Deepak Gupta | Aug 5, 2022 |

Concept Paper on Comprehensive changes in FORM GSTR-3B as per 47th GST Council Meeting

A proposal of comprehensive changes in FORM GSTR-3B was deliberated by the GST Council in its 47th meeting held at Chandigarh on 28th and 29th June 2022. The Council recommended that the said proposal may be placed in public domain for seeking inputs and suggestions of the stakeholders.

Accordingly, the general public and the trade at large are hereby informed that a detailed Concept Paper on comprehensive changes in FORM GSTR-3B is enclosed.

All members of the trade/ stakeholders are requested to kindly furnish their views/comments/suggestions on the Concept Paper latest by 15th September 2022 at gstpolicywing-cbic@gov.in so as to facilitate finalization of the matter.

A comprehensive study has been done in respect of the return required to be filed under section 39 of the CGST Act by considering inter alia various representations and suggestions received over a period of time. Brief history of return filing under GST, amendments made in the Finance Act, 2022 in respect of the provisions related to Returns and elaborate proposal for changes in FORM GSTR-3B are discussed below. The proposed changes ensure that the GSTR1-GSTR2B linkage remains intact and as far as possible, the GSTR-3B should be auto-generated consequent to furnishing details in FORM GSTR-1.

1. The original design of return involved an elaborate process of filing of GSTR-1, 2 & 3 in a sequence which also envisaged inter-linking with back and forth flow of invoices. However GSTR-1-2-3 model were kept in abeyance. Instead, as an interim measure, a summary return in FORM GSTR-3B was introduced, along with the statement of outward supplies in FORM GSTR-1.

2. Subsequently, a new return system was envisaged (ANX-1/ ANX-II and RET-01). Section 43A was also inserted into the CGST Act vide CGST Amendment Act, 2018. However, section 43A was not notified.

3. In the 39thmeeting of the GST Council, it was recommended that the transition to the new return system may be made in an incremental manner by:-

i. the linking of the input tax credit in FORM GSTR-3B to the details of the supplies reflected in the FORM GSTR-2A;

ii. linking of the details of the statement of outward supplies in FORM GSTR-1 to the liability in FORM GSTR-3B.

4. In the 42nd GST Council meeting, it was recommended that the present system of GSTR-1/3B return filing to be continued and the GST laws may be amended to make the GSTR-1/3B return filing system as the default return filing system.

Amendments in CGST Act were recommended by the GST Council in its 43rd meeting to align the GST Law with the GSTR-1/ 2B/ 3B return filing system. The salient features of proposed return filing are as below:

i. Filing of FORM GSTR-1 to be mandatory before filing of return in FORM GSTR-3B;

ii. Filing of FORM GSTR-1 to be sequential;

iii. No two-way communication while filing return;

iv. Provision of furnishing of details of inward supplies to be removed, instead FORM GSTR-2B (static return) shall be made available to recipients;

v. Restrictions in ITC to extend where details of the Input Tax Credit of such supplies which have not been communicated to the registered persons

vi. Provisions for Spike Rules to be incorporated in Section 37 & 38 Accordingly, based on the recommendations of GST Council, amendments have been made in the return related provisions of the CGST Act, through the Finance Act, 2022 and will come into effect once the said provisions of the Finance Act, 2022 are notified.

i. It has been a long pending demand of trade and industry to allow amendment in FORM GSTR-3B. At present, any omission or mistake made while filing a GSTR-3B return, can be rectified in the return to be furnished for the month/ tax period during which such omission or mistake are noticed. Such rectifications/ adjustments can be made upto due date of filing return for September of the next year, or the date of filing annual return, whichever is earlier.

ii. In exceptional circumstances, sometimes value of credit notes issued by a supplier exceeds value of invoices and debit notes issued by him during a tax period. This leads to net negative value of supplies for the taxpayer in the said tax period. Presently, negative values are not allowed to be reported in any table of GSTR-3B. Similarly, recipient may have to report negative values in ITC table due to receipt of credit notes in a month whose value is more than the total ITC available for the month. Trade and industry have been asking the facility of reporting negative values since long.

iii. There is currently no clarity with respect to reporting of various kind of reversals of ITC in specific rows of FORM GSTR-3B. Ineligible ITC as per section 17(5) has to be reported in Table 4(D). However, while some taxpayers report it in Table 4(D), others just take net ITC (after reducing ineligible credit) in Table 4(A).

iv. Taxpayers face difficulty in reconciling various reversals and subsequent reclaims of ITC. Reversal may be required due to conditions such as goods not received/ non-payment of consideration within 180 days. However, ITC reversed may be reclaimed later. Currently, no specific rows for such reversals and reclaims is provided which makes reconciliation difficult for the taxpayer.

i. Auto-population of values from GSTR-1 into GSTR-3B in specific rows: This would establish one-to-one correspondence to a large extent between rows of GSTR-1 & GSTR-3B, thereby providing clarity to the taxpayer and tax officers.

