Certification Course: 7 Days Certification Course on Tax Audit Under Income Tax Act 1961

Reetu | Jun 6, 2022 |

Certification Course: 7 Days Certification Course on Tax Audit Under Income Tax Act 1961

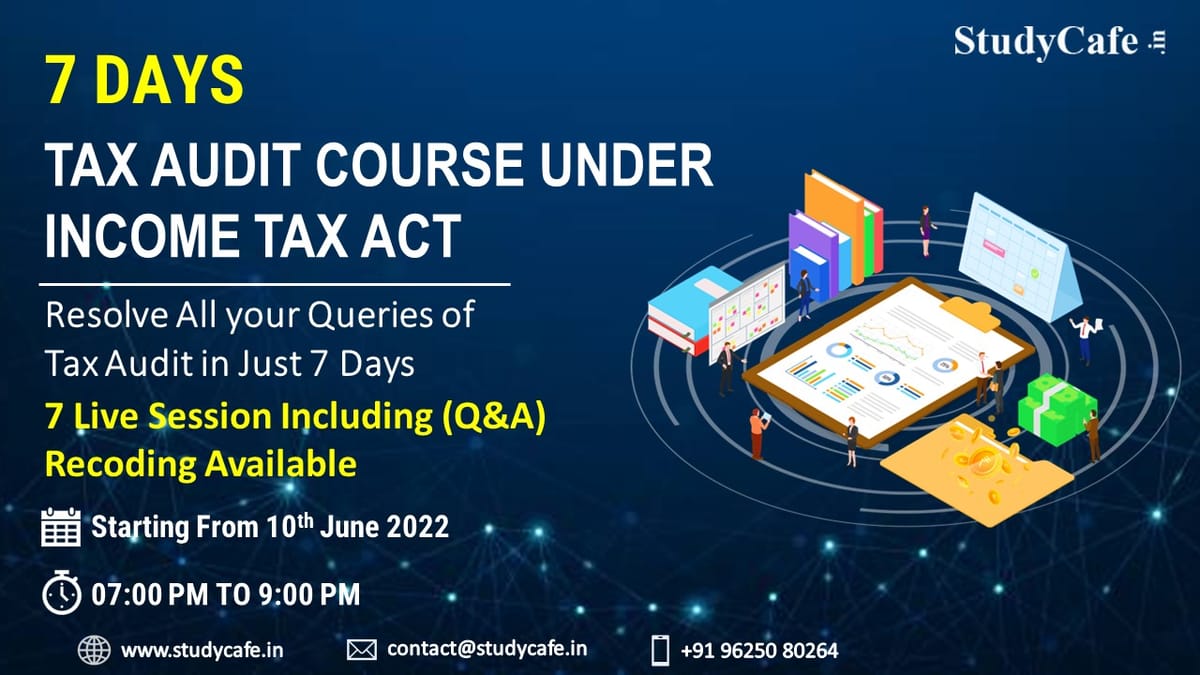

Studycafe is organizing 7 Days course on Tax Audit under income tax Act starting from June 10, 2022. In this 7 Days Certification Course participants will Learn the eligibility and how to file tax audit form and prepare tax audit report.

Detailed 7 Days course has been designed where daily more than 2 hours sessions have been organized. This Course contains Videos along with study material, Files. Recording of the Sessions will also be Provided for 60 Days.

A Certificate of Participation from the Studycafe will be provided on completion of the Certification course.

This Course is starting on June 10, 2022 and will be completed on June 16, 2022 and live session timing will be 07:00 PM to 09:00 PM. Recording of the Session can be accessed any time till 60 days.

This Course is very effective for B.Com, M.Com, CA Trainee, Fresher CA’s. They can learn lot of things from this course.

This is an online Certification course so there will not be any physical delivery of the lectures. Click on below link to and then click on buy option to enroll for this course.

Click Here to Enroll for this Course

After the purchase of this Certification course, you can see this course under my account option under purchased courses. All the videos, study materials, PDF files, PPT’s, will be uploaded there for quick access of participants. This Certification course is valid for 60 Days.

There is no bound on the eligibility from our side for this Certification Course. From a Commerce Graduate to LLB Qualified can apply for this Certification Course and who wants to learn and master in Taxation. However, it will be more beneficial for the below-mentioned persons:

⭐ Commerce Graduates/CA/CS/CMA/Law students

⭐ Tax professionals whether in JOB or Practice

⭐ Qualified CA/CS/CMA/LLB

⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐ Any other person not covered above can join the course if interested.

The course duration is 7 Days and around 14+ hours.

This is a Completely online course, there is no bar on the number of views. During 60 days you can access this Certification course from anywhere at any time with unlimited views.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"