Reetu | May 31, 2021 |

Changes recommended by 43rd GST Council Meeting

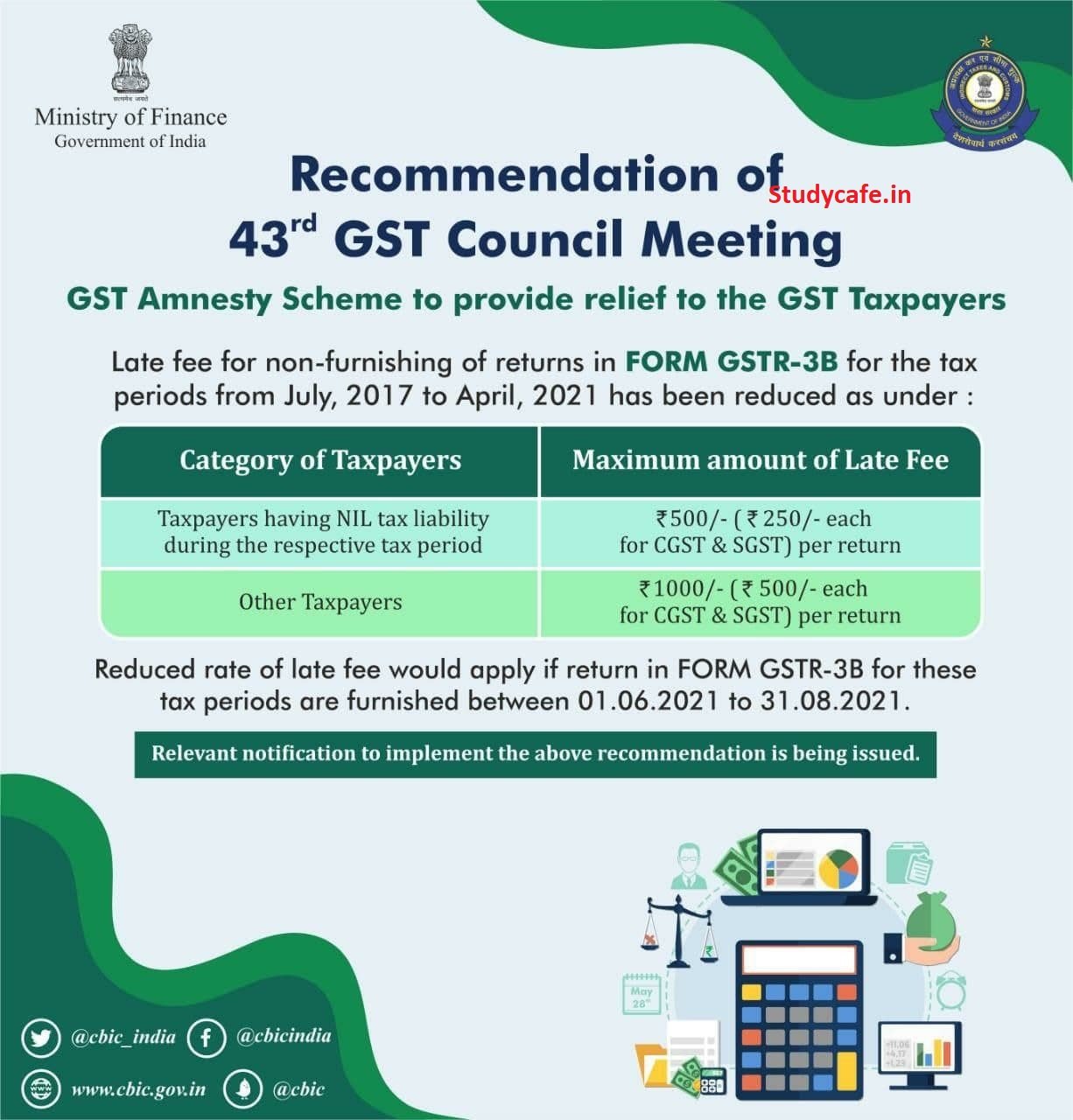

The late fee for non-furnishing of returns in FORM GSTR-3B for the tax periods from July 2017 to April 2021 has been reduced as under :

