Deepak Gupta | Aug 1, 2022 |

![E-Invoicing applicable for Turnover of more than Rs 10Cr w.e.f 1st October 2022 [Read Notification]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2022/08/STUDYCAFE-IMAGES-Autosaved-3.jpg)

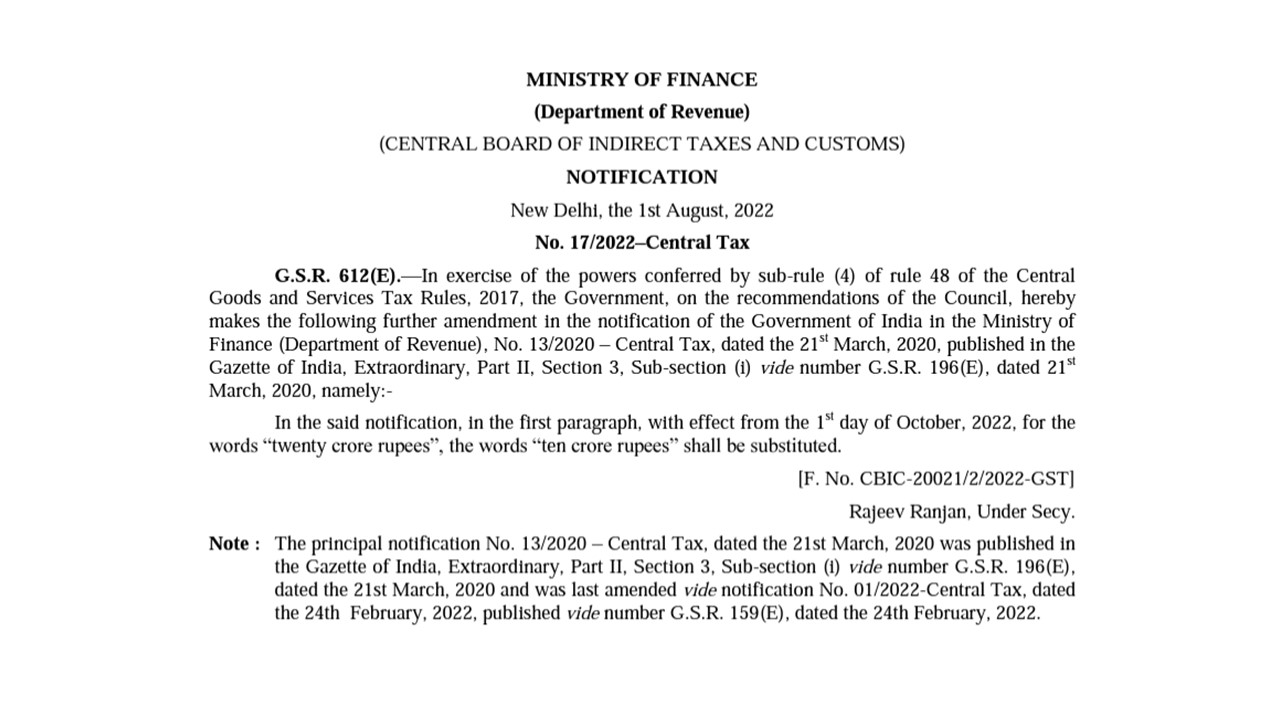

E-Invoicing applicable for Turnover of more than Rs 10Cr w.e.f 1st October 2022 [Read Notification]

As per Notification Number 17/2022–Central Tax dated 1st August 2022, E-Invoicing will be made applicable for Turnover of more than Rs. 10 Cr w.e.f 1st October 2022.

The Government has amended notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 13/2020 – Central Tax, dated the 21st March 2020, whereby, in the first paragraph, with effect from the 1st day of October 2022, for the words “twenty crore rupees”, the words “ten crore rupees” shall be substituted.

Now GST E-invoice will be mandatory if turnover is more than Rs. 10 Cr in any Financial year from FY 2017-18 Onwards.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"