For Regular Updates Join : https://t.me/Studycafe

Studycafe | Dec 27, 2019 |

Deductions under section 80C to 80 U of Income Tax Act 1961 AY 2020-21 | FY 2019-20

Deductions under section 80C to 80 U of Income Tax Act 1961 AY 2020-21 | FY 2019-20

Relevant deductions from gross total income under section 80 C to 80 U [Chapter VI-A] of income tax are given below:

| 1 | DEDUCTION IN RESPECT OF INVESTMENTS IN SPECIFIED ASSETS (SECTION 80C) |

Section 80C provides for a deduction of savings in specified modes of Investments form gross total income. It is available only to an Individual or HUF. The Maximum permissible deduction is Rs.1.5 lakh along with deduction u/s 80CCC & 80CCD.

| S.no. | Admissible Deductions |

| 1 | Premium paid on insurance on life of the Individual or HUF. |

| 2 | Sum paid under the contract for deferred on life of the Assessee or his/her spouse or children. |

| 3 | Sum deducted by the government from the salary of an employee for securing a deferred annuity for self, spouse or children.The sum so deducted should not exceed one-fifth of the salary. |

| 4 | Contribution to any Public Provident Fund governed by Provident Funds Act, 1925 |

| 5 | Contribution by an employee to Recognized Provident Fund. |

| 6 | Contribution by an employee to an Approved Superannuation Fund. |

| 7 | Contribution made to any Public Provident Fund set up by the Central Government. |

| 8 | Subscription to any deposit scheme or contribution to any Pension fund set up by the National Housing Bank. |

| 9 | Payment of Tuition fees by an Individual Assessee at the time of admission to any university, college, school or other educational institutions within India for the purpose of full time education of any two children. |

| 10 | Subscription to deposit scheme of Public Sector, engaged in providing housing finance. |

| 11 | Principle repayment of Housing Loan. |

| 12 | Subscription to units of Mutual funds notified u/s 10(23D). |

| 13 | Sum deposited in Fixed Deposits (FDs) with tenure of five years. |

| 14 | Sum deposited in 5 yrs Post Office Time Deposit (POTD) scheme. |

| 2 | DEDUCTION IN RESPECT OF CONTRIBUTION TO CERTAIN PENSION FUNDS (SECTION 80CCC) |

Deduction in respect of Payment of premium for annuity plan of LIC or any other Insurer is provided. The Premium must be deposited to keep in force a contract for annuity plan of LIC or any other insurer for receiving pension from the fund. For this purpose, the Interest or Bonus accrued or credited to the Assessee s Account shall not be reckoned as Contribution. The Maximum Deduction allowed is Rs.1.5 lakh.

| 3 | DEDUCTION IN RESPECT OF CONTRIBUTION TO PENSION SCHEME OF CENTRAL GOVERNMENT (SECTION 80CCD) |

Contribution towards NPS by Employee [80CCD(1)]: Tax payer is an individual and he is employed by the central government (on or after January 1, 2004), or employed by any other person or self employed. He has in the previous year deposited any amount in his account under NPS. Under this, Employee is to contribute 10% of their salary or more and deduction is available under section 80CCD(1) which is restricted to 10% of the salary and for person other than employee deduction is restricted to 10% of GTI.

80CCD(1B) Tax payer shall be allowed a deduction in computation of his total income of the whole of the amount paid or deposited in the previous year in his account under a pension scheme notified by the Central Government, which shall not exceed fifty thousand rupees.

Contribution towards NPS by Employer [80CCD(2)]:

Contribution by the employer to NPS is deductible under section 80CCD(2) in the hands of the concerned employee in the year in which contribution is made. However no deduction is available in respect of employer’s contribution which is in excess of 10 percent of the salary of the employee.

