CA Pratibha Goyal | Apr 9, 2024 |

CBIC waives interest for specified class of Late GSTR-3B fillers due to GSTN Glitches

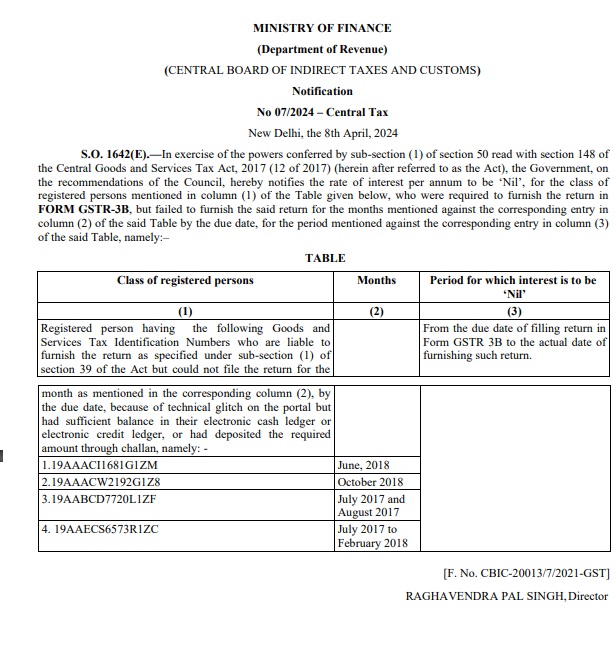

The Central Board of Indirect Tax & Customs (CBIC) in exercise of the powers conferred by sub-section (1) of section 50 read with section 148 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (herein after referred to as the Act), the Government, on the recommendations of the GST Council has notified the rate of interest per annum to be ‘Nil’, for the specified class of registered persons, who have furnished the return in FORM GSTR-3B after the due date.

These specified persons had filed the return after the due date, because of a technical glitch on the portal but had sufficient balance in their electronic cash ledger or electronic credit ledger, or had deposited the required amount through the challan.

The notification for the same is given below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"