Deepak Gupta | May 18, 2019 |

Filing Application for Restoration of Provisional Attachment

1. What is Restoration of Provisional Attachment

If proceedings are pending under section 62 or 63 or 64 or 67 or 73/74 i.e. (proceedings are yet to be concluded) and Commissioner/ Competent authority is of opinion that for the purpose of protecting the interest of Government revenue, it is necessary to provisionally attach the property or bank account belonging to such taxable person, then Commissioner/ Competent authority may pass an order of provisional attachment.

Any person whose property is attached may, within 7 days of attachment order, file an application for restoration of provisional attachment to the effect that the property attached was or is not liable to attachment.

2. How Restoration of Provisional Attachment takes place

Restoration of Provisional Attachment can be initiated suo moto by the Tax Official or the taxpayer can file an application for Restoration of Provisional Attachment within 7 days of attachment order.

3. Application for Restoration of Provisional Attachment can be filed by which date

Application for restoration of provisional attachment need to be filed within 7 days of provisional attachment order.

4. From where can I file an application for Restoration of Provisional Attachment

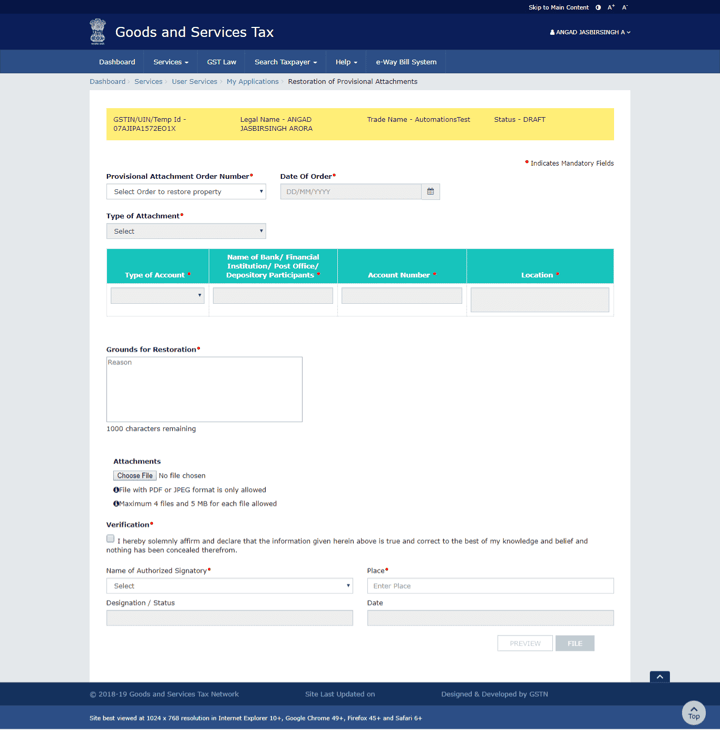

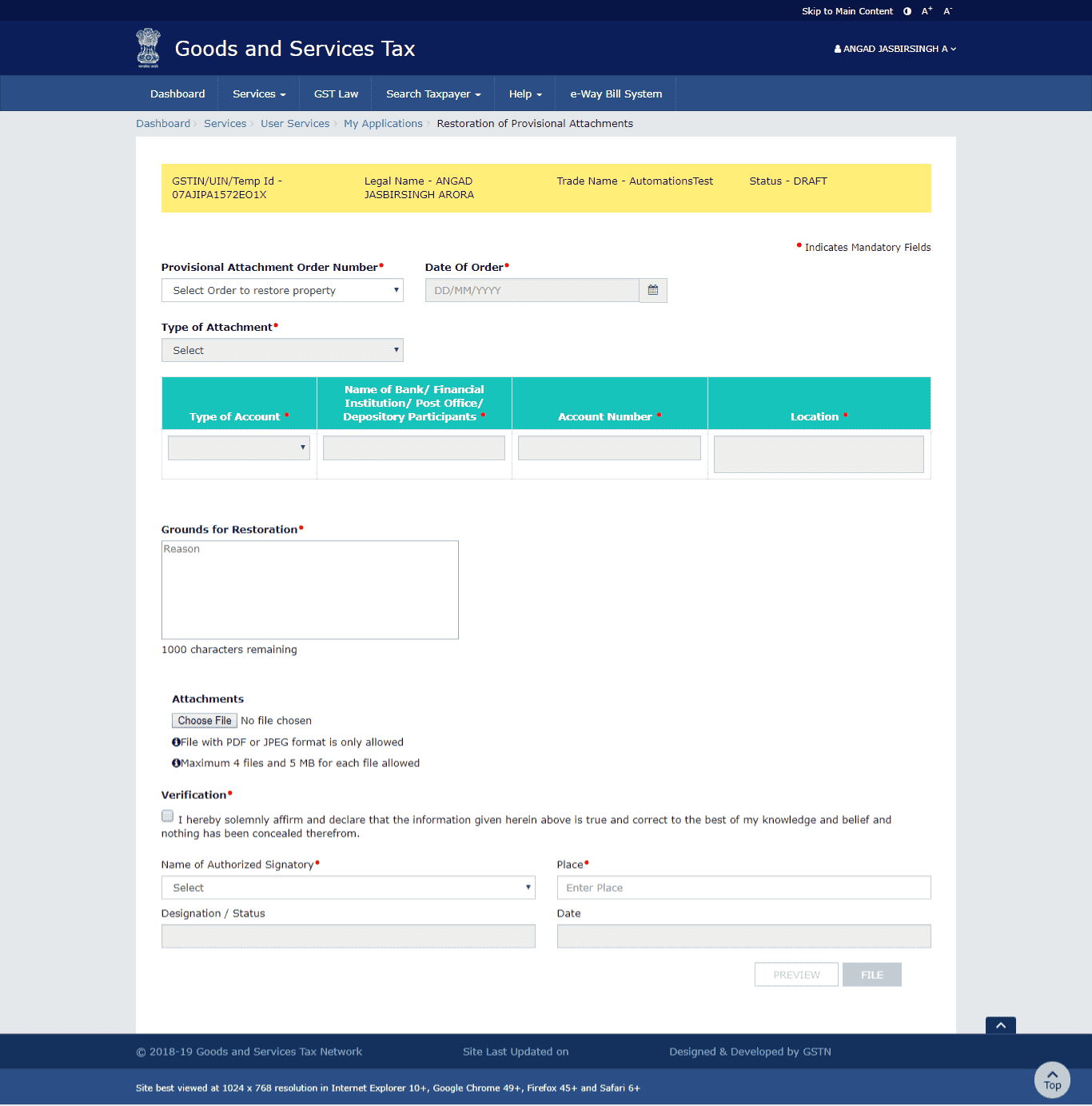

Navigate to Services > User Services > My Applications > Application for Restoration of Provisional Attachment > NEW APPLICATION option.

5. From where can I view filed application for Restoration of Provisional Attachment

5. From where can I view filed application for Restoration of Provisional Attachment

