Reetu | Mar 28, 2024 |

Credit Card Fraud: Credit Card Holders of Axis Bank notice Fraud Transactions; Check How to Block Credit Card

Many Axis Bank credit cardholders have resorted to social media to complain about fraudulent activity they have observed. They stated that they have seen transactions they have not authorised or are receiving OTPs for transactions they have not completed. Some have even reported unauthorised foreign transactions on their Axis Bank credit cards.

According to the Axis Bank website, any transaction in the account that was not explicitly allowed by the cardholder/account holder is considered fraudulent.

Let us see some of the posts on the social media site, X:

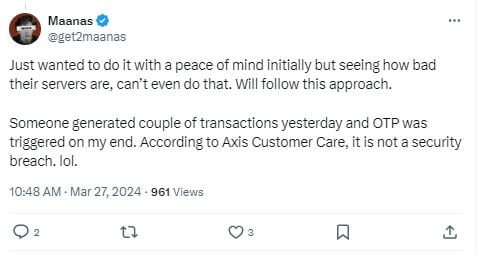

“Just wanted to do it with peace of mind initially but seeing how bad their servers are, can’t even do that. Will follow this approach. Someone generated a couple of transactions yesterday and OTP was triggered on my end. According to Axis Customer Care, it is not a security breach. lol.” a post reads.

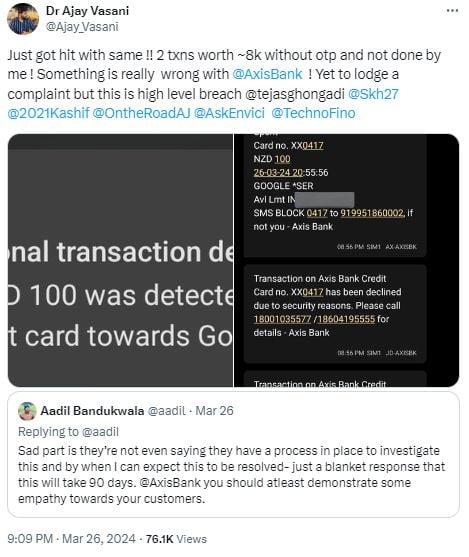

Just got hit with the same !! 2 txns worth ~8k without otp and not done by me! Something is really wrong with @AxisBank! Yet to lodge a complaint but this is high level breach @tejasghongadi @Skh27 @2021Kashif @OntheRoadAJ @AskEnvici @TechnoFino

“⚠️ Axis Bank credit card alert! Some customers are reporting unauthorized international transactions. Axis Bank claims it’s NOT a data breach, but a targeted attack by merchants. Report suspicious activity & disable intl usage for now. #AxisBank #CreditCardFraud #CyberSecurity 💳”

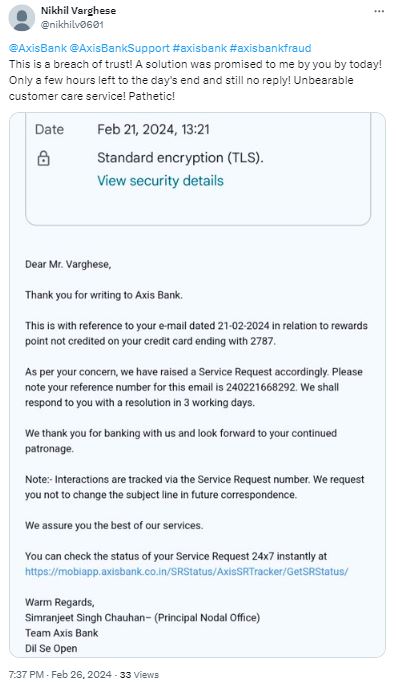

“@AxisBank @AxisBankSupport #axisbank #axisbankfraud

This is a breach of trust! A solution was promised to me by you by today! Only a few hours left to the day’s end and still no reply! Unbearable customer care service! Pathetic!”

