CA Nitin Kanwar has prepared Draft Management Representation Letter for the purpose of Tax audit.

Reetu | Sep 6, 2023 |

Draft Management Representation Letter for Tax Audit

CA Nitin Kanwar has prepared Draft Management Representation Letter for the purpose of Tax audit.

Click here to read Draft Management Representation Letter for Tax Audit of Non-Corporate Entity

Audits are undertaken under various laws, such as company audits/statutory audits conducted under company law requirements, cost audits, stock audits, and so on. Similarly, income tax legislation requires a ‘Tax Audit’ audit.

Tax audit, as the name implies, is an inspection or review of the accounts of any business or profession carried out by taxpayers from an income tax standpoint. It simplifies the process of calculating income for the purpose of submitting income tax returns.

DRAFT MANAGEMENT REPRESENTATION LETTER FOR COMPANY

To,

______________________

Chartered Accountants

Add: _________________________________________

Sub: Representation for the purpose of Tax audit for the financial year 2022-2023(Assessment year 2023-2024)

Dear Sir/Madam,

This representation letter is provided in connection with Tax audit of the books of accounts of the _______________________________ for the Year ended on 31/03/2023 for the purpose to ascertain/derive/report the requirements of Form Nos. 3CA/3CB and 3CD, to ensure that the books of account and other records are properly maintained, that they truly reflect the income of the taxpayer and claims for deduction/relief are correctly made by him & to checking fraudulent practices. We acknowledge our responsibility to keep and maintain such books of account and other documents as may enable the Tax auditor to do tax audit u/s 44AB, in accordance with the provisions of Income Tax Act, 1961.

The management understands its responsibility for the preparation of Form 3CD. Form 3CD should be duly filled & authenticated by the management. Yourself will only verify and confirm the same & on that basis form the opinion & issue the report in Form 3CA/3CB Subject to the observation, if any as the case may be.

We confirm, to the best of our knowledge and belief, the following:-

1. The name of the assessee as per PAN card is__________________________. Copy of PAN Card has been attached herewith.

2. The company is liable/not liable to pay indirect taxes &if yes, for that registration number is as follows:

a) Service Tax:

b) VAT:

c) Excise:

d) Import Export Code:

e) GST:

Copy of Registration Certificates has been attached herewith.

3. The relevant clause of Section 44AB under which the Tax Audit is being conducted is :

(a) carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year.

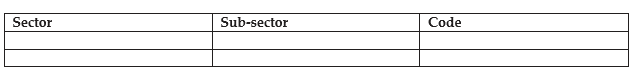

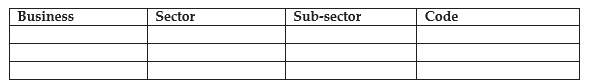

4. Nature of Business or Profession carried during the year, along with sector, subsector, code is as follows:

5. There is no change in the nature of business or profession.

OR

There is change in the nature of business or profession. The particulars of such change is as follows:

Certified copy of Board Resolution & altered MOA has been attached herewith.

To Read More – Click Here

The Author of the Article can be reached at [email protected]

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"