Reetu | Feb 8, 2022 |

FAQs on Insolvency and Bankruptcy Code 2016

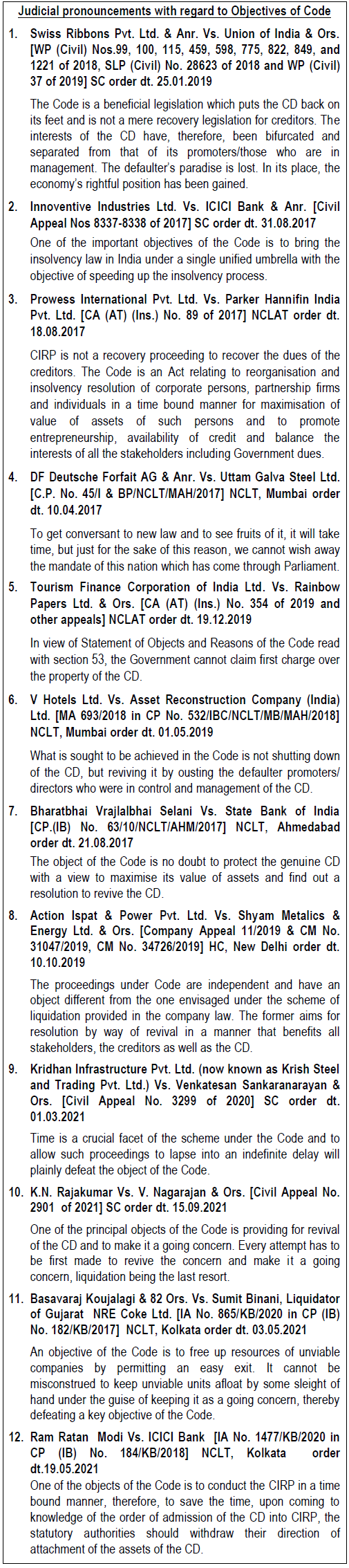

Q.1. What is the purpose of enactment of the Insolvency and Bankruptcy Code, 2016?

Ans. As per Preamble to the Code, the purpose of this Act is as follows:-

(a) To consolidate and amend the laws relating to reorganisation and insolvency resolution of corporate persons, partnership firms and individuals.

(b) To fix time periods for implementation of the Code in a time bound manner.

(c) To maximize the value of assets of stakeholders.

(d) To promote entrepreneurship.

(e) To increase/stimulate availability of credit.

(f) To balance the interests of all the stakeholders including alteration in the order of priority of payment of Government dues.

(g) To establish an Insolvency and Bankruptcy Board of India as a regulatory body for the Code.

Q.2. To whom shall the provisions of the Code apply?

Ans. According to Section 2, the provisions of the Code shall apply for insolvency, liquidation, voluntary liquidation or bankruptcy, as the case may be, of the following entities:-

(a) any company incorporated under the Companies Act, 2013 or under any previous company law;

(b) any other company governed by any special Act for the time being in force, except in so far as the said provisions are inconsistent with the provisions of such special Act;

(c) any Limited Liability Partnership incorporated under the Limited Liability Partnership Act 2008;

(d) such other body incorporated under any law for the time being in force, as the Central Government may, by notification, specify in this behalf;

(e) personal guarantors to corporate debtors;

(f) partnership firms and proprietorship firms; and

(g) individuals, other than persons referred to in clause (e).

Q.3. Who shall be termed as Corporate Debtor?

Ans. As per Section 3(8) of the Code, Corporate Debtor means a corporate person who owes a debt to any person.

Q.4. Who is a Corporate Person?

Ans. A Corporate Person as defined under section 3 (7) is as follows:

a) a company as defined under section 2(20) of the Companies Act, 2013;

b) a limited liability partnership as defined in Section 2(1)(n) of the Limited Liability Partnership Act, 2008; or,

c) any other person incorporated with limited liability under any law for the time being in force but shall not include any financial service provider.

Q.5. What are the services that are included in the term Financial Service?

Ans. As per Section 3(16), Financial Service include any of the following services, namely:

(a) accepting of deposits;

(b) safeguarding and administering assets consisting of financial products, belonging to another person, or agreeing to do so;

(c) effecting contracts of insurance;

(d) offering, managing or agreeing to manage assets consisting of financial products belonging to another person;

(e) rendering or agreeing, for consideration, to render advice on or soliciting for the purposes of––

(i) buying, selling, or subscribing to, a financial product;

(ii) availing a financial service; or

(iii) exercising any right associated with a financial product or financial service;

(f) establishing or operating an investment scheme;

(g) maintaining or transferring records of ownership of a financial product;

(h) underwriting the issuance or subscription of a financial product; or

(i) selling, providing, or issuing stored value or payment instruments or providing payment services;

Q.6. Who shall be covered in the definition of a Financial Service Provider?

Ans. As per Section 3(17) of the Code, a Financial Service Provider means a person engaged in the business of providing financial services in terms of authorisation issued or registration granted by a financial sector regulator.

Q.7. What do we understand as Financial Sector Regulator?

Ans. As per Section 3(18), “financial sector regulator” means an authority or body constituted under any law for the time being in force to regulate services or transactions of financial sector and includes the Reserve Bank of India, the Securities and Exchange Board of India, the Insurance Regulatory and Development Authority of India, the Pension Fund Regulatory Authority and such other regulatory authorities as may be notified by the Central Government;

Q.8. What shall be included in Financial Information?

Ans. As per Section 3(13), “financial information”, in relation to a person, means one or more of the following categories of information, namely:-

a) records of the debt of the person;

b) records of liabilities when the person is solvent;

c) records of assets of person over which security interest has been created;

d) records, if any, of instances of default by the person against any debt;

e) records of the balance sheet and cash-flow statements of the person; and

f) such other information as may be specified

Q.9. What shall be treated as Debt under the Code?

Ans. As per Section 3(11) of the Code, “debt” means a liability or obligation in respect of a claim which is due from any person and includes a financial debt and operational debt.

Q.10. What is the meaning of the term ‘default?

Ans. As per Section 3(12) of the Code, “default” means non-payment of debt when whole or any part or instalment of the amount of debt has become due and payable and is not paid by the debtor or the corporate debtor, as the case may be.

To Read More Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"