Contributions to ‘Atal Pension Yojana‘ are eligible for Tax Deduction under section 80CCD.

| 4 | LIMIT ON DEDUCTION U/S 80C, 80CCC, 80CCD |

The Limit for maximum deduction available u/s 80C, 80CCC, 80CCD (combined together) is Rs.1.5 Lakh only.

Assessee gets an additional deduction of 50,000 if he makes investment in NPS scheme notified by the Central Government. This means the Limit for maximum deduction available u/s 80C, 80CCC, 80CCD+80CCD(1B) is Rs. 2 Lakh.

| 5 | DEDUCTION IN RESPECT OF MEDICAL INSURANCE PREMIUM (SECTION 80D) |

This Section provides for a deduction of Rs. 25,000 in respect of premium paid towards a health insurance policy for the Assessee or his family (spouse and dependent children) or any contribution made to the Central Government Health Scheme in aggregate and a further deduction of Rs. 25000 is allowed of premium paid in respect of health insurance policy for parents. An increased deduction of Rs. 30000 is allowed in case any of the persons mentioned above are senior citizens (i.e. of age 60 years or above).

It has been amended by finance Act 2018 that the upper limit of this increased deduction should be raised to Rs. 50,000.

Further it is provided that for claiming such deduction u/s 80D the payment must be by any mode other than cash.

Further Deduction of Rs. 5000 shall be allowed in respect of payment made on Account of preventive health check-up of self, spouse, children or parents made during the previous year. For claiming this deduction payment can be by any mode including cash.

The Analysis of amendment is provided in the table given below:

| Nature of amount spent | Family Member | Parents | ||

| Age below 60 years | Age 60 years or more | Age below 60 years | Age 60 years or more | |

| Medical Insurance | 25,000 | 50,000 | 25,000 | 50,000 |

| CGHS | 25,000 | 50,000 | – | – |

| Health Check-up | 5,000 | 5,000 | 5,000 | 5,000 |

| Medical Expenditure | – | 50,000 | – | 50,000 |

| Maximum deduction | 25,000 | 50,000 | 25,000 | 50,000 |

| 6 | DEDUCTION IN RESPECT OF REHABILITATION OF HANDICAPPED DEPENDENT RELATIVE (SECTION 80DD) |

It provides for a deduction to an Assessee being an individual or HUF who is a resident in India. Deduction of Rs. 75,000 is available in respect of any Amount paid for the medical treatment (including nursing), training and rehabilitation of a dependent, or any amount paid or deposited under a scheme framed in this behalf.

In case of severe disability (i.e. a person with 80% or more disability), the deduction of Rs. 1,25,000 shall be available.

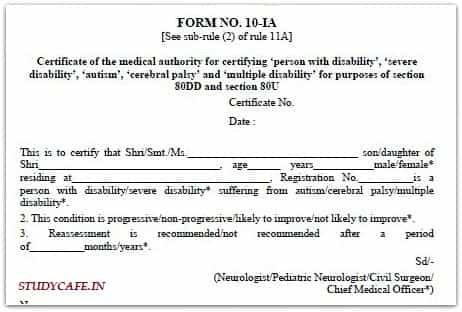

To claim this deduction, you have to submit FORM NO. 10-IA.

Dependent means In the case of an Individual the spouse, children, parents, brothers, sisters, of the individual and in the case of HUF, any member who is wholly dependent on the assessee.

| 7 | DEDUCTION IN RESPECT OF MEDICAL TREATMENT (SECTION 80DDB) |

A deduction of Rs. 40000 or Amount actually paid whichever is less is allowed to an Assessee who is resident in India being an Individual or HUF. Deduction is allowed of any amount paid for the medical treatment of such disease or ailment as may be specified in the rules.

It has been amended that in case the amount is paid in respect of a senior citizen/very senior citizen then the deduction would be Rs.100,000 or the amount actually paid whichever is less.

