Ankita Khetan | Jul 30, 2017 |

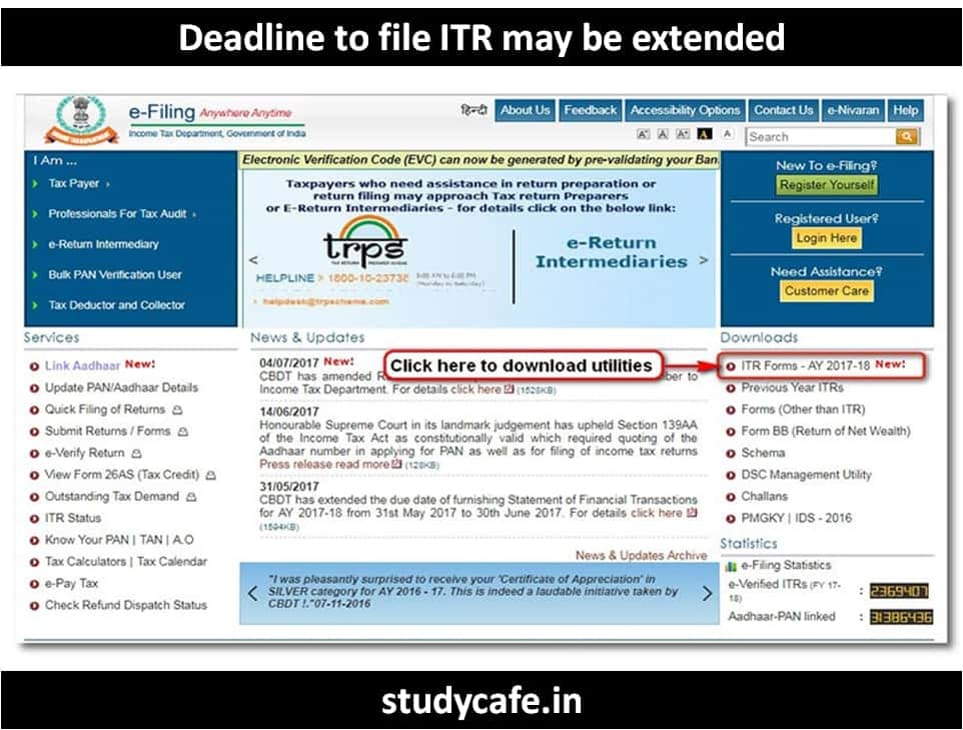

Deadline to file ITR may be extended

(ITRs) for the financial year 2016-17 will not be extended beyond Monday’s deadline, a top official said on Sunday.

“The last date for filing of ITRs remains July 31. There are no plans to extend this deadline. The department has already received over 2 crore returns filed electronically. The department requests taxpayers to file their return in time,” the official said.

Even though income tax top officers are claiming that ITR deadline won’t be extended but Tax Professionals are expecting that Government would extend the due date for filing return of income for financial year 2016-17 (Assessment year 2017-18), considering the past trend of extension of due dates for filing return of Income and challenges faced while filing return on Income Tax Website.

Below are details of past notifications for Extension of due date:

The below mentioned reasons are also making it difficult for assessees to file the return of income within the deadline and government will on huge pressure to extend the deadline : –

This year the Union Government to bring in more transparency in the system had introduced Section 139AA vide notification no. 37/2017 dated 11th May,2017 which has made it mandatory to quote the Aadhaar number for filing I-T returns after 1 July this year. Most of the people in India file the return of Income in the last few days nearing to the due date.

One of the most important reason for not filing return of income within the due date is people are are facing many problems in linking Aadhaarand PAN. For instances, in many cases either the date of birth don’t match, or for a few names don’t match (spelling error, only initial used in either of them). The way to resolve mismatch issues is by updatingeither Aadhaar or PAN. This is taking a lot of time for most of them and so the assesses have missed the ITR deadline.

With the whole new Indirect tax regime (GST) coming into existence this year, most of the chartered accountants are busy with GST registration, GST migration etc etc. Understanding GST rules & regulations themselves and explaining it to their clients about the compliance and other requirements. With very limited time left in hand and considering the above changes made by the government it is even difficult for Chartered Accountants to file ITRs within the deadline.

There was a revision madeby finance ministry videNotification 30/2016 dated 29th April,2016in the due date for issuing TDS certificates i.e Form 16A by banks and other deductorsfor Financial year 2015-16 (Assessment Year 2016-17) and onwards and it was extended by 15 days. So due date for financial year 2016-17 (Assessment Year 2017-18) is 15th June, 2017. Earlier banks and other deductors were legally required to issue TDS certificates(form 16A) for a particular financial year latest by 31st May of the assessment year.

There was a revision by finance ministry vide notification no. 42/2017 dated 2nd June,2017in the due date for issuing TDS certificates i.e Form 16 by employers to the employees for Financial year 2016-17 (Assessment Year 2017-18) and it was extended to 15th June, 2017 . Earlier the last date for employers to issue Form 16 to their employees was May 31 of the assessment year. Without getting Form 16/TDS certificates from their employer even the salaried employees could not file their file their return of income on time.

Compiled by CA Ankita Khetan

Deadline to file ITR may be extended,Deadline to file ITR extended for AY 2017-18, Deadline to file ITR may be extendeddue date to file return of income for ay 2016-17due date to file return of income for fy 2016-17income tax returnITRitr due dateitr due date extendedincome tax return deadlineincome tax return due date for ay 2017-18income tax due date extensionreasons why income tax return due date should be extendedincome tax return due date extension notificationincome tax return due date extension notification for A.Y 2017-18income tax due date extension for ay 2017-18due date for filing income tax return for ay 2016-17due date for filing income tax return for ay 2017-18last date for filing income tax return for ay 2017-18last date to file itr for ay 2017-18penalty for late filing of income tax return for ay 2017-18belated return for ay 2016-17income tax return last date for salarieddue date extension for ay 2016-17, income tax return due date extended, Notification for Extension of Income Tax Return Due date for F.Y 2016-17 Notification for Extension of Income Tax Return Due date for A.Y 2017-18, Official Notification for Extension of Income Tax Return Due date for A.Y 2017-18, Notification for Extension of Income Tax Return Due date for A.Y 2017-18, Notification for Extension of Income Tax Return Due date for A.Y 2017-18 pdf, income tax return due date extended pdf, income tax return due date extension notification, income tax return due date extension notification A.Y 2017-18, Link of Notification for Extension of Income Tax Return Due date for F.Y 2016-17, income tax return due date extended, Notification for Extension of Income Tax Return Due date for F.Y 2016-17 Notification for Extension of Income Tax Return Due date for F.Y 2016-17 Official Notification for Extension of Income Tax Return Due date for F.Y 2016-17 Notification for Extension of Income Tax Return Due date for F.Y 2016-17 Notification for Extension of Income Tax Return Due date for F.Y 2016-17 pdf, income tax return due date extended pdf, income tax return due date extension notification, income tax return due date extension notification F.Y 2016-17 Link of Notification for Extension of Income Tax Return Due date for F.Y 2016-17

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"