Empanelment of CA firm for Concurrent Audit of India Post Payments Bank Ltd

Sushmita Goswami | Dec 29, 2021 |

Empanelment of CA firm for Concurrent Audit of India Post Payments Bank Ltd

India Post Payments Bank Limited (“IPPB”) is a company incorporated and registered under Companies Act, 2013 and a payments banking company registered under section 22 (1) of the Banking Regulation Act, 1949 duly licensed by RBI. IPPB is engaged in conducting banking and payments business providing services to retail and corporate customers. IPPB has its Registered Office at Speed Post Centre, Bhai Veer Singh Marg, New Delhi – 110001.

Concurrent audit is an examination which is contemporaneous with the occurrence of transactions or is carried out as near thereto as possible. It attempts to shorten the interval between a transaction and its examination by an independent person. There is an emphasis in favor of substantive checking in key areas rather than test checking. This audit is essentially a management process integral to the establishment of sound internal accounting functions and effective controls and setting the tone for a vigilant internal audit to preclude the incidence of serious errors and fraudulent manipulations.

A concurrent auditor may not sit in judgement of the decisions taken by an authorized official. This is beyond the scope of concurrent audit. However, the audit will necessarily have to see whether the transactions or decisions are within the policy parameters laid down by the Corporate Office, they do not violate the instructions or policy prescriptions of the RBI, other regulators, and that they are within the delegated authority.

The Bank has decided not to charge any Tender Fees.

The Bank has decided not to charge any EMD for this tender. However, bidders need to submit ‘Bid Declaration Form’ as per annexure.

Below are the Minimum areas of coverage under Concurrent Audit as per Reserve Bank of India (RBI) circular for concurrent audit system issued in year 2015 and 2019. However, minimum coverage is not restricted but the above activities / department (refer para no. 4(2)) i.e. checklist for Risk department, Compliance Department, Product department, BDEG (Business Development Enterprise Group) and other departments etc. will also be covered under the concurrent audit system at India Post Payments Bank:

Centralized Processing Center:

(i) House Keeping including settlement / reconciliation of all internal office accounts, monitoring of General Ledger / Subsidiary General Ledger / Parking Accounts, opening / modification of internal accounts, etc. (Ref. RBI circular dated July 17, 2019 and others in this regard).

(ii) Verification of Bank Reconciliation Statement and reporting of unreconciled transactions.

(iii) Cash transactions including physical verification of cash (petty cash), if any.

(iv) Clearing transactions.

(v) Reporting of frauds / Suspicious transactions observed during the audit.

(vi) Reconciliation with bank’s account at Clearing House and review of old outstanding entries for reconciliation.

(vii) Remittance of funds by way of DDs / NEFT / RTGS / IMPS / NACH / AEPS / APBS / DMT etc. any other mode in cash exceeding the prescribed limit.

(viii) Contractors and Vendors should not be as per the IBA negative list.

(ix) Outstanding entries / transactions in the internal office accounts including sundry, suspense and other transit accounts pending beyond prescribed period.

(x) Adherence to KYC/AML guidelines in opening of fresh accounts and monitoring of transactions in such accounts.

(xi) Accounts opened and closed within a short span of time i.e., accounts with quick mortality.

(xii) Activation and operations in inoperative accounts.

(xiii) Value dated transactions.

(xiv) Customer accounts modifications

(xv) Customer service requests closure by the vendor team.

(xvi) Authorizations and approvals to be held on records as per the internal guidelines.

Those firms who satisfy the following criteria, are eligible to apply:

a. Category 1 and 2 empaneled firms as per RBI / CAG empanelment category list as on the date of application for this purpose.

b. Firms which have at least 2 number of trained representatives of firm trained by ICAI on Concurrent Audit, Retired Officers of Commercial Banks, qualified Chartered Accountants as Partner (at least 2 FCA partners), who will be available on all working days to attend the handle Concurrent Audit assignment.

c. CA Firms should be having at least one year of Concurrent Audit experience in any Payments Bank or Centralized Processing Units or Back end processing units of scheduled commercial banks.

d. Firms who have the experience of verification of Internal Office Accounts, Risk department, Compliance department, Treasury Department, Product/BDEG department, Information Technology / Security department will be eligible. (relevant experience certificate has to be submitted).

e. Firms should be having their head office / branch office in Delhi / NCR.

f. The firms should have qualified Information System Auditor (CISA/DISA). IS audit would be conducted in accordance with IS Audit policy of the Bank & as per format provided by the bank, which should form an integral part of concurrent audit.

g. Firms chosen for engagement as Concurrent Auditors should be other than the ones selected for empanelment as Statutory Auditors to eliminate any room for conflict of interest.