[Earlier the limit was Rs. 60,000 for Senior Citizen & Rs. 80,000 for very senior citizen.]

| 8 | FIRST TIME HOME BUYERS CAN CLAIM AN ADDITIONAL TAX DEDUCTION ON HOME LOAN INTEREST PAYMENTS |

ADDITIONAL TAX DEDUCTION OF UP TO RS 50,000 ON HOME LOAN INTEREST PAYMENTS

THE BELOW CRITERIA HAS TO BE MET FOR CLAIMING TAX DEDUCTION UNDER SECTION 80EE.

1.) The home loan should have been sanctioned during FY 2016-17.

2.) Loan amount should be less than Rs 35 Lakh.

3.) The value of the house should not be more than Rs 50 Lakh &

4.) The home buyer should not have any other existing residential house in his name.

THE BELOW CRITERIA HAS TO BE MET FOR CLAIMING TAX DEDUCTION UNDER SECTION 80EEA.

ADDITIONAL TAX DEDUCTION OF UP TO RS 1,50,000 ON HOME LOAN INTEREST PAYMENTS

1.) The home loan should have been sanctioned during FY 2019-20.

2.) The value of the house should not be more than Rs 45 Lakh &

3.) The home buyer should not have any other existing residential house in his name.

Kindly note that the deduction under Section 80EEA is available for home loans from banks and approved financial institutions only. Under Section 24, even interest paid on home loans from friends and relatives is eligible for tax benefit.

To claim tax benefit under Section 24, you should have received possession of your house (interest paid before possession is eligible for deduction over the next 5 years in 5 equal installments). Section 80EE and 80EEA do not impose any requirement of possession or completion of construction. Therefore, Section 80EEA provides you immediate tax relief even if you have purchased an under-construction property.

Both resident Indians and non-resident Indians (NRIs) can claim the deduction u.s 80EEA.

| 9 | DEDUCTION IN RESPECT OF PURCHASE OF ELECTRIC VEHICLE |

ADDITIONAL TAX DEDUCTION OF UP TO RS 1,50,000 ON LOAN OF PURCHASE OF ELECTRIC VEHICLE

The home loan should have been sanctioned during during the period beginning on the 1st day of April, 2019 and ending on the 31st day of March, 2023.

| 10 | LOAN FOR HIGHER STUDIES |

If you take any loan for higher studies (after completing Senior Secondary Exam), tax deduction can be claimed under Section 80E for interest that you pay towards your Education Loan. This loan should have been taken for higher education for you, your spouse or your children or for a student for whom you are a legal guardian. Principal Repayment on educational loan cannot be claimed as tax deduction.

There is no limit on the amount of interest you can claim as deduction under section 80E. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier.

| 11 | CONTRIBUTIONS MADE TO CERTAIN RELIEF FUNDS AND CHARITABLE INSTITUTIONS: |

Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Tax Act. This deduction can only be claimed when the contribution has been made via cheque or draft or in cash. In-kind contributions such as food material, clothes, medicines etc do not qualify for deduction under section 80G.

The donations made to any Political party can be claimed under section 80GGC.

W.e.f F.Y. 2017-18, the limit of deduction under section 80G / 80GGC for donations made in cash is reduced from current Rs 10,000 to Rs 2,000 only.

| 12 | SECTION 80GG: APPLICABLE FOR ALL THOSE INDIVIDUALS WHO DO NOT OWN A RESIDENTIAL HOUSE & DO NOT RECEIVE HRA |

The Tax Deduction amount under 80GG is Rs 60,000 per annum. Section 80GG is applicable for all those individuals who do not own a residential house & do not receive HRA (House Rent Allowance).

The extent of tax deduction will be limited to the least amount of the following;

1.) Rent paid minus 10 percent the adjusted total income.

2.) Rs 5,000 per month.

3.) 25 % of the total income.

