The Income Tax Appellate Tribunal has notified E-Filing Portal Standard Operating Procedure.

Reetu | Jul 22, 2023 |

E-Filing Portal Standard Operating Procedure by Income Tax Appellate Tribunal

The Income Tax Appellate Tribunal has notified E-Filing Portal Standard Operating Procedure.

e-Filing is the process of electronic online filing of appeals and applications before a Bench of Income Tax Appellate Tribunal (in short “Tribunal”). An Assessee or Assessing Officer or any other person, who is entitled to file an appeal, cross objection or application before the Tribunal u/s. 253 of Income Tax Act, 1961, can file the same through e-Filing Portal. This provision will apply to appeals under other enactments mutatis mutandis.

Once an e-filed appeal / cross objection / application is physically presented in the office of the Tribunal, the Registry will verify the documents uploaded in the e-Filing Portal with the ones submitted physically. After scrutiny in all respects, the Registry will accept the e-Filing.

It is clarified that the date of presentation of appeal physically in terms of Rule 6 & 7 of Income Tax (Appellate Tribunal) Rules, 1963 or the respective Acts shall be reckoned for all purposes of limitation.

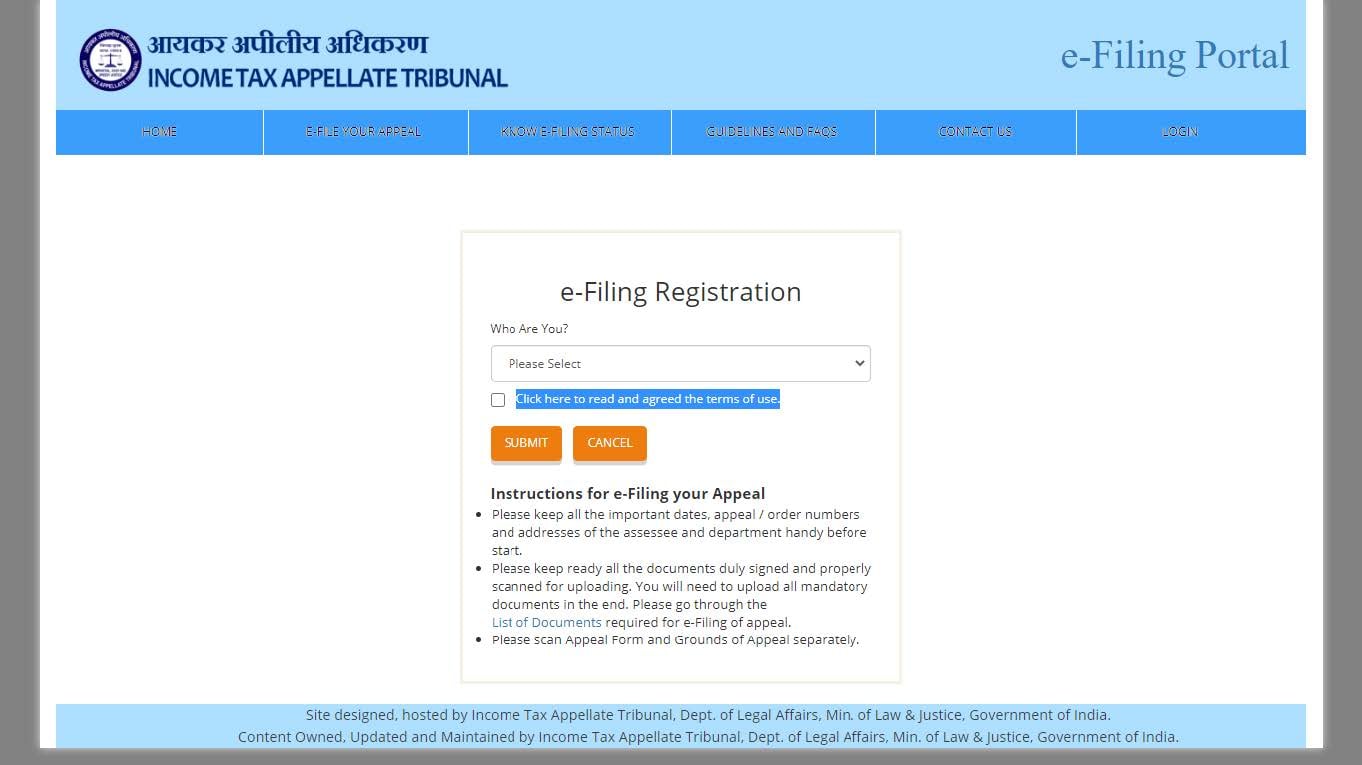

Permanent Account Number (or TAN as the case may be) of the assessee, Mobile Number and e-Mail ID are the key identifiers in the e-Filing Portal. Therefore, having a PAN/TAN, valid Mobile Number and e-Mail ID are pre-requisites for using this Portal

To proceed further, select ‘Who are you?’. If you are an assessee, please select ‘I am an Assessee’. If you are an officer of Income Tax Department, please select ‘I am Department.’

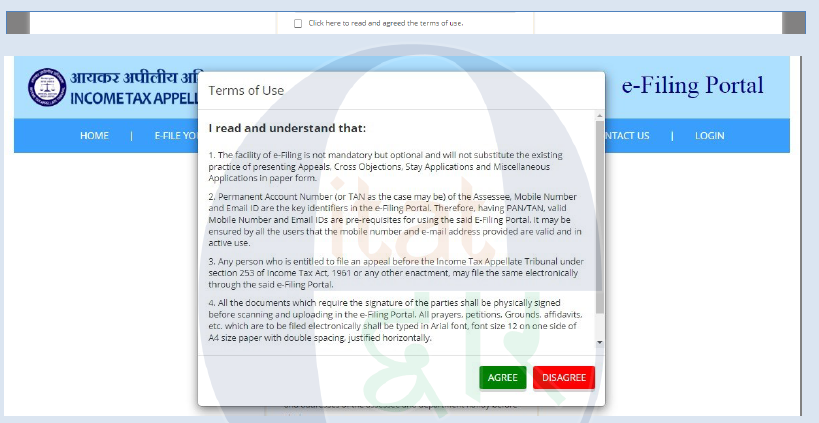

Thereafter, select ‘Click here to read and agree to the ‘Terms of Use’ option. This will popup the ‘Terms of Use’ of e-Filing Portal of the Tribunal.

Go through the Terms of Use and Standard Operating Procedure (SOP) for e-Filing carefully. Keep all the important dates, appeal / order numbers and addresses of the assessee and department readily available before start. Please keep ready all the documents duly signed and properly scanned for uploading. You will need to upload all mandatory documents in the end. Please go through the List of Documents required for e-Filing of appeal.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"