Reetu | Jun 1, 2022 |

Centre Clears Entire GST Compensation Due Till Date 31st May 2022

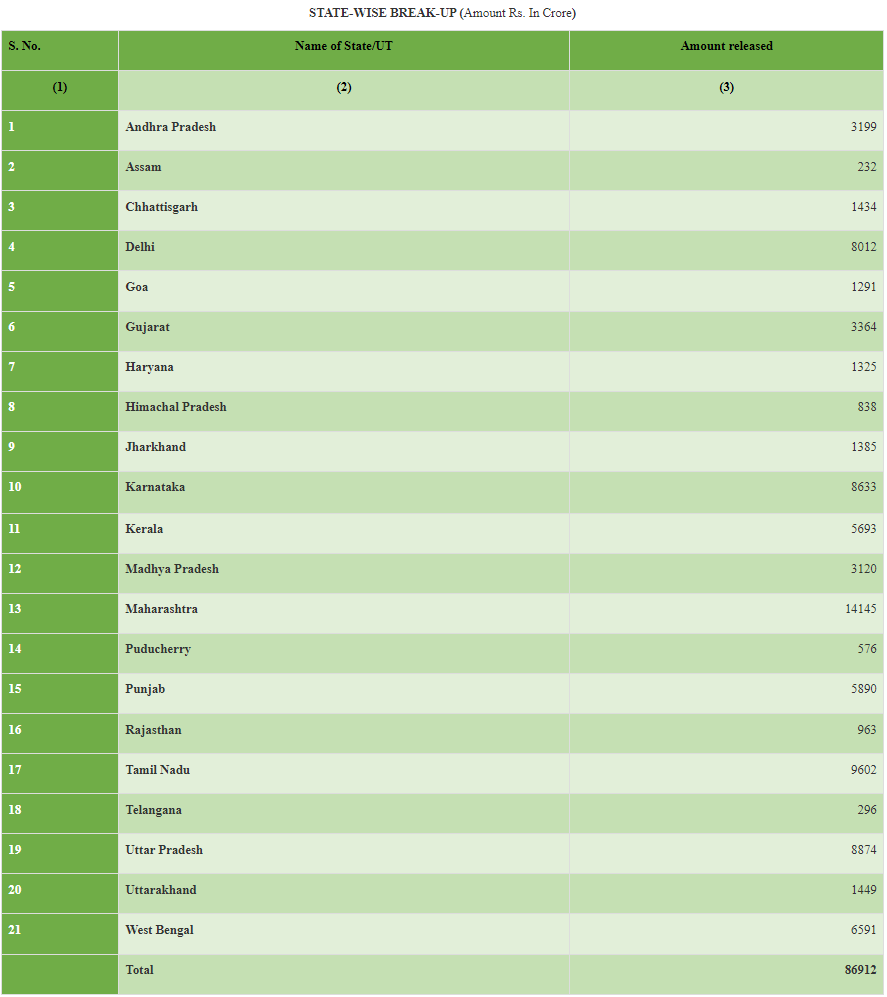

The Government of India has disbursed the entire amount of GST compensation payable to states up to May 31, 2022 by releasing Rs.86,912 crores. This decision was made to aid states in managing their resources and ensuring that their programmes, particularly capital expenditure, are carried out successfully during the fiscal year. Despite the fact that the GST Compensation Fund only has roughly Rs.25,000 crore available, this decision was made. The balance is being released by the Centre from its own resources while the Cess is being collected.

The Goods and Services Tax (GST) was implemented in the country on July 1, 2017, and states were promised of compensation for any revenue loss resulting from GST implementation under the provisions of the GST (Compensation to States) Act, 2017 for a period of five years. Cess is charged on certain products to provide compensation to states, and the money collected is credited to the Compensation Fund. Compensation to states is being paid from the Compensation Fund as of July 1st, 2017.

The Compensation Fund released bi-monthly GST compensation to states for the fiscal years 2017-18 and 2018-19 on time. Because the states’ protected revenue has been growing at a compounded rate of 14 percent while Cess collection has not increased in the same proportion, COVID-19 has expanded the gap between protected revenue and actual revenue receipt, including a reduction in cess collection.

To bridge the resource gap created by the short distribution of compensation, the Centre borrowed and issued Rs.1.1 lakh crore in 2020-21 and Rs.1.59 lakh crore in 2021-22 as back-to-back loans to cover a portion of the cess collection shortfall. The aforesaid decision has been approved by all of the states. Furthermore, the Centre has begun releasing regular GST compensation from the Fund to cover the shortfall.

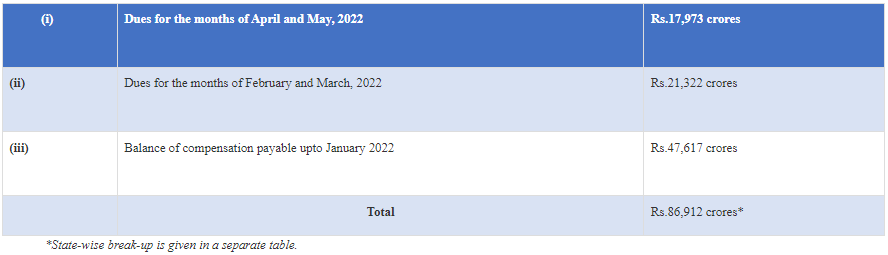

With the combined efforts of the Centre and the States, gross monthly GST collection, including Cess, has made tremendous progress. The table below shows the details of GST compensation payable for previous fiscal years and for the current fiscal year’s April-May period: –

With this release of Rs. 86,912 crore, the compensation to States till May 2022 gets fully paid and only compensation for June 2022 would remain.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"