ii. Restricting editing of values auto-populated in GSRTR-3B from GSTR-1: FORM GSTR-3B may be designed such that going forward it may be feasible to put restriction on editing of specific rows in GSTR-3B in line with extant provisions of CGST Act.

iii. Streamlining the process of settlement of IGST revenues: The ITC reversed needs to be considered for Settlement of IGST. Further, amendments made by taxpayer in those details which are required for settlement purpose (viz. in Table-3.2 or section 17(5) reversals etc.) needs to be captured for ensuring accurate settlement of IGST revenues. Distinction must be made between:

a. the ITC reversed which need not be reclaimed in future; and

b. the ITC which is reversed but may be claimed in future.

iv. Line-wise entry in FORM GSTR-3B will facilitate the process of scrutiny and audit by the tax administration due to availability of better quality of data. This will in turn help in revenue mobilization efforts of tax administration.

i. Auto drafted Input Tax Credit statement in FORM GSTR-2B has been made available to the taxpayer w.e.f. August 2020 containing all data regarding ITC available based on B2B supplies received from other persons, imports, ISD and RCM supplies

ii. Auto-population of ITC and liabilities in FORM GSTR-3B (Payment return) from FORM GSTR-2B (auto-generated inward supply statement) and FORM GSTR-1 (Outward supply statement) respectively has been started w.e.f. December 2020 which has simplified the return filing.

Keeping in view the challenges of taxpayers as detailed above and the journey of return enhancements done till date, it is proposed to make changes in the format of GSTR-3B which would cover the following aspects:

i. Auto-population of values from GTSR-1 into GSTR-3B in specific rows: This would establish one-to-one correspondence to a large extent between rows of GSTR-1 & GSTR-3B, thereby providing clarity to the taxpayer and tax officers. Further, it would minimize requirement of user input in GSTR- 3B and ease GSTR-3B filing process.

ii. Provision for allowing amendment in GSTR-3B vide insertion of various amendment tables for outward supplies, input supplies liable to reverse charge and ITC: Since FORM GSTR-1 and FORM GSTR-2B have been linked with FORM GSTR-3B, it is recommended that amendment in FORM GSTR-3B, as far as feasible, should flow from amendment in FORM GSTR- 1, as far as outward liabilities are concerned. Even in the new return system which was envisaged, the amendment in RET-1(RET-1A) was proposed through amendment in details of outward supply (ANX-1/ANX-1A). Therefore, for giving more clarity to the taxpayers, separate amendment table (for liabilities) may be introduced in FORM GSTR-3B so that any amendment made in FORM GSTR-1 gets reflected in FORM GSTR- 3Bclearly. Similarly, an amendment table may also be incorporated in FORM GSTR-3B to show any amendment in ITC portion. [The amendment tables may be activated only on selection by taxpayers]

iii. Allowing negative values in GSTR-3B & carrying forward the negative values of previous tax period to current tax period.

iv. Providing specific rows for showing various reversals and subsequent reclaims of ITC.

v. Streamlining the process of settlement of IGST revenues: The ITC reversed needs to be considered for Settlement of IGST. Further, amendments made by taxpayer in those details which are required for settlement (viz. in Table-3.2 or section 17(5) reversals etc.) need to be captured for ensuring accurate settlement of IGST revenues. Distinction must be made between:

a. the ITC reversed which need not be reclaimed in future; and

b. the ITC which is reversed but may be claimed in future.