(If you are claiming HRA (House Rent Allowance) of more than Rs 50,000 per month (or) paying rent which is more than Rs 50,000 then the tenant has to deduct TDS @ 5%. Tax could be deducted at the time of credit of rent for the last month of the tax year or last month of tenancy, as applicable.)

| 13 | DEDUCTION IN RESPECT OF DONATIONS FOR SCIENTIFIC RESEARCH AND RURAL DEVELOPMENT (SECTION 80GGA) |

Admissible Deduction from Gross Total Income:-

Any sum paid by the Assessee to the Research Association which has, as its object, the undertaking of scientific research

Any sum paid to an Association or Institution which has, as its object, the undertaking of any programme of Rural Development to be used for carrying for carrying out any programme of Rural Development.

Any sum paid to Research Association which has, as its object the undertaking of research in Social Science or Statistical Research.

Any sum paid to Public Sector company or a local authority for carrying out any eligible project or scheme.

Any sum paid to Rural Development fund.

Any sum paid to National Urban Poverty Education Fund (NUPEF).

Sub-section (2A) has been inserted which provides that no deduction shall be allowed in respect of donation of any sum exceeding Rs. 10000 unless such sum is paid by any mode other than cash.

Click here to know information on Tax Exempted Institutions

| 14 | DEDUCTION IN RESPECT OF CONTRIBUTIONS GIVEN BY COMPANIES TO POLITICAL PARTIES (SECTION 80GGB) |

This provides of deduction of any sum contributed in the Previous Year by an Indian Company to any Political Party or an Electoral Trust. From assessment year 2014-15, no deduction shall be allowed in respect of any sum contributed by way of cash.

| 15 | DEDUCTION IN RESPECT OF CONTRIBUTIONS GIVEN BY ANY PERSON TO POLITICAL PARTIES (SECTION 80GGC) |

This provides for Deduction from Gross Total Income of any sum contributed in the Previous Year by any Person to a Political Party or an Electoral Trust. It will not be available to a Local Authority and an Artificial Judicial Person. No deduction shall be allowed in respect of any sum contributed by way of cash.

| 16 | SAVING INTEREST |

Deduction from gross total income of an individual or HUF, up to a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account with a bank, co-operative society or post office can be claimed under this section. Section 80TTA deduction is not available on interest income from fixed deposits.

A new provision to allow deduction of up to Rs. 50,000 to the senior citizen who has earned interest income from deposits with banks or post office or co-operative banks has been inserted by Finance Act 2018. Interest earned on saving deposits and fixed deposits both shall be eligible for deduction under this provision.

Deduction under Section 80TTA shall not be available to senior citizens in respect of interest on saving deposits.

| 17 | STANDARD DEDUCTION ON SALARY INCOME |

A standard deduction upto Rs 40,000/- or the amount of salary received, whichever is less has been allowed as Deduction from Gross Total Income by Finance Act 2018. Consequently the present exemption in respect of Transport Allowance (except in case of differently abled persons) [Rs 1600*12=Rs 19200] and reimbursement of medical expenses [Rs 15000] is proposed to be withdrawn.

| 18 | NEW DEDUCTION INTRODUCED FOR FARM PRODUCER COMPANIES |

To promote agricultural activities a new section 80PA has been inserted. This new provision proposes 100% deductions of profits for a period of 5 years to farm producer companies who have total turnover of up to Rs. 100 crores during the financial year.

For claiming this deduction the gross total income of producer companies should include income from:

| a | The marketing of agricultural produce grown by its members. |

| b | The purchase of agricultural implements, seeds, livestock or other articles intended for agriculture for the purpose of supplying them to its members. |

| c | The processing of the agricultural produce of its members. |

| 19 | 80-JJAA : INCENTIVE FOR EMPLOYMENT GENERATION |

Deduction of 30% is allowed in addition to normal deduction of 100% in respect of emoluments paid to eligible new employees who have been employed for a minimum period of 240 days during the year.

However, the minimum period of employment is relaxed to 150 days in the case of apparel industry, the same has been extend to footwear and leather industry.

