Extend Due Date for furnishing of Income tax returns & Tax audit reports: Maharashtra Tax Practitioners

Reetu | Dec 15, 2021 |

Extend Due Date for furnishing of Income tax returns & Tax audit reports: Maharashtra Tax Practitioners

Maharashtra Tax Practitioners’ Association has given Representation to Finance Minister Hon’ble Nirmala Sitharaman for Extension of Due Date for furnishing of Income tax returns & Tax audit reports.

It has been submitted that due date for submission of Tax Audit Report Balance Sheet, Profit and Loss Account under Income Tax Act, 1961 for A.Y. 2021-22 is 15th Jan, 2022. The Audit work includes verification of Turnover and ITC on purchases and expenses as well. Due to Practical difficulties faced by tax payers & tax professionals in filing: [a] Income tax returns, tax audit forms [b] System glitches in new website launch. The request representation has submitted.

Below is Copy of Representation Submitted :

The Union Finance Minister,

Union of India, North Block,

New Delhi-110 001

Respected Sir,

Sub: Appeal for [a] extension of due date for furnishing of Income-tax returns, Tax audit reports etc. & [b] Issues faced by us after launching of new website

REF.: Practical difficulties faced by tax payers & tax professionals in filing: [a] Income tax returns, tax audit forms [b] System glitches in new website launch

[01] About Our Association:

Our Association represents the Tax Consultants, Advocates, Chartered Accountants, Company Secretaries & Cost Accountants practicing in direct & indirect taxes from whole of the Maharashtra state. Presently, we have around 1700 plus active members from the state.

Our Association was earlier known as The Western Maharashtra Tax Practitioners’ Association. In the recent Special General Meeting of our members held on 6th June 2021, · we have decided to expand our wings & made our area of operation as whole Maharashtra.

[02] Role of our Association:

Our Association always represents the concerns and problems faced by these members before the respective tax authorities. This initiative of our Association has proved beneficial for the tax administering authorities, our members and ultimately the tax payers at large.

[03] About this representation:

This representation contains various issues faced by Tax Professionals in filing of returns, tax audit forms etc. & issues of the new website

C) Practical difficulties faced by tax payers & tax professionals in filing Income tax returns, tax audit forms:

1) Extension of due date for filing ITR’s: As you are aware that the Income-tax website is changed & there are hundreds of issues in the new website. However, some of the issues have been resolved, but many issues as enumerated below are still persisting. It took huge time to get these issues resolved. Still the following issues persists:

A) Filing of tax Audit forms: The utilities for filing tax audit reports have been made available very recently & hence the work of filing tax audit reports is held up. The data required in the changed forms is to be extracted from the accounts for which the staff I tax professionals offices & taxpayers offices is taking time.

B) Overlapping due dates: The due date for filing GSTR-9 & GSTR-9C for f y 2020-21 is 31st December, 2021. Whereas, the due date for filing tax audit reports under Income-tax Act, 1961 is 15th January 2022. The due dates are overlapping & hence professionals find it difficult to prepare both the audit reports.

C) CA examination: The basic data, checking of accounts, finalisation work for tax audit reports is mainly prepared in the offices of Chartered Accountants by the articled clerks under CA course. The examination of CA final, IPCC will be concluded on 20th December 2021. The articled assistants appearing for the examination have taken leave for the same. Therefore, the work in the offices of Chartered Accountants has been hampered to a considerable extent.

D) ITR Form-5 & Form-6: Utilities for ITR form-5 applicable for partnership firms, AOP & Co-operative Societies, ITR form-6 for Companies are still having many issues while filing theses ITR’s. Tax professionals facing these issues & hence are unable to file these returns.

E) Recent changes in Tax audit forms: CBDT has recently made various changes in tax audit form seeking additional information therein. Tax professionals have to get acquainted to it. The information sought is required to be collected from the client & / or his accountant. Both of them require time & study of the relevant information.