Navigate to Services > User Services > My Applications > Application for Restoration of Provisional Attachment > SEARCH > Click ARN option.

6. From where can I view notice issued for Restoration of Provisional Attachment

Navigate to Services > User Services > My Applications > Application for Restoration of Provisional Attachment > SEARCH > NOTICES option.

7. From where can I reply to notice issued for Restoration of Provisional Attachment

Navigate to Services > User Services > My Applications > Application for Restoration of Provisional Attachment > SEARCH > REPLIES option.

8. In the case of suo moto Restoration of Provisional Attachment done by Tax Official, how will I come to know of that and where can I view the issued notice on the GST portal

In the case of suo moto Restoration of Provisional Attachment done by Tax Official, you will receive an intimation via email and SMS. You can view the issued notice from the following navigation: Services > User Services > View Additional Notices/Orders > View option.

9. What are the various statuses for application for Restoration of Provisional Attachment

Various statuses for Restoration of Provisional Attachment are:

1. Pending for action by tax officer – Status of ARN upon application received for restoration of provisional attachments.

2. Pending for reply by taxpayer – Status of RFN upon issue of notice to taxpayer to seek clarification.

3. Reply furnished, pending for order – Status of ARN upon reply received from taxpayer.

4. Restoration order issued – Status of ARN upon issue of restoration order.

10. From where can I view order issued for Restoration of Provisional Attachment

Navigate to Services > User Services > My Applications > Application for Restoration of Provisional Attachment > SEARCH > ORDERS option.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"