Empanelment of CA Firm for Audit of Oriental Insurance Company Limited

Reetu | May 24, 2022 |

Empanelment of CA Firm for Audit of Oriental Insurance Company Limited

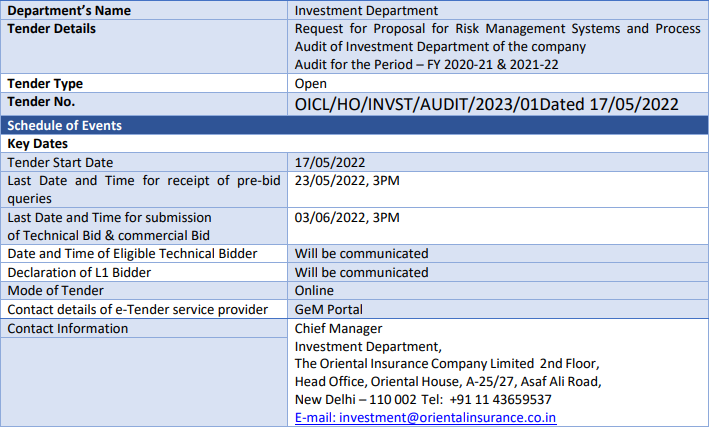

The CFO & Deputy General Manager (Investment Account), The Oriental Insurance Company Limited invites online bids from eligible companies / organizations/firms for Risk Management Systems and Process Audit of Investment Department of the company. The Risk Management System and Process Audit of Investment Department is required to be conducted as per the instructions and directives issued from time to time by the IRDAI and/or RBI/SEBI or any other statutory authority directives applicable for General Insurance Companies including Statutory Tax Compliance Status etc. in all respect.

The Oriental Insurance Company Limited (OICL), a public sector undertaking, is dealing in General Insurance business. OICL has been enjoying the highest rating from leading Indian Credit Rating agencies such as CRISIL and ICRA. OICL with its Head Office at New Delhi has 29 Regional Offices and nearly 1800+ operating offices in various cities of the country.

The purpose of this Request for Proposal (hereafter referred to as “RFP”) is to define scope of work for the Bidder for Risk Management Systems and Process Audit of Investment Department.

This RFP contains details regarding scope, project timelines, evaluation process, terms and conditions as well as other relevant details which Bidder needs to factor while responding to this RFP.

As per IRDAI (Investment) Regulations, 2016 under 13(D) (1),the eligibility criteria for selection of an Audit Firm are as under:

1. The Chartered Accountant firm shall be a firm registered with the Institute of Chartered Accountants of India (ICAI).

2. The Audit firm should have experience for at least 4 years in conducting reviews of Risk Management System and Process of either Banks or Mutual Funds or Insurance Companies or have, on behalf of IRDAI conducted investment inspection of insurance companies.

3. On the date of appointment as an auditor for certifying Investment Risk Management System and process, the auditor must not hold more than two audits of Internal, Concurrent and Risk Management System Audit, all taken together. Hence, the Audit firm can at the maximum hold not more than three audits (i.e. Investment Risk management Systems and Process Audit, Internal Audit, Concurrent Audit – all taken together), apart from Statutory audit at any point of time. For this purpose, at the time of appointment, the firm shall submit a declaration to this effect.

4. The audit firm should not have been prohibited /debarred by any regulating agency including IRDAI, RBI, SEBI, ICAI etc.

5. The Risk management Auditors appointed for certifying Investment Risk Management System and Process, should not have conducted the following assignments for our company during a period of two years immediately preceding the appointment as Risk Management Auditor;

(i) Statutory Audit

(ii) Any Internal Audit

(iii) Any Concurrent Audit

(iv) Any consulting assignment whether or not related to audit functions.

The selection of the Audit Firm shall be on the basis of above criteria and it is, therefore, requested that a letter of interest (Annexure-A) in the enclosed format may submit through GeM Portal for submission of Bids online.

Eligibility criterion for the Bidders to qualify this stage is clearly mentioned in Clause 1.4. The Bidders who meet all these criteria would only qualify for the second stage of evaluation. The Bidder would also need to provide supporting documents for eligibility proof as mentioned in Annexure A.

The decision of OICL shall be final and binding on all the Bidders to this document. OICL may accept or reject an offer without assigning any reason whatsoever.

Bidders shall submit the Bids online through GEM portal

To Read More Details Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"