h. RBI has issued relevant rules and guidelines from time to time for appointment and tenure of the concurrent auditors. Bank will follow the regulatory guidelines in this regard. The extent directions as per RBI circular “ACB/ LMC of the bank shall decide the maximum tenure of external concurrent auditors with the bank. Generally, tenure of external concurrent auditors with a bank shall not be more than five years on continuous basis. Further, the age limit for retired staff engaged as concurrent auditors may be capped at 70 years. However, no concurrent auditor shall be allowed to continue with a branch/business unit for a period of more than three years”.

i) The Bank reserves the right to disqualify any or all applications either on the basis of their responses without assigning any reasons, whatsoever. Those applicants who satisfy the requirements and specifications as determined by the Bank as per the terms and conditions of this document shall be short-listed.

ii) Preference will be given to the firms having more no. of partners CISA/DISA qualified.

iii) The prima facie scrutiny of the applications will be done by a Screening Committee duly constituted for this purpose specifically.

iv) The final selection of the CA firms will be approved by the Selection Committee duly constituted for this purpose specifically.

v) Bank also reserves the right to make query or may seek presentations with the firm or any other agency, ask for additional information, particulars, and submission of one, some or more undertakings from any firm at any point of time. None of such act shall be deemed as an offer of engagement as Concurrent Auditor by the Bank to the firm unless and until Bank intimates in writing to the firm regarding allocation of any department / office / unit for concurrent audit.

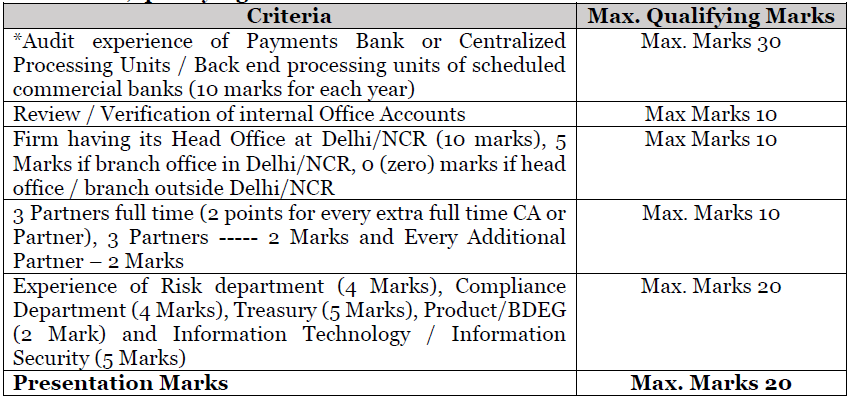

vi) Selected firms will be empaneled as per below mentioned marks criteria. However, qualifying marks are 60. Details as under:

Refers to the concurrent audit only.

CA firms scoring 60 and above (qualifying marks) out of total 80 marks, will be called for presentation. Scores obtained on presentation will be added to the qualifying score obtained to empanel required number of firms. Further, top 3 scoring bidders will be selected and empaneled by the bank.

1. Concurrent audit to be done on daily basis. Trained representative of the firm (Articled Clerk trained by ICAI on concurrent audit) / retired commercial banks officers /qualified Chartered Accountants to be available at each location on all days.

2. One of the Principal Partners or senior partner to visit the office at least 2/3 times a week, minimum 8 times every month.

3. Bank will impose financial penalty for unauthorized absence, non-detection of income leakage, major lacunae in conduct of account including reporting to RBI/ ICAI.

4. Bank may impose non-financial penalty leading to termination of contract for instances of failure to comment on fraud, misappropriation of funds, any other serious irregularities which result in loss to the Bank.

5. If there is any change in the constitution of your firm or you suffer from any statutory disqualification, you must inform the Bank immediately.

6. CA firms to furnish personal details / comply with KYC norms, viz., proof of identity and address proof / contact numbers / contacts in case of emergency, etc., of all the representatives of the firm who visit the office / CPC, for security reasons.

7. The partners / representatives of CA firms who visit the Office / CPC shall make their presence in a register maintained for the said purpose.

8. The representatives of the CA firms shall not enter prohibited / restricted areas, viz., IT server room, record room and / or any other security related areas without the prior approval from the concerned.

9. CA firms shall not hold any documents overnight in their custody. Hence, all vouchers / books/ registers/ security document / title deeds / any other documents / vital correspondence etc., are to be returned to the officials of the office / CPC on each day.

10. Office / CPC shall be advised to provide applicable ” Enquiry” rights / access to the Bank’s Core Banking System to the representatives of the CA firm.

To Read More Details Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"