CA Pratibha Goyal | Dec 9, 2022 |

Chartered Accountant held guilty of professional misconduct for exceeding Tax Audit Limit

It was noted that the Chartered Accountant, CA. Rajender Kumar has conducted 564, 656, and 312 Tax Audits during the year 2010-11, 2011-12, and 2013-14 respectively.

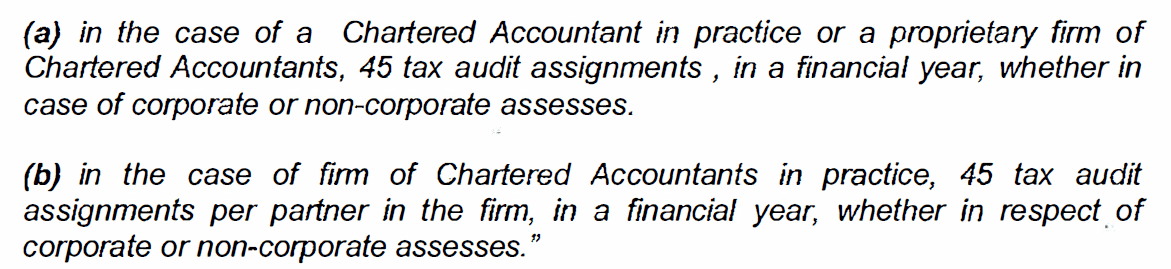

As per ICAI guidelines, the specified number of Tax Audit Assignments means:

It may further website, be the noted said limit that was vide increased Announcement dated 11.02.2014 to 60 in dated place of 45. However the same is not applicable in this case.

The Committee was of the view that ends of justice can be met, if CA. Rajender Kumar, the Respondent is given punishment in commensurate with his professional misconduct.

Keeping in view the facts and circumstances of the case and material on record, the Committee, ordered that the name of the Respondent i.e. CA. Rajender Kumar (M. No. 084956), Palwal be removed from the Register of members for a period of 03 (Three) Months and also imposed a fine of Rs. 5, 00, 000/-(Rupees Fivelakhs) which shall be paid within a period of 03 {Three) months from the date of receipt of this Order.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"