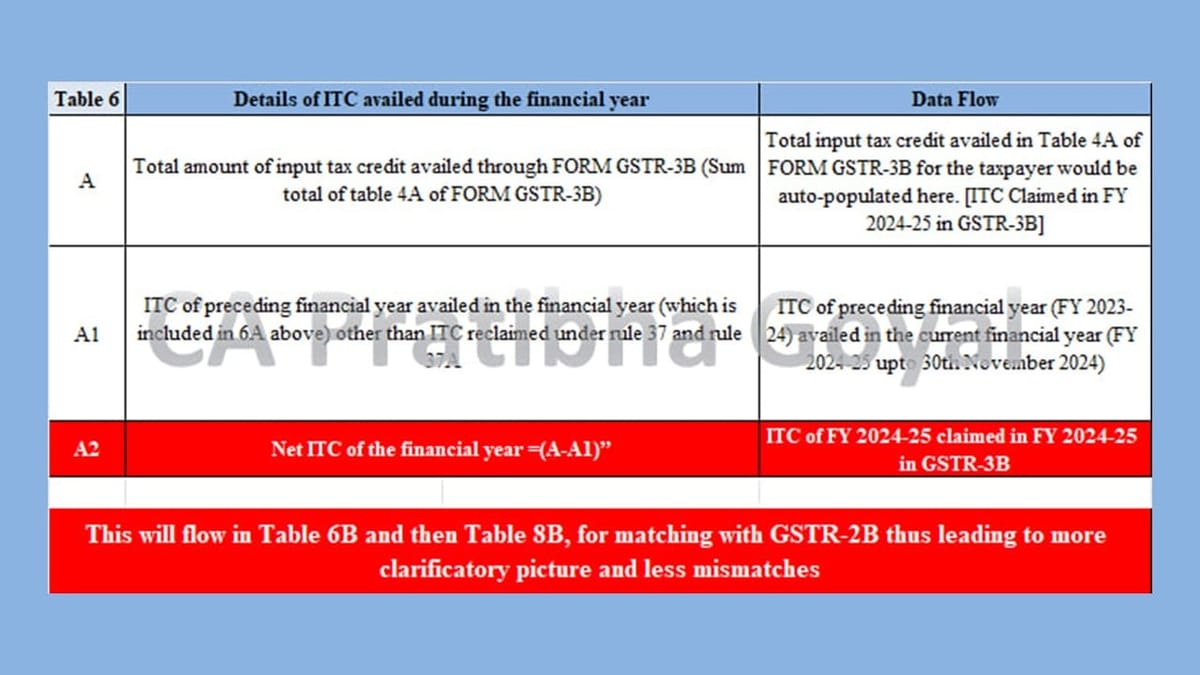

| Amendment in GSTR-9 | Implication |

| New Table 6A1 Introduced in Table 6 “Details of ITC availed during the financial year” | ITC of preceding financial year (FY 2023-24) availed in the current financial year (which is included in 6A – Auto-populated from GSTR-3B) above) (FY 2024-25 upto 30th November 2024) other than ITC reclaimed under rule 37 and rule 37A. This will now separate ITC of Previous year, claimed in current year upto the cut-off date of “30th November) |

| In the entry against serial number 6H, the words, brackets and letter “(other than 6B above)” shall be omitted; | Correspondingly, Table 6H has been amended, since the new breakdown in Table 6A provides clarity on reclaimed ITC. |

| For serial number 6J and the entries relating thereto, the following shall be substituted (I-A2) | Now the data that flows to Table 8B is of CY 2024-25 only. The irrelevant differences on account of FY 23-24 in table 8D will reduce. |

| For serial number 6M and the entries relating thereto, the following shall be substituted ITC availed through ITC-01, ITC 02 and ITC-02A (other than GSTR-3B and TRAN Forms) | This ensures that only ITC related to Transitional forms is reported here |

| Table 7 Details of ITC reversed and Ineligible ITC for the financial year | 2 separate tables created to show reversal of ITC as per Rule 37A [Reversal of input tax credit in the case of non-payment of tax by the supplier and re-availment thereof] and Rule 38 [Claim of credit by a banking company or a financial institution] |

| Table 8B: ITC as per 6(B) above | Now the data in 8B of CY 2024-25 only |

| In the entries against serial number 6H, after the words, brackets, figure and letter “(as per 6(E) above)”, the words “in the financial year” shall be inserted | IGST paid on import of goods availed in FY 2024-25 to be reported here |

| Table 8H1 Introduced: IGST Credit availed on Import of goods in next financial year | IGST paid on import of goods availed in FY 2024-25 availed next year to be reported here |

| 8I= 8G – (6H + 6H1) | IGST not availed will Lapse. |

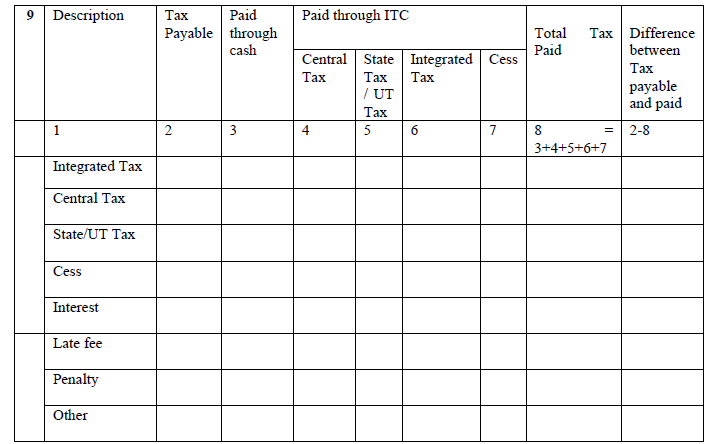

Changes in Table 9

Table 9 now clearly flags the difference between Tax Paid and Tax payble. Deficient Tax Liability is required to be paid by DRC-03.

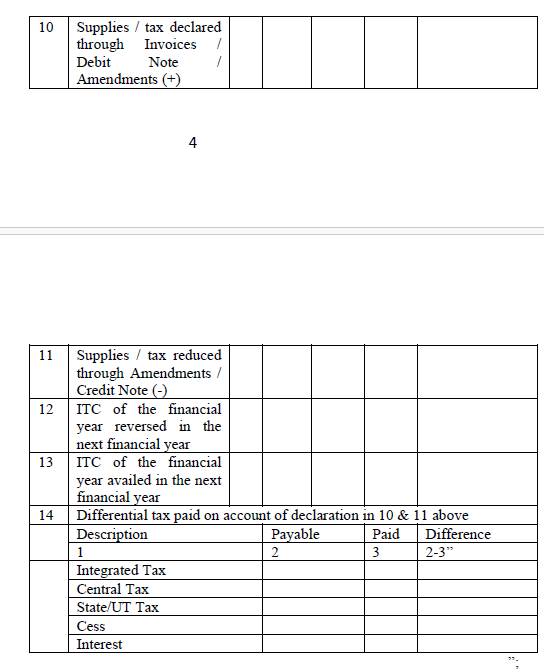

Changes in Table 10

Table 10, 11, 12, 13 and 14 are mandatory for FY 2024-25 and onwards.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"