CA Pratibha Goyal | Mar 28, 2024 |

Due Date Compliance Calendar and List of Festivals in April 2024

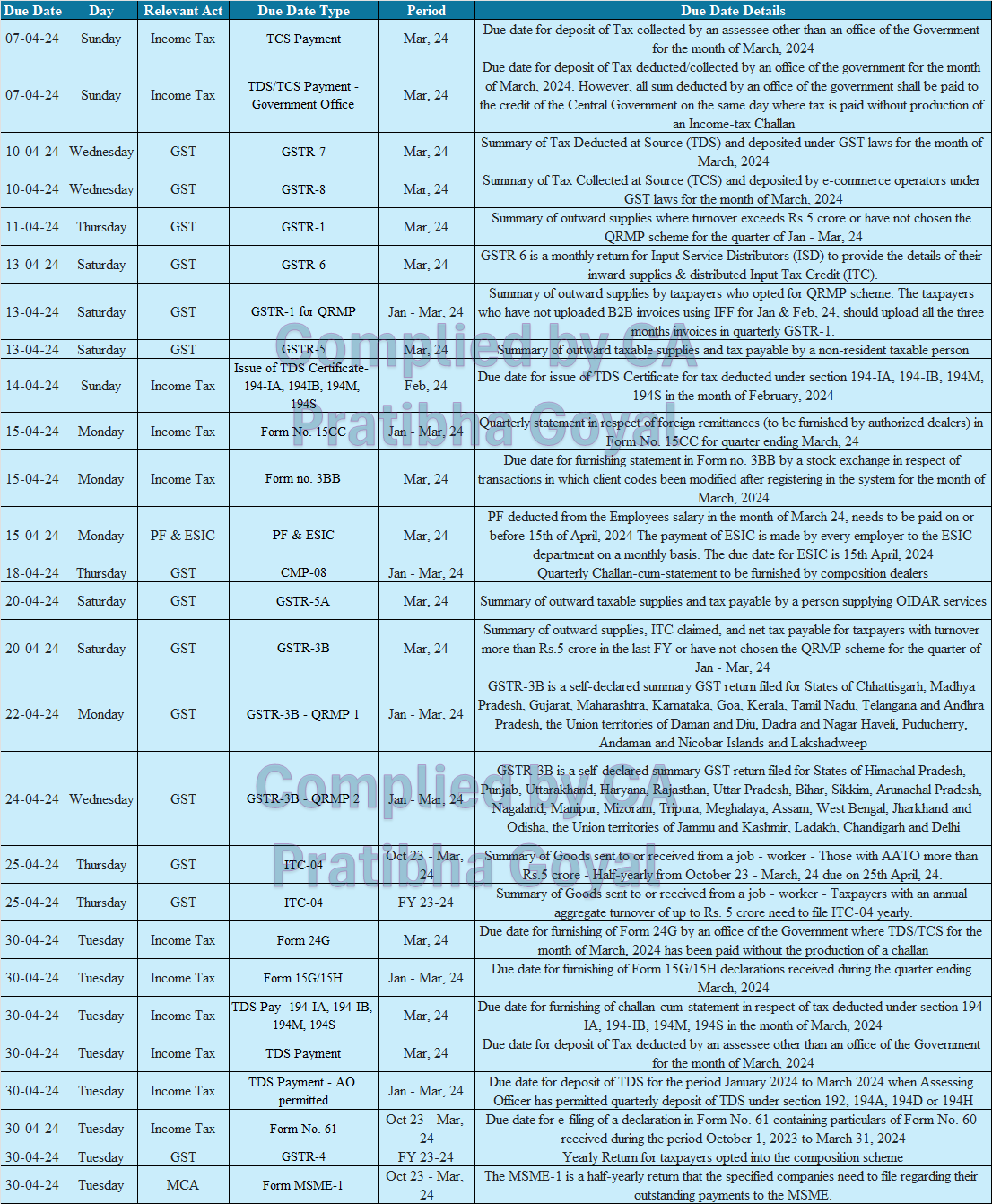

Here is the due date Compliance Calendar April 2024 for GST, Income Tax, MCA, and PF & ESIC Laws. We hope same will be helpful for you to complete your compliance before the due dates. We have also shared the same in the chart form along with the days of the week so that the Tax Professional can plan things accordingly. We have also provided the list of festivals in April for better planning.