| Category of Taxpayers | The maximum amount of Late Fee |

| Taxpayers having NIL tax liability during the respective tax period | Rs. 500/- (Rs. 250/- each for CGST & SGST) per return |

| Other Taxpayers | Rs. 1000/- (Rs. 500/- each for CGST & SGST) per return |

A reduced rate of the late fee would apply if return in FORM GSTR-3B for these tax periods are furnished between 01.06.2021 to 31.08.2021.

Relevant notification to implement the above recommendation is being issued.

Taxpayer Friendly changes recommended by 43rd GST Council Meeting

| Category of Taxpayers | Maximum amount of Late Fee |

| Taxpayers having NIL tax liability | Rs. 500/- (Rs. 250/- each for CGST & SGST) per return |

| Other Taxpayers | Rs. 2000/- (Rs. 1000/- each for CGST & SGST) per return |

Taxpayer Friendly changes recommended by 43rd GST Council Meeting

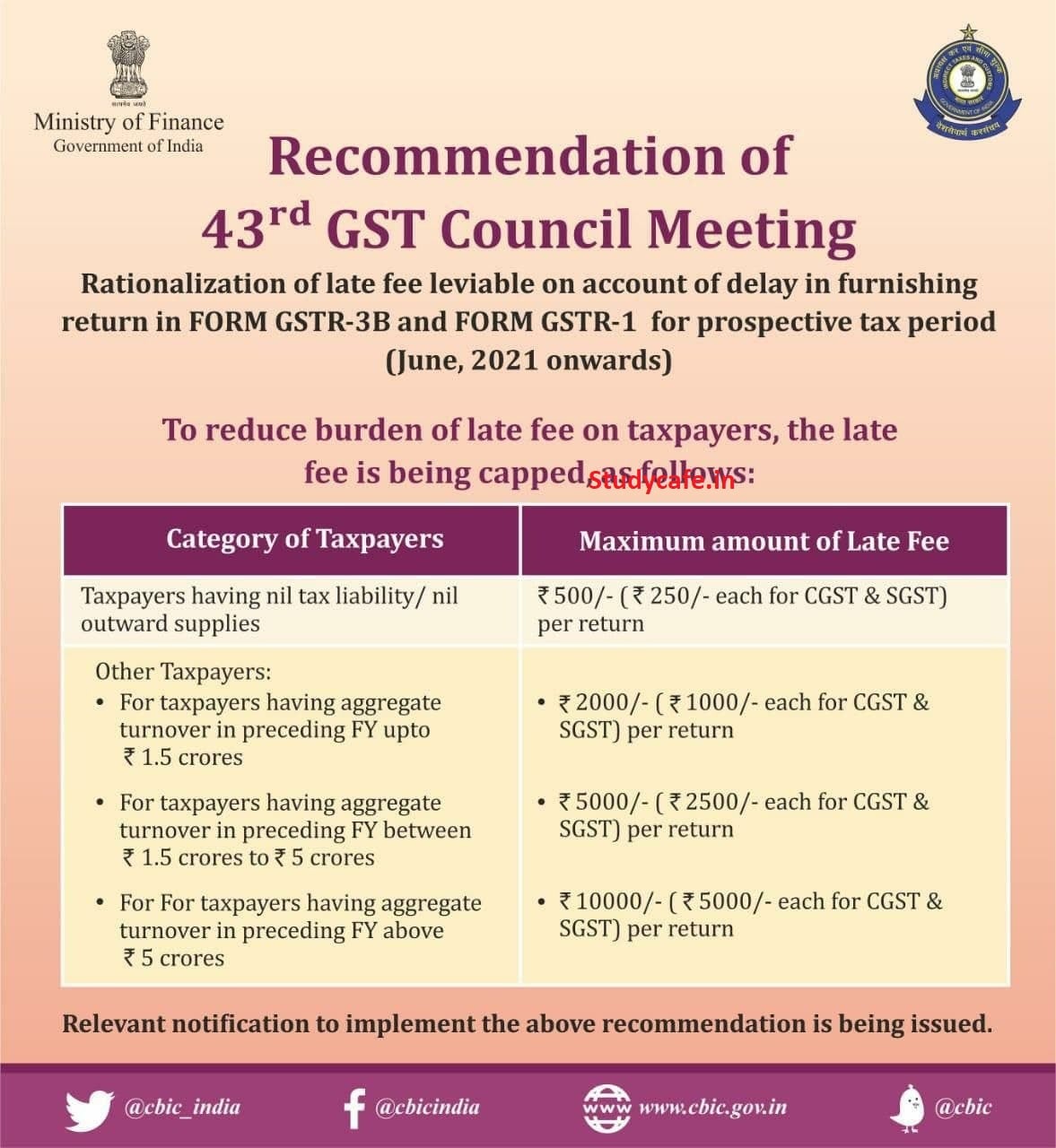

To reduce burden of late fee on taxpayers, the late fee is being capped, as follows:

| Category of Taxpayers | Maximum amount of Late Fee |

| Taxpayers having nil tax liability/ nil outward supplies | Rs. 500/- (Rs. 250/- each for CGST & SGST) per return |

| Other Taxpayers | |

| • For taxpayers having aggregate turnover in preceding FY upto Rs. 1.5 crores | Rs. 2000/- (Rs. 1000/- each for CGST & SGST) per return |

| • For taxpayers having aggregate turnover in preceding FY between Rs. 1.5 crores to Rs. 5 crores | Rs. 5000/- ( Rs. 2500/- each for CGST & SGST) per return |

| • For For taxpayers having aggregate turnover in preceding FY above Rs . 5 crores | Rs. 10000/- ( Rs. 5000/- each for CGST & SGST) per return |

Relevant notification to implement the above recommendation is being issued.