Manufacturers are often denied the deduction if an employee is employed in 1st year for a period of less than 240 days/150 days, but continues to remain employed for more than 240 days/150 days in the 2nd year. To overcome this difficulty, the requirement of period of employment has been proposed to be relaxed. Now as per the new provision the deductions shall be allowed to the manufacturer in respect of an employee hired in 1st year, if he continues to remain in employment in current year(2nd year) for more than 240/150 days, as the case may be.

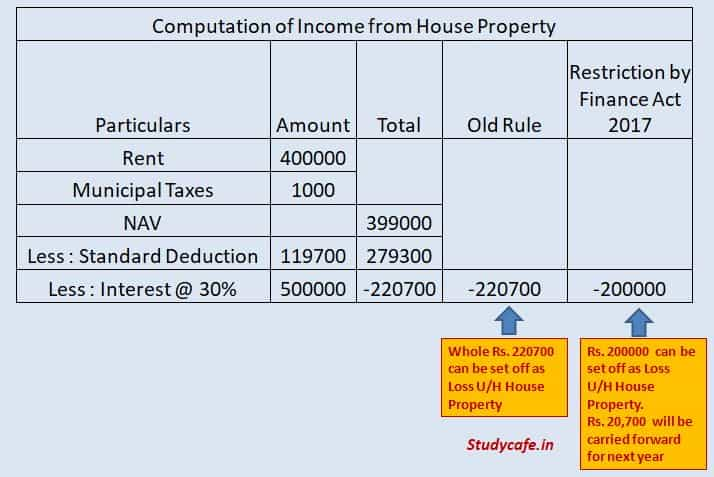

| 20 | SECTION 24 (B) (LOSS UNDER THE HEAD INCOME FROM HOUSE PROPERTY) |

From FY 2017-18, the Tax benefit on loan repayment of second house is restricted to Rs 2 lakh per annum only (even if you have multiple houses the limit is still going to be Rs 2 Lakh only and the ceiling limit is not per house property).

The unclaimed loss if any will be carried forward to be set off against house property income of subsequent 8 years. In most of the cases, this can be treated as ‘dead loss‘.

I believe that this is a major blow to the investors who have bought multiple houses on home loan(s) with an intention to save taxes alone.

Until FY 2016-17, interest paid on your housing loan is eligible for the following tax benefits ;

Municipal taxes paid, 30% of the net annual income (standard deduction) and interest paid on the loan taken for that house are allowed as deductions.

After these deductions, your rental income can be NIL or NEGATIVE and is called ‘loss from house property’ in the latter case.

Such loss is currently allowed to be set off against other heads of income like Income from Salary or Business etc. which helps you to lower you tax liability substantially.

Deductions under section 80C to 80 U of Income Tax Act 1961 AY 2020-21 | FY 2019-20

Currently (FY 2018-19), income tax on notional rent is payable if one has more than one self-occupied house. No tax on notional rent on Second Self-occupied house has been proposed. So, you can now hold 2 Self-occupied properties and don’t have to show the rental income from second SoP as notional rent. This is with effective from FY 2019-20.

| 21 | REVISED REBATE UNDER SECTION 87A |

Tax rebate of Rs 12,500 for individuals with taxable income of up to Rs 5 Lakh has been proposed in Interim-Budget 2019-20-18 / AY 2020-21 as well.

| 22 | SECTION 54 |

The benefit of rollover of capital gains under section 54 of the Income Tax Act will be increased from investment in one residential house to two residential houses for a tax payer having capital gains up to Rs 2 crore. This benefit can be availed once in a life time.

Under Section 54GB(5) of the Income Tax Act, 1961, long term capital gains on the sale of residential property will be exempt if the sale proceeds are invested in a eligible startup, provided such transfer took place prior to March 31, 2019. This has now been extended to March 2021.

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

Tags : Income Tax, Income Tax Deduction, Deduction from Gross Total Income

For Regular Updates Join : https://t.me/Studycafe

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"