Reetu | Nov 14, 2022 |

DGFT Amends Import Policy: Importer can apply for Registration after 60th Day and within 5 Days before Arrival Consignment

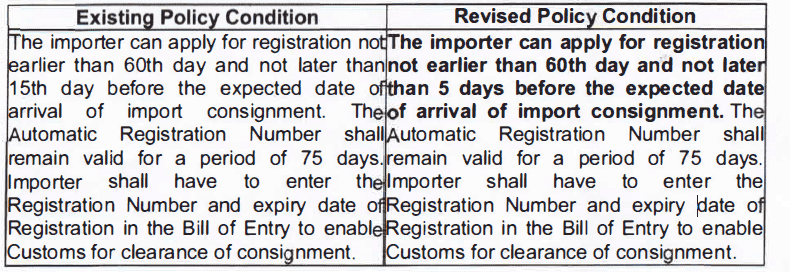

The Directorate General of Foreign Trade(DGFT) has made amendment in Policy Condition No. 7(ii) of Chapter 27 of ITC {HS), 2022, Schedule – I (Import Policy) – Implementation of Coal Import Monitoring System (CIMS) via issuing Notification.

Amendment in Import Policy bring out the changes that Importer can apply for Registration after 60th Day and within 5 Days before Arrival Consignment.

The Notification Stated, “In exercise of powers conferred by Section 3 & 9 of FT (D&R) Act, 1992, read with paragraph 1.02 and 2.01 of the Foreign Trade Policy, 2015-2020, as amended from time to time, the Central Government hereby amends the Policy Condition No.7(ii) of Chapter- 27 of Schedule-I (Import Policy) of ITC (HS), 2022.”

Effect of the Notification:

The Policy Condition No. ?(ii) of Chapter- 27 of Schedule-I (Import Policy) of ITC (HS), 2022 has been revised.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"