Tista | Jan 10, 2020 |

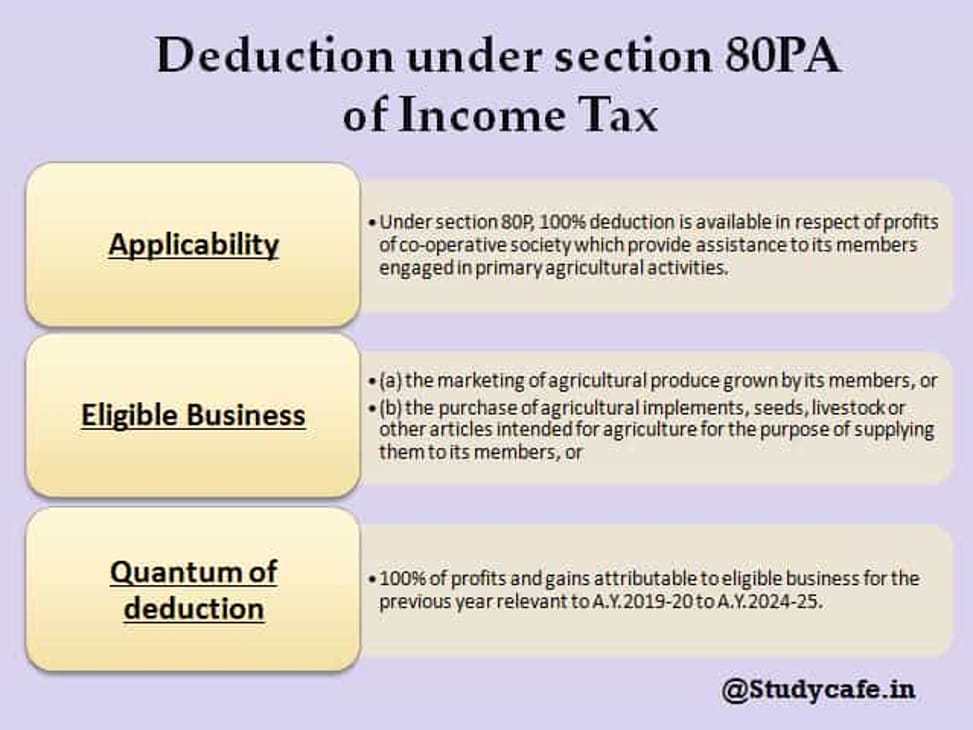

Deduction under section 80PA of Income Tax

Deduction in respect of certain income of Producer Companies [Section 80PA]

(i) Applicability:-

Under section 80P, 100% deduction is available in respect of profits of co-operative society which provide assistance to its members engaged in primary agricultural activities.

A similar benefit has been extended, by insertion of new section 80PA, to Farm Producer Companies (FPC), having a total turnover of less than ₹100 crore in any previous year, whose gross total income includes any profits and gains derived from eligible business.

(ii) Meaning of Eligible Business:-

Eligible business means –

(a) the marketing of agricultural produce grown by its members, or

(b) the purchase of agricultural implements, seeds, livestock or other articles intended for agriculture for the purpose of supplying them to its members, or

(c) the processing of the agricultural produce of its members

(iii) Quantum of deduction:-

100% of profits and gains attributable to eligible business for the previous year relevant to A.Y.2019-20 to A.Y.2024-25.

In a case where the assessee is entitled also to deduction under any other provision of Chapter VI-A, the deduction under this section shall be allowed with reference to the income, if any, as referred to in this section included in the gross total income as reduced by the deductions under such other provision of this Chapter.

(iv) Example:-

| Turnover of eligible business | Turnover of other business | Total Turnover | Whether eligible to claim deduction | Reason |

| 75 crores | 24 crores | 99 crores | Yes | Total Turnover is less than ₹100 crores |

| 80 crores | 25 crores | 105 crores | No | Turnover is more than ₹100 crores |

| 50 crores | 50 crores | 100 crores | No | Turnover is not less than ₹100 crores |

| 0 | 80 crores | 80 crores | No | Turnover does not include profit derived from eligible business |

| 100 crores | 0 | 100 crores | No | Turnover is not less than ₹100 crores |

(iv) Meaning of certain terms:-

• Member : A person or Producer institution (whether incorporated or not) admitted as a Member of a Producer Company and who retains the qualifications necessary for continuance as such.

• Producer Company : A body corporate having objects or activities specified in section 581B of the Companies Act, 1956 and registered as Producer Company under that Act.

As per section 581B of the Companies Act, 1956, the objects of the Producer Company shall relate to all or any of the following matters, namely:–

(a) production, harvesting, procurement, grading, pooling, handling, marketing, selling, export of primary produce of the Members or import of goods or services for their benefit. However, the Producer Company may carry on any of the activities specified in this clause either by itself or through other institution;

(b) processing including preserving, drying, distilling, brewing, vinting, canning and packaging of produce of its Members;

(c) manufacture, sale or supply of machinery, equipment or consumables mainly to its Members;

(d) providing education on the mutual assistance principles to its Members and others;

(e) rendering technical services, consultancy services, training, research and development and all other activities for the promotion of the interests of its Members;

(f) generation, transmission and distribution of power, revitalisationof land and water resources, their use, conservation and communications relatable to primary produce;

(g) insurance of producers or their primary produce;

(h) promoting techniques of mutuality and mutual assistance;

(i) welfare measures or facilities for the benefit of Members as may be decided by the Board;

(j) any other activity, ancillary or incidental to any of the activities referred to in clauses (a) to (i) or other activities which may promote the principles of mutuality and mutual assistance amongst the Members in any other manner;

(k) financing of procurement, processing, marketing or other activities specified in clauses (a) to (j) which include extending of credit facilities or any other financial services to its Members.

Section 581B(2) provides that every Producer Company shall deal primarily with the produce of its active Members for carrying out any of its objects specified in this section.

• Active Member : Active Member means a member who fulfils the quantum and period of patronage of the Producer Company as may be required by the articles.

For Regular Updates Join : https://t.me/Studycafe

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

Tags : Income Tax, Income Tax Deduction

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"