Empanelment of CA Firms for Internal Audit of Visakhapatnam Port Trust

Reetu | Dec 20, 2021 |

Empanelment of CA Firms for Internal Audit of Visakhapatnam Port Trust

TENDER No.

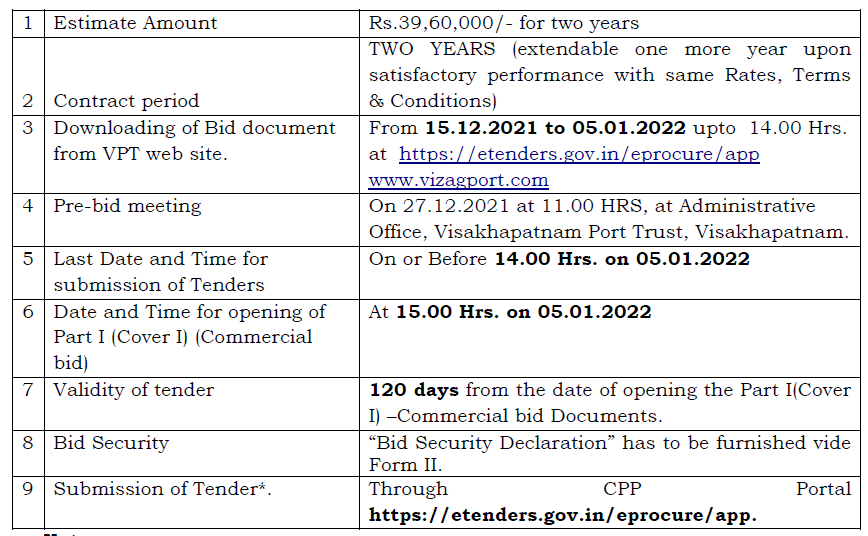

Electronic Tenders (Two Cover System) are invited by Visakhapatnam Port Trust, Visakhapatnam from bidders fulfilling the Eligibility Criteria for pre-qualification as stipulated in this notice for the work of “APPOINTMENT OF A SERVICE PROVIDER(C&AG EMPANELLED CHARTERED ACCOUNTANT FIRM) TO RENDER INTERNAL AUDIT SERVICES TO VISAKHAPATNAMPORT TRUST FOR A PERIOD OF TWO(2) YEARS AND EXTENDABLE BY ONE MORE YEAR UPON SATISFACTORY PERFORMANCE WITH SAME RATES, TERMS & CONDITIONS”

Note :

The work will be awarded to the CAG empaneled firm of Chartered Accountants based on evaluation of tender in two cover system of tendering.

Tenderers can also download the tender document from the Visakhapatnam Port Trust’s website: www.vizagport.com and https://etenders.gov.in/eprocure/app.

For this a set of “Tender Document” has been prescribed containing the scope of work, general conditions governing the process of tendering as well as forms for furnishing the information in Technical Bid Cover –I and Price Bid-Cover-II.

The Tenderer should submit the bid through CPP Portal https://etenders.gov.in/eprocure/app.

The last date of receipt of tender is 05.01.2022 at 14.00 hrs. Tender received by this time/ date will opened on the 05.01.2022 at 15.00 hrs. The tender will be evaluated, and the work will be awarded to the selected Tenderer.

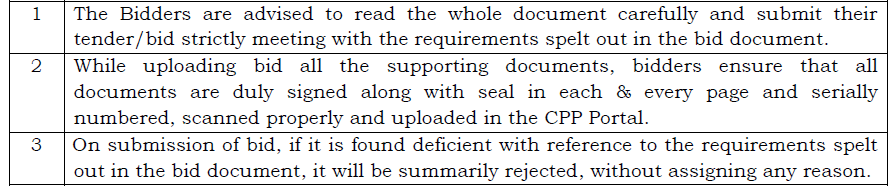

Tenderer requires to submit documents as specified in Requirement & Eligibility, Determination of Responsiveness and Techno Commercial evaluation of this Tender document.

Interested Firm of Chartered Accountant in taking up this assignment are requested to participate in this tender.

i) NIT invited through ‘TWO COVER SYSTEM’ by VISAKHAPATNAM PORT TRUST from eligible bidders for “APPOINTMENT OF A SERVICE PROVIDER(C&AG EMPANELLED CHARTERED ACCOUNTANT FIRM) TO RENDER INTERNAL AUDIT SERVICES TO VISAKHAPATNAM PORT TRUST FOR A PERIOD OF TWO(2) YEARS” with an option to extend for one more year with the same rates, Terms and Conditions on satisfactory performance of service during the course of contract.

ii) The bid document containing the entire details is available at the www.vizagport.com and https://etenders.gov.in/eprocure/app for downloading during the period specified in the NIT (Section – I).

iii) The Bidders must fulfill the Minimum Qualification criteria for pre-qualification and other requirements stipulated in Section III –Qualification criteria for the bidders of the bid document. The tender shall remain valid for a period of 120days from the date of opening of the Part I (Cover I).

iv) The Contract Agreement will be in force for a period of Two years from the date specified in the Work Order and extendable for One more year with the same rate, Terms and conditions on mutually agreed basis, which will be based on the satisfactory performance of service during the course of Contract.

v) The Bidder undertakes, if his tender is accepted, has to enter into and execute when called upon to do so, a Contract Agreement as provided in Annexure B with such modifications as agreed upon. Until the formal Contract Agreement is prepared and executed, this tender document together with the written acceptance shall form a binding agreement between the Port and the firm.

vi) Audit firms which are auditors for direct tax and indirect tax of VPT are not eligible to bid.

The work is proposed to be given to a reputed firm having the following criteria:

a) Experience in similar works* with Organisations having turnover of more than Rs.360.00 crores. (25% of Port’s Turnover of around Rs.1440 crores) during the last 7 years. In case of experience in organisation the bidder shall submit Proof of Work Order/Work Completion Certificate for the experience claimed (Refer Form III).

In respect of Complete Internal Audit Services, the period shall be reckoned as per the initial Work order. For eg. If the initial work order is for a period of one year, the work deemed to be completed subject to submission of satisfactory completion certificate for the said one year, irrespective of subsequent extensions, if any.

b) The firm should also have at least 5 partners with professional qualification in the field of work.

c) The Chartered Accountant firm should be empaneled by the Comptroller &. Auditor General of India or Reserve Bank of India.

d) The firm should have at least one Partner Qualified CISA/DISA Certification.

e) Any bidder who was previously awarded work in VPT but was terminated due to the failure of the consultant/successful bidder or the successful bidder who failed to accept the work, are not eligible to participate in this Tender.

f) Audit firms who are Direct/Indirect Tax consultants/Auditors to VPT at present are not eligible to participate.

*Similar Work: The Firm should have done Internal Audit to Government Organisation/Public Sector Undertaking/Public Sector Enterprise/Autonomous Bodies during the past seven years with a Gross receipts/Turnover of more than Rs.360 crores.

To Read More Details Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"