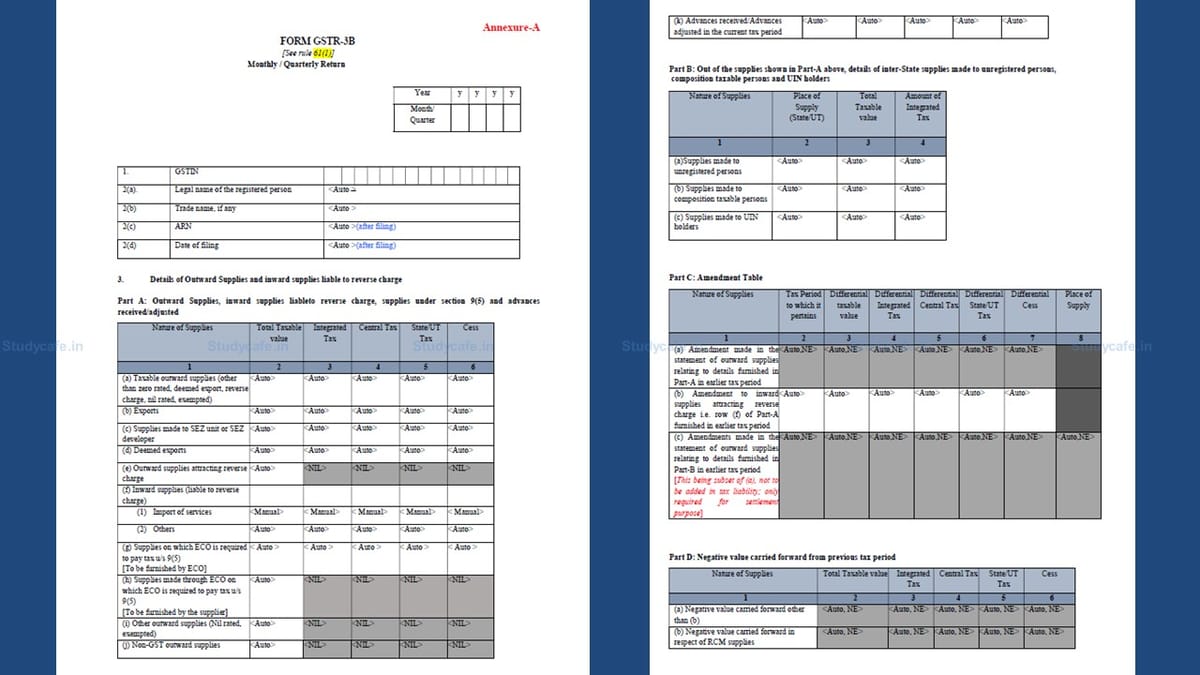

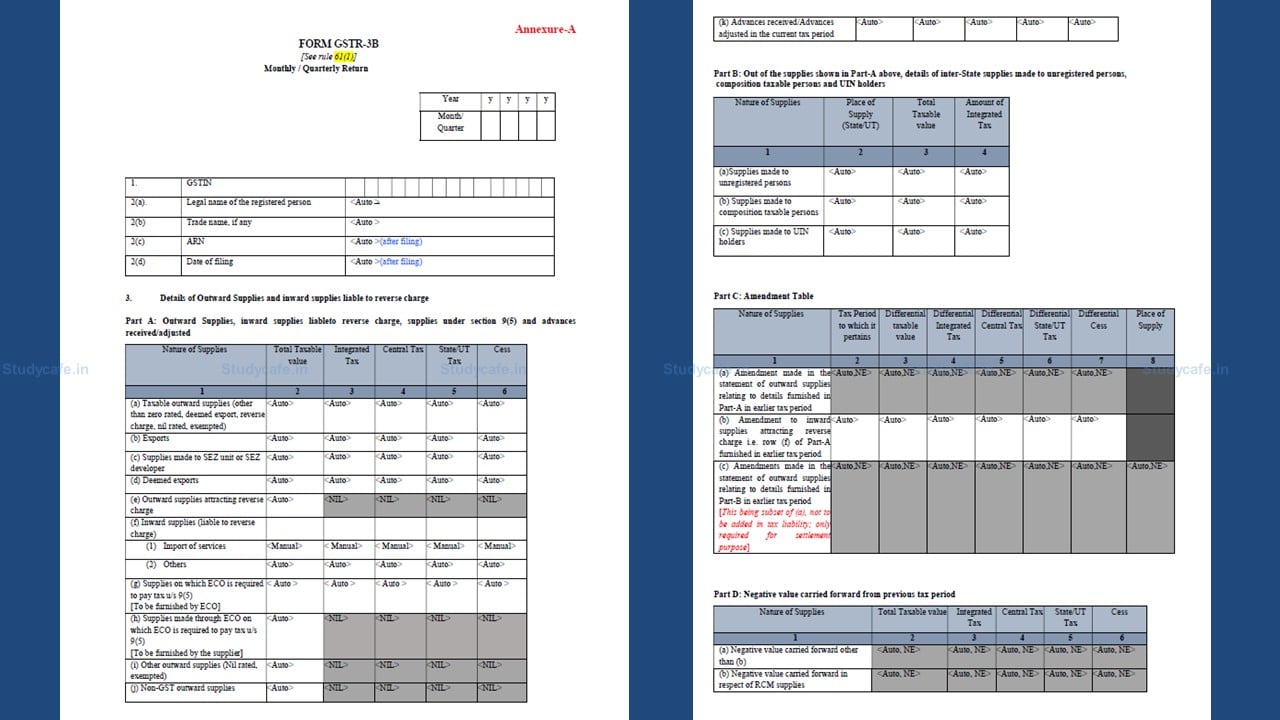

3. Based on the above mentioned principles, GST Council in its 47th meeting held at Chandigarh on 28th and 29th June 2022 has recommended that proposal for comprehensive changes in FORM GSTR-3B to be placed in public domain for seeking inputs/ suggestions of the stakeholders. Accordingly, a draft FORM GSTR-3B return which is enclosed to this note as Annexure A and Explanatory instructions relating to the draft return are enclosed as Annexure B are placed for seeking inputs/suggestions of the stakeholders.

Concept Paper on Comprehensive changes in FORM GSTR-3B as per 47th GST Council Meeting

Click here to Download GSTR-3B Form along with proposed changes

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"