07-04-2024

TCS Payment: Due date for deposit of Tax collected by an assessee other than an office of the Government for the month of March, 2024

TDS/TCS Payment – Government Office: Due date for deposit of Tax deducted/collected by an office of the government for the month of March, 2024. However, all sum deducted by an office of the government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan.

10-04-2024

GSTR-7: Summary of Tax Deducted at Source (TDS) and deposited under GST laws for the month of March, 2024

GSTR-8: Summary of Tax Collected at Source (TCS) and deposited by e-commerce operators under GST laws for the month of March, 2024

11-04-2024

GSTR-1: Summary of outward supplies where turnover exceeds Rs.5 crore or have not chosen the QRMP scheme for the quarter of Jan – Mar, 24

13-04-2024

GSTR-6: GSTR 6 is a monthly return for Input Service Distributors (ISD) to provide the details of their inward supplies & distributed Input Tax Credit (ITC).

GSTR-1 for QRMP: Summary of outward supplies by taxpayers who opted for the QRMP scheme. The taxpayers who have not uploaded B2B invoices using IFF for Jan & Feb, 24, should upload all the three months invoices in quarterly GSTR-1.

GSTR-5: Summary of outward taxable supplies and tax payable by a non-resident taxable person.

14-04-2024

Issue of TDS Certificate- 194-IA, 194IB, 194M, 194S: Due date for issue of TDS Certificate for tax deducted under section 194-IA, 194-IB, 194M, 194S in the month of February, 2024

15-04-2024

Form No. 15CC: Quarterly statement in respect of foreign remittances (to be furnished by authorized dealers) in Form No. 15CC for quarter ending March, 24

Form no. 3BB: Due date for furnishing statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes been modified after registering in the system for the month of March, 2024

PF & ESIC: PF deducted from the Employees salary in the month of March 24, needs to be paid on or before 15th of April, 2024 The payment of ESIC is made by every employer to the ESIC department on a monthly basis. The due date for ESIC is 15th April, 2024

18-04-2024

CMP-08: Quarterly Challan-cum-statement to be furnished by composition dealers

20-04-2024

GSTR-5A: Summary of outward taxable supplies and tax payable by a person supplying OIDAR services

GSTR-3B: Summary of outward supplies, ITC claimed, and net tax payable for taxpayers with turnover more than Rs.5 crore in the last FY or have not chosen the QRMP scheme for the quarter of Jan – Mar, 24.

22-04-2024

GSTR-3B – QRMP 1: GSTR-3B is a self-declared summary GST return filed for States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana and Andhra Pradesh, the Union territories of Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep

24-04-2024

GSTR-3B – QRMP 2: GSTR-3B is a self-declared summary GST return filed for States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh and Delhi

25-04-2024

ITC-04

30-04-2024

Form 24G: Due date for furnishing of Form 24G by an office of the Government where TDS/TCS for the month of March, 2024 has been paid without the production of a challan

Form 15G/15H: Due date for furnishing of Form 15G/15H declarations received during the quarter ending March, 2024

TDS Pay- 194-IA, 194-IB, 194M, 194S: Due date for furnishing of challan-cum-statement in respect of tax deducted under section 194-IA, 194-IB, 194M, 194S in the month of March, 2024

TDS Payment: Due date for deposit of Tax deducted by an assessee other than an office of the Government for the month of March, 2024

TDS Payment – AO: permitted Due date for deposit of TDS for the period January 2024 to March 2024 when Assessing Officer has permitted quarterly deposit of TDS under section 192, 194A, 194D or 194H

Form No. 61: Due date for e-filing of a declaration in Form No. 61 containing particulars of Form No. 60 received during the period October 1, 2023 to March 31, 2024

GSTR-4: Yearly Return for taxpayers opted into the composition scheme

Form MSME-1: The MSME-1 is a half-yearly return that the specified companies need to file regarding their outstanding payments to the MSME.

Hope you will find the same helpful. Please do share it with your friends for maximum reach.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"