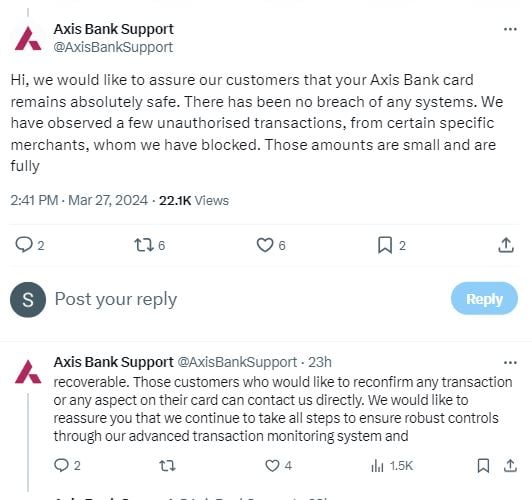

In response to an Axis Bank card user on its social media handle on X, Axis Bank stated, “Hi, we would want to assure our clients that your Axis Bank card is completely safe. There have been no system breaches. We discovered a few unauthorised transactions from specific merchants, which we have stopped. These amounts are tiny and complete. Recoverable. Customers who wish to reconfirm any transaction or aspect of their card may contact us directly. We want to reassure you that we are continuing to take all necessary precautions to ensure strong controls, including our comprehensive transaction monitoring system and transaction reviews. Regards, Team Axis Bank.”

You can contact us using your registered mobile number at the number listed on the Call page, or you can visit one of our branches. There are no charges for card closure. However, in order to submit your card cancellation request, you must first clear all outstanding balances. (All active EMIs and loans on your credit card will be foreclosed).

Call Axis Bank credit card customer service at 1860 419 5555 to report the scam. You can also send SMS blockcards to 56161600 or 918691000002.

You can request the closure of your credit card at any of the local Axis Bank branches. You will be required to provide your credit card and personal information for verification.

Customers of Axis Bank can block their credit cards via Internet banking by following the steps outlined below:

Step 1: Access your Axis Bank net banking website.

Step 2: Go to the Accounts section.

Step 3: From the ‘My Cards’ menu, click ‘More Services’.

Step 4: Click ‘Block Credit Card’.

Step 5: Select the credit card you wish to block.

According to the RBI’s new credit card rules, “Card-issuers shall be liable to compensate the complainant for the loss of his/her time, expenses, financial loss, as well as for the harassment and mental anguish suffered by him/her due to the card issuer’s fault and where the grievance has not been redressed in time. If a complainant does not receive a satisfactory response from the card-issuer within 30 days of filing the complaint, he or she may contact the Office of the RBI Ombudsman under the Integrated Ombudsman Scheme for redress of his or her grievance(s).”

Within 30 days of receiving the complaint, the card issuer must respond to a cardholder who disputes a charge with an explanation and, if required, documentation evidence.

To honour requests to close a credit card, the bank must notify the customer of the closure immediately via email, SMS, or other means. Customers must be given a variety of choices for closing their cards, such as a helpline, a dedicated email address, Interactive Voice Response (IVR), a clearly visible link on the website, internet banking, a mobile application, or any other means; they cannot insist on a particular route.

“Failure on the part of the card issuers to complete the process of closure within seven working days shall result in a penalty of Rs.500 per day of delay payable to the customer until the account is closed, provided there is no outstanding balance,” noted the RBI.

The master directive requires the credit card issuer to respond to any request to terminate a credit card within seven business days, provided that the cardholder has paid all outstanding obligations.

It should be noted that if a bank or NBFC does not cancel an account within seven working days, there will be a Rs. 500 penalty per day until the account is cancelled, assuming there are no outstanding balances.

According to the master directive, “The card-issuer shall not insist on sending a closure request via post or any other means that may result in the delay of receipt of the request.” Failure on the part of the card-issuers to complete the process of closure within seven working days shall result in a penalty of Rs.500 per day of delay payable to the client, until the account is closed, provided there is no due in the account.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"