Taxpayer Friendly changes recommended by 43rd GST Council Meeting

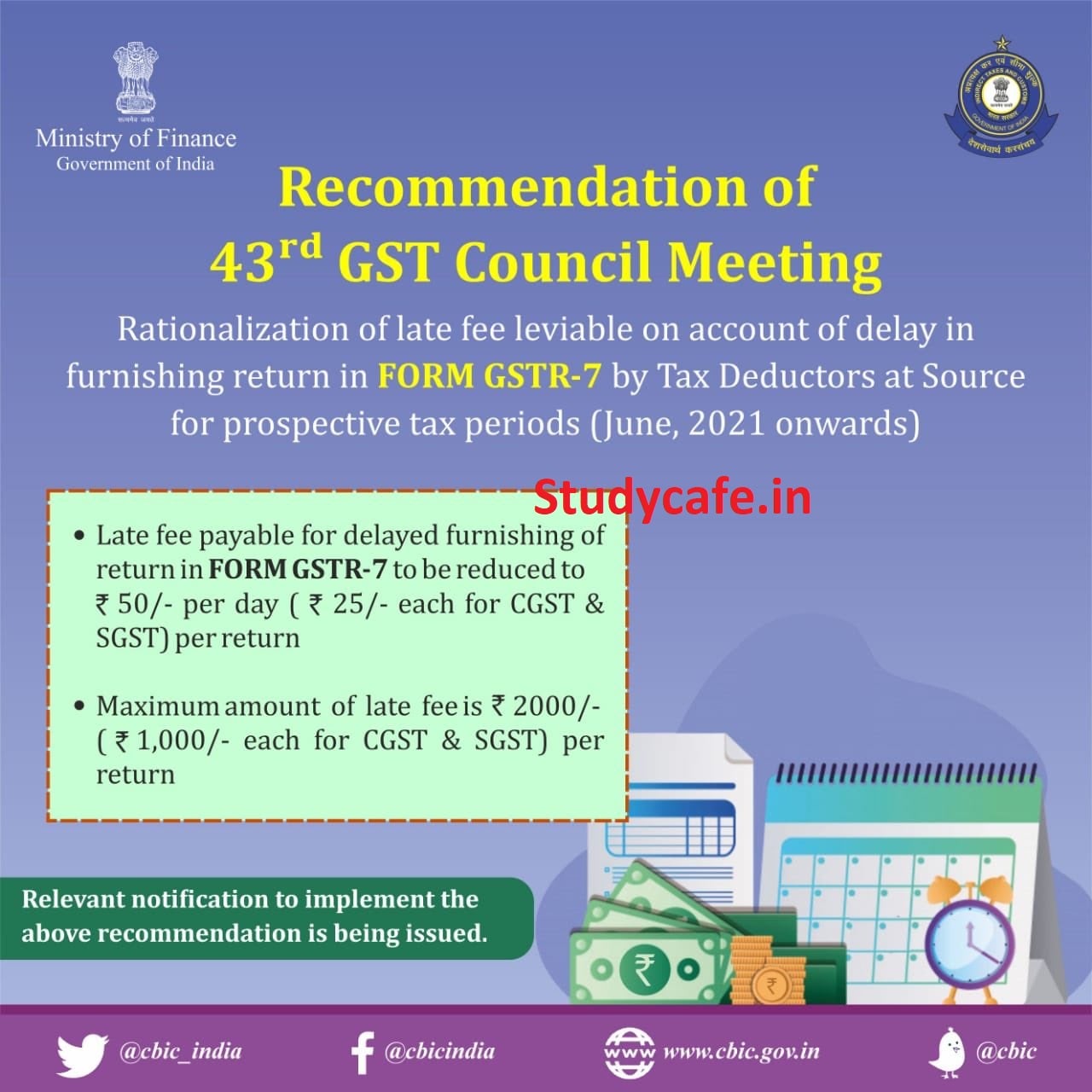

Late fee payable for delayed furnishing of FORM GSTR-7 to be reduced to Rs.50/- per day (Rs. 25 CGST + Rs 25 SGST) and to be capped to a maximum of Rs 2000/- (Rs. 1,000 CGST + Rs 1,000 SGST) per return.

Taxpayer Friendly changes recommended by 43rd GST Council Meeting

Taxpayers registered under the Companies Act to be permitted to furnish GST returns by using Electronic Verification Code (EVC) instead of Digital Signature Certificate (DSC) till 31.08.2021.

Taxpayer Friendly changes recommended by 43rd GST Council Meeting

Cumulative application of rule 36(4) for availing ITC for tax periods April, May and June, 2021 in the return for the period June, 2021.

Taxpayer Friendly changes recommended by 43rd GST Council Meeting

Extension of due date of filing GSTR-1/ IFF for the month of May 2021 by 15 days

Extension of the due date of filing GSTR-4 for FY 2020-21 to 31.07.2021.

Extension of the due date of filing ITC-04 for QE March 2021 to 30.06.2021.

As a COVID-19 relief measure, a number of specified COVID-19 related goods such as medical oxygen, oxygen concentrators and other oxygen storage and transportation equipment, certain diagnostic markers test kits and COVID-19 vaccines, etc., have been recommended for full exemption from IGST, even if imported on payment basis, for donating to the government or on recommendation of state authority to any relief agency. This exemption shall be valid upto 31.08.2021. Hitherto, IGST exemption was applicable only when these goods were imported “free of cost” for free distribution. The same will also be extended till 31.8.20201. It may be mentioned that these goods are already exempted from Basic Customs duty. Further in view of rising Black Fungus cases, the above exemption from IGST has been extended to Amphotericin B.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"