CA Pratibha Goyal | Mar 27, 2024 |

Due Date for Mutual Fund ELSS Investment for 80C is 28th March not 31st March: Hurry Up

As per the Income Tax Act, if you are opting in the Old Tax Regime for the Financial Year 2023-24, you should ensure that your tax deduction expenditure for Section 80C Deduction should be made up to 31st March 2024. But this time 31st March 2024 falls on Sunday and thus what is the due date now?

Also please note that on account of the 5th Saturday, banks are working on the 30th of March. But again banks are closed on Friday 29th March on account of Good Friday. Further Stock Markets are closed on 29th, 30th and 31st March i.e., Friday, Saturday and Sunday. As Stock Market are closed, Mutual Fund Houses are also closed on these 3 Days which means, to get the Tax benefit in financial year 2023-24, one need to make the investment by 28th March 2024.

Also Read: Important Income Tax Changes from 1st April

For the allocation of ELSS mutual fund purchase, the purchase transaction should happen when the Stock Market is Open. In case you make payment after 28th, the amount will be credited with Mutual Fund House, but the Mutual Fund Unit will be allocated on 1st April 24. Thus this will not be counted for Investment U/S 80C of Income Tax.

According to Sebi requirements, investment funds must be credited to the mutual fund account by 3 PM on the day the capital market (stock or debt market) is open in order to receive the same day’s NAV for the units being acquired.

To help you grasp this, consider this example. Let’s say someone invests in a mutual fund scheme via UPI. Before 3:30 PM, the funds are credited to the mutual fund house’s bank account. The person will thereafter be qualified for the NAV for that same day. However, the investor will receive the NAV of the following working day if the funds arrive at the mutual fund’s bank account after 3 PM.

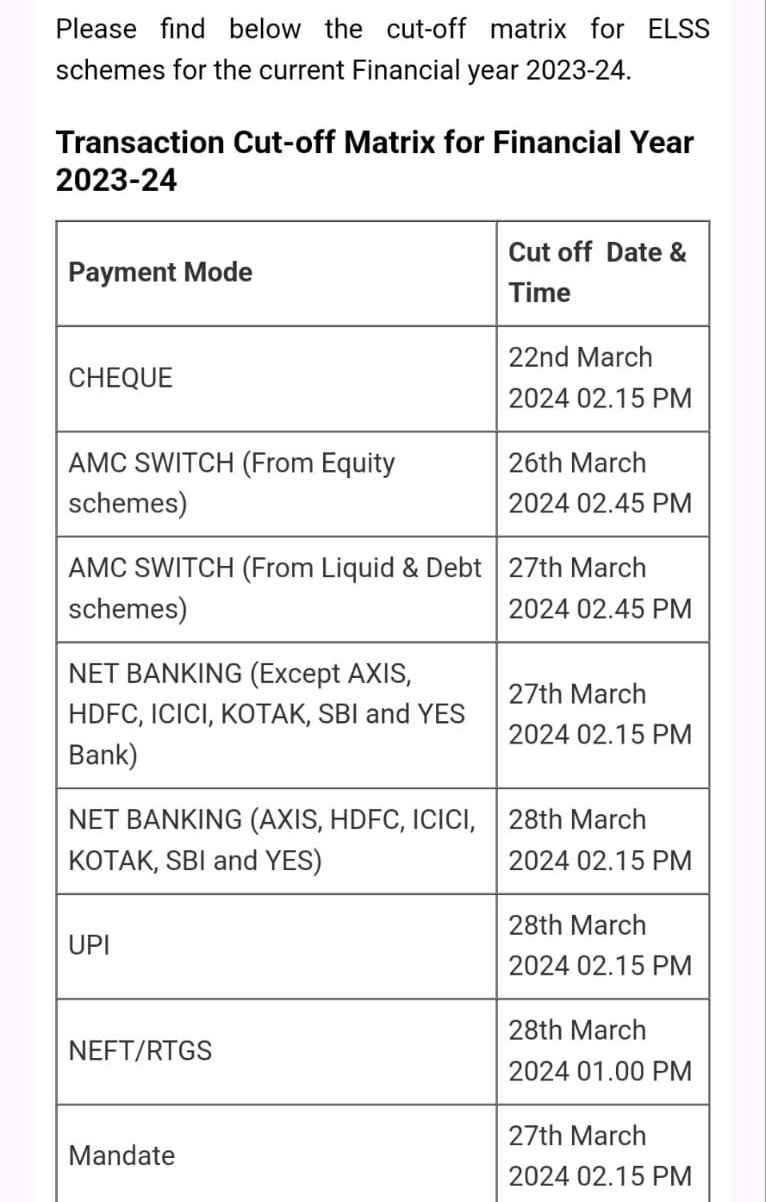

According to NJ Wealth Mutual Fund, in order for an ELSS mutual fund investment to be eligible for the Section 80C tax benefit for 2023–2024, funds must arrive by 2.15 PM on March 28, 2024.

Mutual fund companies and banks have different arrangements for the receiving of this money. Before beginning the investment procedure, it is important to check with the mutual fund house of your choice. Thus, in order to prevent these last-minute problems, if investing in an ELSS mutual fund plan, finish the process as soon as possible.

Also Read: Submit Tax Saving proofs to Employer to claim LTA by March 31st

Have you done the Investment? Do let us know.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"