F) JTR due dates for audit & no’n audit assesses: The due date for filing ITR for audit assessee is 31st December 2021. For non audit assessee due date for filing Tax audit report is 15th January 2022, the gap of 15 days is insufficient. Whereas, the gap in these two due dates is 2 months in normal circumstances. Therefore, there must be a gap of two months in these two due dates. Therefore, tax professionals neither concentrate on work of audit assessee nor concentrate on work of non audit assessee.

G) Due date of Scrutiny Assessments: The due date of scrutiny assessments for A Y 2018 – 19 & other scrutiny assessments under other sections is 31 st December 2021. Tax professionals find it almost impossible whether to file ITR’s, Tax audit reports, GSTR-9, GSTR-9C audit or to comply with the scrutiny assessments in the given time.

H) Introduction of AIS / TIS: In case of Individual & HUF assessee Annual Information Statement (AIS), Tax Information Statement (TIS) have been introduced in Oct / Nov 2021. Coordinating with the data on these statements is almost an impossible task as the statements have been introduced after many assessees have finalised their accounts. These statements are faulty in it, as it contains half the information. In many cases the banks have not supplied the full /part of the information. If there are bulk transactions of shares or other transactions then it does not get downloaded or takes too much time to get downloaded. In case of discrepancies in data available it becomes difficult to how to correlate the data with actual figures. It will lead to issues in scrutiny assessments in future. Therefore, it is urged that the basis of AIS, TIS data be started ,from next assessment year. Those who have already filed ITR before the introduction of A.I.S. are now advised to file a revised return. If CBDT has in.troduced A.I.S. late on the portal why assessee should file a revised ITR?

I) Filing Form 10-1D for Company assessee: For Company assessee opting for option to file return u/s 115BAB of The Income – Tax Act, 1961 the form is not getting uploaded on the website. If the complaint is raised, after some days portal gives a reply that “issue is resolved, file Form 10-1D’. Factually, still the issue persists. Thus company assessee will have to pay income tax at a higher rate without any fault at their end.

J) Due date for filing revised returns: The due date for filing revised returns is 31st December for all assessee. However, due to the reasons of new website the due date of filing original returns has been extended. Therefore, the due date for filing revised returns be extended at 3 months from filing the extended due date of filing the original return.

K) Departmental messages containing XXXX: The tax payment challans, messages on mail, mobile contains xxxx in name, PAN of the assessee. It is time consuming and unwanted. What the CBDT is achieving by sending xxxx in every message? The same must be removed & all details as to full name, full PAN etc be reflected in each communication from the department.

L) Form 10-1 E could not be filed by representative assessee: In case of deceased I lunatic assessee the return for the unfilled period be fled by the legal heir of the deceased / lunatic. However, if the legal heir chooses to opt for taxation u/s 115-BAC of the deceased / lunatic he cannot do so as the applicable form 10-1 E could not be uploaded by the legal heir.

M) Old Penalty Notices still live on new portal: Penalty notices of the period before the new site was launched in which answers were filed upto 31.05.2021 (period of old website) were not processed & the cases are still seen as not responded. Appropriate actions in such cases are required to be given. It may so happen that the assessee under sincere belief of responding the notice may be penalised due to this for no fault.

N) Filing of returns with DSC: If any assessee chooses to file his ITR by signing it by digital signature then even individual returns without audit cannot be filed with DSC. The issue must be resolved on priority.

0) Suggestion for Point no I & L above: Atleast for some period the signed copy of the relevant form be directed / allowed to be accepted in the respective ward offices till the website get smoothened.

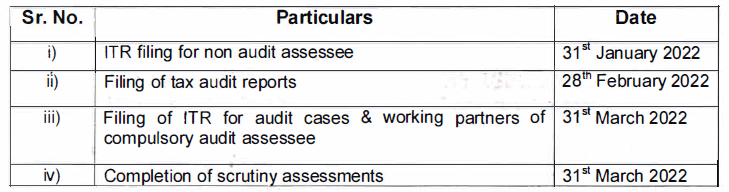

It is therefore urged that extension for filing of various returns & compliances be granted as follows:

To Read Full Representation Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"